GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In terms of cost escalation, MIAL has seen a cost overrun<br />

of | 2700 crore and cost approval & tariff revision<br />

application has been made to AERA. The decision on this is<br />

expected in the next three or four months<br />

Airport division<br />

MIAL and BIAL reported a muted topline performance with sequential<br />

decline of 3.3% and 2.2% to | 321.6 crore and | 150.5 crore, respectively.<br />

In terms of operating performance, the passenger movement remained<br />

muted in both airports. MIAL’s total passenger declined 2.7% sequentially<br />

to 7.8 million in Q4FY12. While the number of domestic passengers<br />

declined 4.2% QoQ to 5.3 million, the number of international passengers<br />

grew 0.6% QoQ to 2.5 million. BIAL also reported a decline of 7.8%<br />

sequentially in passenger movement to 3.1 million in Q4FY12.<br />

In terms of cost escalation, MIAL has seen a cost overrun of ~| 2700<br />

crore to |12,500 crore and cost approval and tariff revision application<br />

has been made to AERA. The cost overrun in MIAL was on account of a<br />

delay in shifting of the Shivaji statue, increase in scope of work and rise in<br />

cost of construction. There continues to remain uncertainty over the<br />

funding of the project especially after the cost overrun as AAI may find it<br />

difficult to infuse additional equity (as reported in the media article). The<br />

company is also contemplating an application with the regulator for an<br />

increase in AERO charges to meet the funding gap.<br />

<strong>GVK</strong> is also looking for a private equity deal in the airport segment to<br />

raise ~| 3000 crore to repay the debts raised for acquisition of a stake.<br />

Currently, the foreign players are confused with the government stand<br />

and, hence, are delaying their decision.<br />

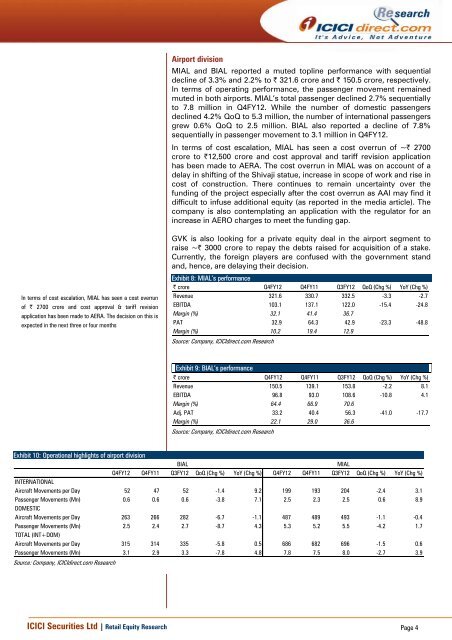

Exhibit 8: MIAL’s performance<br />

| crore Q4FY12 Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %)<br />

Revenue 321.6 330.7 332.5 -3.3 -2.7<br />

EBITDA 103.1 137.1 122.0 -15.4 -24.8<br />

Margin (%) 32.1 41.4 36.7<br />

PAT 32.9 64.3 42.9 -23.3 -48.8<br />

Margin (%) 10.2 19.4 12.9<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 9: BIAL’s performance<br />

| crore Q4FY12 Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %)<br />

Revenue 150.5 139.1 153.8 -2.2 8.1<br />

EBITDA 96.8 93.0 108.6 -10.8 4.1<br />

Margin (%) 64.4 66.9 70.6<br />

Adj. PAT 33.2 40.4 56.3 -41.0 -17.7<br />

Margin (%) 22.1 29.0 36.6<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Exhibit 10: Operational highlights of airport division<br />

BIAL MIAL<br />

Q4FY12 Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %) Q4FY12 Q4FY11 Q3FY12 QoQ (Chg %) YoY (Chg %)<br />

INTERNATIONAL<br />

Aircraft Movements per Day 52 47 52 -1.4 9.2 199 193 204 -2.4 3.1<br />

Passenger Movements (Mn)<br />

DOMESTIC<br />

0.6 0.6 0.6 -3.8 7.1 2.5 2.3 2.5 0.6 8.9<br />

Aircraft Movements per Day 263 266 282 -6.7 -1.1 487 489 493 -1.1 -0.4<br />

Passenger Movements (Mn)<br />

TOTAL (INT+DOM)<br />

2.5 2.4 2.7 -8.7 4.3 5.3 5.2 5.5 -4.2 1.7<br />

Aircraft Movements per Day 315 314 335 -5.8 0.5 686 682 696 -1.5 0.6<br />

Passenger Movements (Mn) 3.1 2.9 3.3 -7.8 4.8 7.8 7.5 8.0 -2.7 3.9<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 4