Mauritania - Islamic Development Bank

Mauritania - Islamic Development Bank

Mauritania - Islamic Development Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

gold, copper, oil and deep-sea fishing) with<br />

little or no value-added for export markets.<br />

The two economies are disconnected and<br />

the spillover effect seen in most developing<br />

countries (without a high dependence on<br />

natural resource rents) has not taken place.<br />

26. This unique economic structure has<br />

produced mixed results: On the positive<br />

side, the enclave economy has provided high<br />

and consistent rents that have allowed the<br />

Government to finance development activities<br />

including infrastructure for irrigated agriculture.<br />

On the negative side, the enclave economy has<br />

only limited links with the subsistence economy.<br />

In particular as the value added to raw material<br />

exports is limited and given the capital-intensive<br />

nature of extraction activities, the demand for<br />

labor is negligible.<br />

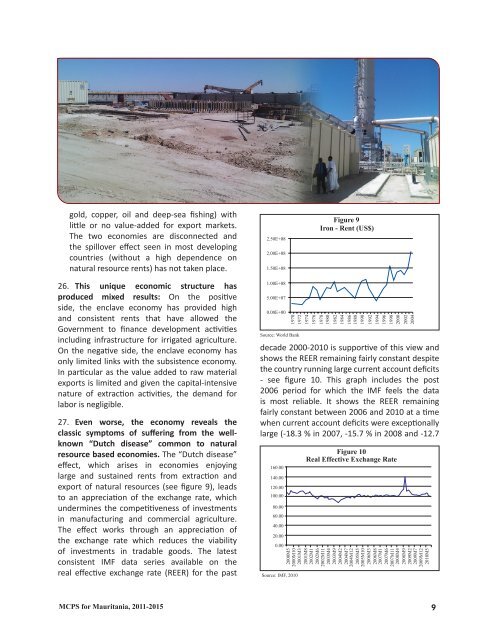

27. Even worse, the economy reveals the<br />

classic symptoms of suffering from the wellknown<br />

“Dutch disease” common to natural<br />

resource based economies. The “Dutch disease”<br />

effect, which arises in economies enjoying<br />

large and sustained rents from extraction and<br />

export of natural resources (see figure 9), leads<br />

to an appreciation of the exchange rate, which<br />

undermines the competitiveness of investments<br />

in manufacturing and commercial agriculture.<br />

The effect works through an appreciation of<br />

the exchange rate which reduces the viability<br />

of investments in tradable goods. The latest<br />

consistent IMF data series available on the<br />

real effective exchange rate (REER) for the past<br />

decade 2000-2010 is supportive of this view and<br />

shows the REER remaining fairly constant despite<br />

the country running large current account deficits<br />

- see figure 10. This graph includes the post<br />

2006 period for which the IMF feels the data<br />

is most reliable. It shows the REER remaining<br />

fairly constant between 2006 and 2010 at a time<br />

when current account deficits were exceptionally<br />

large (-18.3 % in 2007, -15.7 % in 2008 and -12.7<br />

MCPS for <strong>Mauritania</strong>, 2011-2015 9