GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

GVK Power (GVKPOW) - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

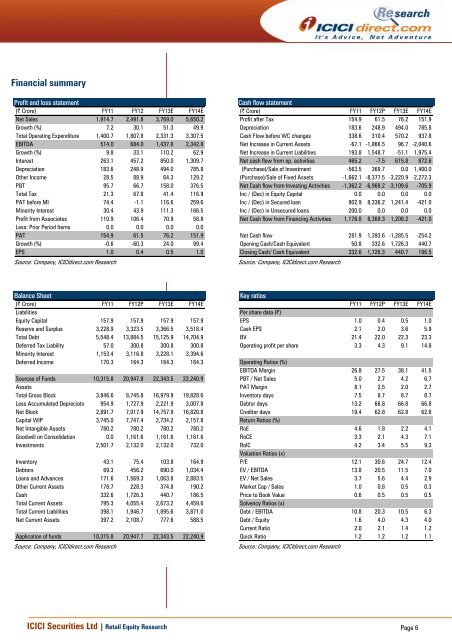

Financial summary<br />

Profit and loss statement<br />

(| Crore) FY11 FY12 FY13E FY14E<br />

Net Sales 1,914.7 2,491.8 3,769.0 5,650.2<br />

Growth (%) 7.2 30.1 51.3 49.9<br />

Total Operating Expenditure 1,400.7 1,807.8 2,331.3 3,307.5<br />

EBITDA 514.0 684.0 1,437.8 2,342.8<br />

Growth (%) 9.8 33.1 110.2 62.9<br />

Interest 263.1 457.2 850.0 1,309.7<br />

Depreciation 183.6 248.9 494.0 785.8<br />

Other Income 28.5 88.9 64.3 129.2<br />

PBT 95.7 66.7 158.0 376.5<br />

Total Tax 21.3 67.8 41.4 116.9<br />

PAT before MI 74.4 -1.1 116.6 259.6<br />

Minority Interest 30.4 43.9 111.3 166.5<br />

Profit from Associates 110.9 106.4 70.9 58.8<br />

Less: Prior Period Items 0.0 0.0 0.0 0.0<br />

PAT 154.9 61.5 76.2 151.9<br />

Growth (%) -0.6 -60.3 24.0 99.4<br />

EPS 1.0 0.4 0.5 1.0<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Balance Sheet<br />

(| Crore) FY11 FY12P FY13E FY14E<br />

Liabilities<br />

Equity Capital 157.9 157.9 157.9 157.9<br />

Reserve and Surplus 3,228.9 3,323.5 3,366.5 3,518.4<br />

Total Debt 5,548.4 13,884.5 15,125.9 14,704.9<br />

Deferred Tax Liability 57.0 300.8 300.8 300.8<br />

Minority Interest 1,153.4 3,116.8 3,228.1 3,394.6<br />

Deferred Income 170.3 164.3 164.3 164.3<br />

Sources of Funds 10,315.8 20,947.8 22,343.5 22,240.9<br />

Assets<br />

Total Gross Block 3,846.6 8,745.8 16,979.9 19,828.6<br />

Less Accumulated Depreciatio 954.9 1,727.9 2,221.9 3,007.8<br />

Net Block 2,891.7 7,017.9 14,757.9 16,820.8<br />

Capital WIP 3,745.0 7,747.4 2,734.2 2,157.8<br />

Net Intangible Assets 780.2 780.2 780.2 780.2<br />

Goodwill on Consolidation 0.0 1,161.6 1,161.6 1,161.6<br />

Investments 2,501.7 2,132.0 2,132.0 732.0<br />

Inventory 43.1 75.4 103.8 164.9<br />

Debtors 69.3 456.2 690.0 1,034.4<br />

Loans and Advances 171.6 1,569.3 1,063.8 2,883.5<br />

Other Current Assets 178.7 228.3 374.8 190.2<br />

Cash 332.6 1,726.3 440.7 186.5<br />

Total Current Assets 795.3 4,055.4 2,673.2 4,459.6<br />

Total Current Liabilities 398.1 1,946.7 1,895.6 3,871.0<br />

Net Current Assets 397.2 2,108.7 777.6 588.5<br />

Application of funds 10,315.8 20,947.7 22,343.5 22,240.9<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

Cash flow statement<br />

(| Crore) FY11 FY12P FY13E FY14E<br />

Profit after Tax 154.9 61.5 76.2 151.9<br />

Depreciation 183.6 248.9 494.0 785.8<br />

Cash Flow before WC changes 338.6 310.4 570.2 937.8<br />

Net Increase in Current Assets -67.1 -1,866.5 96.7 -2,040.6<br />

Net Increase in Current Liabilities 193.8 1,548.7 -51.1 1,975.4<br />

Net cash flow from op. activities 465.2 -7.5 615.8 872.6<br />

(Purchase)/Sale of Investment -563.5 369.7 0.0 1,400.0<br />

(Purchase)/Sale of Fixed Assets -1,662.1 -8,377.5 -3,220.9 -2,272.3<br />

Net Cash flow from Investing Activities -1,362.2 -6,968.2 -3,109.6 -705.9<br />

Inc / (Dec) in Equity Capital 0.0 0.0 0.0 0.0<br />

Inc / (Dec) in Secured loan 902.9 8,336.2 1,241.4 -421.0<br />

Inc / (Dec) in Unsecured loans 200.0 0.0 0.0 0.0<br />

Net Cash flow from Financing Activities 1,178.8 8,369.3 1,208.2 -421.0<br />

Net Cash flow 281.9 1,393.6 -1,285.5 -254.2<br />

Opening Cash/Cash Equivalent 50.8 332.6 1,726.3 440.7<br />

Closing Cash/ Cash Equivalent<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

332.6 1,726.3 440.7 186.5<br />

Key ratios<br />

FY11 FY12P FY13E FY14E<br />

Per share data (|)<br />

EPS 1.0 0.4 0.5 1.0<br />

Cash EPS 2.1 2.0 3.6 5.9<br />

BV 21.4 22.0 22.3 23.3<br />

Operating profit per share 3.3 4.3 9.1 14.8<br />

Operating Ratios (%)<br />

EBITDA Margin 26.8 27.5 38.1 41.5<br />

PBT / Net Sales 5.0 2.7 4.2 6.7<br />

PAT Margin 8.1 2.5 2.0 2.7<br />

Inventory days 7.5 8.7 8.7 8.7<br />

Debtor days 13.2 66.8 66.8 66.8<br />

Creditor days<br />

Return Ratios (%)<br />

19.4 62.8 62.8 62.8<br />

RoE 4.6 1.8 2.2 4.1<br />

RoCE 3.3 2.1 4.3 7.1<br />

RoIC<br />

Valuation Ratios (x)<br />

4.2 3.4 5.5 9.3<br />

P/E 12.1 30.6 24.7 12.4<br />

EV / EBITDA 13.8 20.5 11.5 7.0<br />

EV / Net Sales 3.7 5.6 4.4 2.9<br />

Market Cap / Sales 1.0 0.8 0.5 0.3<br />

Price to Book Value<br />

Solvency Ratios (x)<br />

0.6 0.5 0.5 0.5<br />

Debt / EBITDA 10.8 20.3 10.5 6.3<br />

Debt / Equity 1.6 4.0 4.3 4.0<br />

Current Ratio 2.0 2.1 1.4 1.2<br />

Quick Ratio<br />

Source: Company, <strong>ICICI</strong>direct.com Research<br />

1.2 1.2 1.2 1.1<br />

<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 6