GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>GVK</strong>’s power segment performance was dismal in Q4FY12<br />

as power plants reported lower PLF due to continued<br />

restricted supply of gas<br />

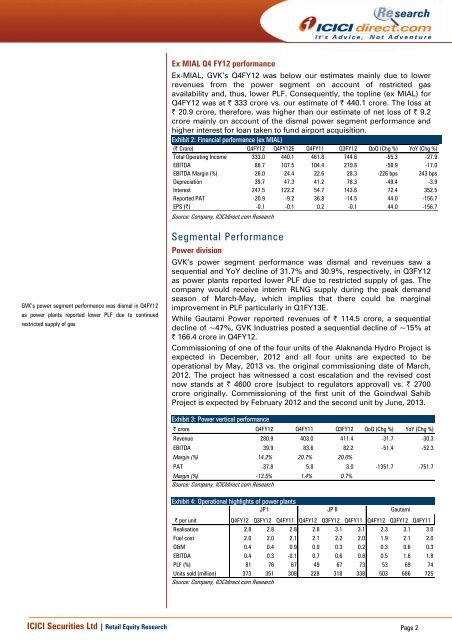

Ex MIAL Q4 FY12 performance<br />

Ex-MIAL, <strong>GVK</strong>’s Q4FY12 was below our estimates mainly due to lower<br />

revenues from the power segment on account of restricted gas<br />

availability and, thus, lower PLF. Consequently, the topline (ex MIAL) for<br />

Q4FY12 was at | 333 crore vs. our estimate of | 440.1 crore. The loss at<br />

| 20.9 crore, therefore, was higher than our estimate of net loss of | 9.2<br />

crore mainly on account of the dismal power segment performance and<br />

higher interest for loan taken to fund airport acquisition.<br />

Exhibit 2: Financial performance (ex MIAL)<br />

(| Crore) Q4FY12 Q4FY12E Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %)<br />

Total Operating Income 333.0 440.1 461.8 744.6 -55.3 -27.9<br />

EBITDA 86.7 107.5 104.4 210.8 -58.9 -17.0<br />

EBITDA Margin (%) 26.0 24.4 22.6 28.3 -226 bps 343 bps<br />

Depreciation 39.7 47.3 41.2 78.3 -49.4 -3.9<br />

Interest 247.5 122.2 54.7 143.6 72.4 352.5<br />

Reported PAT -20.9 -9.2 36.8 -14.5 44.0 -156.7<br />

EPS (|) -0.1 -0.1 0.2 -0.1 44.0 -156.7<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Segmental Performance<br />

<strong>Power</strong> division<br />

<strong>GVK</strong>’s power segment performance was dismal and revenues saw a<br />

sequential and YoY decline of 31.7% and 30.9%, respectively, in Q3FY12<br />

as power plants reported lower PLF due to restricted supply of gas. The<br />

company would receive interim RLNG supply during the peak demand<br />

season of March-May, which implies that there could be marginal<br />

improvement in PLF particularly in Q1FY13E.<br />

While Gautami <strong>Power</strong> reported revenues of | 114.5 crore, a sequential<br />

decline of ~47%, <strong>GVK</strong> Industries posted a sequential decline of ~15% at<br />

| 166.4 crore in Q4FY12.<br />

Commissioning of one of the four units of the Alaknanda Hydro Project is<br />

expected in December, 2012 and all four units are expected to be<br />

operational by May, 2013 vs. the original commissioning date of March,<br />

2012. The project has witnessed a cost escalation and the revised cost<br />

now stands at | 4600 crore (subject to regulators approval) vs. | 2700<br />

crore originally. Commissioning of the first unit of the Goindwal Sahib<br />

Project is expected by February 2012 and the second unit by June, 2013.<br />

Exhibit 3: <strong>Power</strong> vertical performance<br />

| crore Q4FY12 Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %)<br />

Revenue 280.9 403.0 411.4 -31.7 -30.3<br />

EBITDA 39.9 83.6 82.2 -51.4 -52.3<br />

Margin (%) 14.2% 20.7% 20.0%<br />

PAT -37.8 5.8 3.0 -1351.7 -751.7<br />

Margin (%) -13.5% 1.4% 0.7%<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 4: Operational highlights of power plants<br />

JP I JP II Gautami<br />

| per unit Q4FY12 Q3FY12 Q4FY11 Q4FY12 Q3FY12 Q4FY11 Q4FY12 Q3FY12 Q4FY11<br />

Realisation 2.8 2.8 2.8 2.8 3.1 3.1 2.3 3.1 3.0<br />

Fuel cost 2.0 2.0 2.1 2.1 2.2 2.0 1.9 2.1 2.0<br />

O&M 0.4 0.4 0.9 0.0 0.3 0.2 0.3 0.6 0.3<br />

EBITDA 0.4 0.3 -0.1 0.7 0.6 0.8 0.5 1.6 1.8<br />

PLF (%) 81 76 67 49 67 73 53 69 74<br />

Units sold (million) 373 351 308 228 318 338 503 686 725<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 2