Mauritania - Islamic Development Bank

Mauritania - Islamic Development Bank

Mauritania - Islamic Development Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

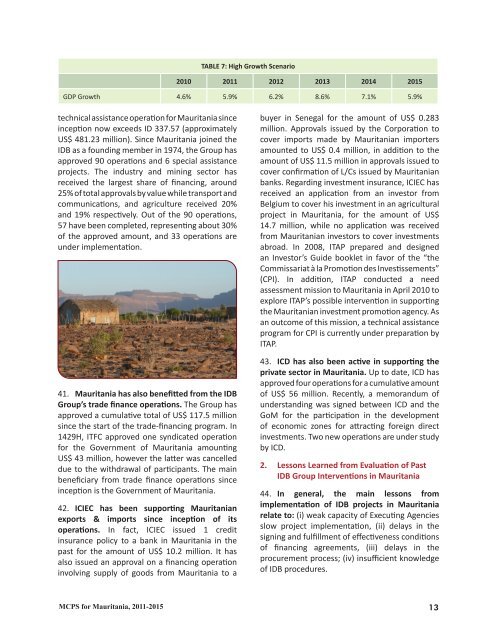

TABLE 7: High Growth Scenario<br />

2010 2011 2012 2013 2014 2015<br />

GDP Growth 4.6% 5.9% 6.2% 8.6% 7.1% 5.9%<br />

technical assistance operation for <strong>Mauritania</strong> since<br />

inception now exceeds ID 337.57 (approximately<br />

US$ 481.23 million). Since <strong>Mauritania</strong> joined the<br />

IDB as a founding member in 1974, the Group has<br />

approved 90 operations and 6 special assistance<br />

projects. The industry and mining sector has<br />

received the largest share of financing, around<br />

25% of total approvals by value while transport and<br />

communications, and agriculture received 20%<br />

and 19% respectively. Out of the 90 operations,<br />

57 have been completed, representing about 30%<br />

of the approved amount, and 33 operations are<br />

under implementation.<br />

41. <strong>Mauritania</strong> has also benefitted from the IDB<br />

Group’s trade finance operations. The Group has<br />

approved a cumulative total of US$ 117.5 million<br />

since the start of the trade-financing program. In<br />

1429H, ITFC approved one syndicated operation<br />

for the Government of <strong>Mauritania</strong> amounting<br />

US$ 43 million, however the latter was cancelled<br />

due to the withdrawal of participants. The main<br />

beneficiary from trade finance operations since<br />

inception is the Government of <strong>Mauritania</strong>.<br />

42. ICIEC has been supporting <strong>Mauritania</strong>n<br />

exports & imports since inception of its<br />

operations. In fact, ICIEC issued 1 credit<br />

insurance policy to a bank in <strong>Mauritania</strong> in the<br />

past for the amount of US$ 10.2 million. It has<br />

also issued an approval on a financing operation<br />

involving supply of goods from <strong>Mauritania</strong> to a<br />

buyer in Senegal for the amount of US$ 0.283<br />

million. Approvals issued by the Corporation to<br />

cover imports made by <strong>Mauritania</strong>n importers<br />

amounted to US$ 0.4 million, in addition to the<br />

amount of US$ 11.5 million in approvals issued to<br />

cover confirmation of L/Cs issued by <strong>Mauritania</strong>n<br />

banks. Regarding investment insurance, ICIEC has<br />

received an application from an investor from<br />

Belgium to cover his investment in an agricultural<br />

project in <strong>Mauritania</strong>, for the amount of US$<br />

14.7 million, while no application was received<br />

from <strong>Mauritania</strong>n investors to cover investments<br />

abroad. In 2008, ITAP prepared and designed<br />

an Investor’s Guide booklet in favor of the “the<br />

Commissariat à la Promotion des Investissements”<br />

(CPI). In addition, ITAP conducted a need<br />

assessment mission to <strong>Mauritania</strong> in April 2010 to<br />

explore ITAP’s possible intervention in supporting<br />

the <strong>Mauritania</strong>n investment promotion agency. As<br />

an outcome of this mission, a technical assistance<br />

program for CPI is currently under preparation by<br />

ITAP.<br />

43. ICD has also been active in supporting the<br />

private sector in <strong>Mauritania</strong>. Up to date, ICD has<br />

approved four operations for a cumulative amount<br />

of US$ 56 million. Recently, a memorandum of<br />

understanding was signed between ICD and the<br />

GoM for the participation in the development<br />

of economic zones for attracting foreign direct<br />

investments. Two new operations are under study<br />

by ICD.<br />

2. Lessons Learned from Evaluation of Past<br />

IDB Group Interventions in <strong>Mauritania</strong><br />

44. In general, the main lessons from<br />

implementation of IDB projects in <strong>Mauritania</strong><br />

relate to: (i) weak capacity of Executing Agencies<br />

slow project implementation, (ii) delays in the<br />

signing and fulfillment of effectiveness conditions<br />

of financing agreements, (iii) delays in the<br />

procurement process; (iv) insufficient knowledge<br />

of IDB procedures.<br />

MCPS for <strong>Mauritania</strong>, 2011-2015 13