Wiener Stadtwerke Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

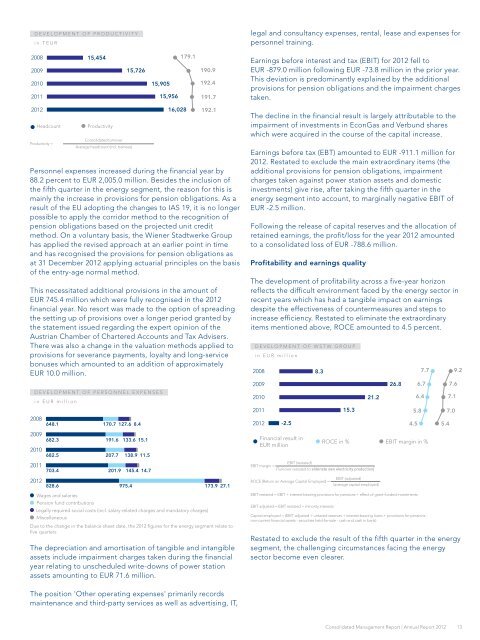

DEVELOPMENT OF PRODUCTIVITy<br />

in TEUR<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

15,454<br />

Headcount Productivity<br />

Productivity =<br />

Consolidated turnover<br />

Average headcount (incl. trainees)<br />

15,726<br />

15,905<br />

15,956<br />

179.1<br />

190.9<br />

192.4<br />

191.7<br />

16,028 192.1<br />

Personnel expenses increased during the financial year by<br />

88.2 percent to EUR 2,005.0 million. Besides the inclusion of<br />

the fifth quarter in the energy segment, the reason for this is<br />

mainly the increase in provisions for pension obligations. As a<br />

result of the EU adopting the changes to IAS 19, it is no longer<br />

possible to apply the corridor method to the recognition of<br />

pension obligations based on the projected unit credit<br />

method. On a voluntary basis, the <strong>Wiener</strong> <strong>Stadtwerke</strong> Group<br />

has applied the revised approach at an earlier point in time<br />

and has recognised the provisions for pension obligations as<br />

at 31 December <strong>2012</strong> applying actuarial principles on the basis<br />

of the entry-age normal method.<br />

This necessitated additional provisions in the amount of<br />

EUR 745.4 million which were fully recognised in the <strong>2012</strong><br />

financial year. No resort was made to the option of spreading<br />

the setting up of provisions over a longer period granted by<br />

the statement issued regarding the expert opinion of the<br />

Austrian Chamber of Chartered Accounts and Tax Advisers.<br />

There was also a change in the valuation methods applied to<br />

provisions for severance payments, loyalty and long-service<br />

bonuses which amounted to an addition of approximately<br />

EUR 10.0 million.<br />

DEVELOPMENT OF PERSONNEL ExPENSES<br />

in EUR million<br />

2008 648.1<br />

2009<br />

2010<br />

2011<br />

682.3<br />

682.5<br />

703.4<br />

170.7 127.6 8.4<br />

191.6<br />

207.7<br />

201.9<br />

133.6 15.1<br />

138.9 11.5<br />

145.4 14.7<br />

<strong>2012</strong><br />

828.6<br />

975.4<br />

173.9 27.1<br />

Wages and salaries<br />

Pension fund contributions<br />

Legally required social costs (incl. salary-related charges and mandatory charges)<br />

Miscellaneous<br />

Due to the change in the balance sheet date, the <strong>2012</strong> figures for the energy segment relate to<br />

five quarters<br />

The depreciation and amortisation of tangible and intangible<br />

assets include impairment charges taken during the financial<br />

year relating to unscheduled write-downs of power station<br />

assets amounting to EUR 71.6 million.<br />

The position 'Other operating expenses' primarily records<br />

maintenance and third-party services as well as advertising, IT,<br />

legal and consultancy expenses, rental, lease and expenses for<br />

personnel training.<br />

Earnings before interest and tax (EBIT) for <strong>2012</strong> fell to<br />

EUR -879.0 million following EUR -73.8 million in the prior year.<br />

This deviation is predominantly explained by the additional<br />

provisions for pension obligations and the impairment charges<br />

taken.<br />

The decline in the financial result is largely attributable to the<br />

impairment of investments in EconGas and Verbund shares<br />

which were acquired in the course of the capital increase.<br />

Earnings before tax (EBT) amounted to EUR -911.1 million for<br />

<strong>2012</strong>. Restated to exclude the main extraordinary items (the<br />

additional provisions for pension obligations, impairment<br />

charges taken against power station assets and domestic<br />

investments) give rise, after taking the fifth quarter in the<br />

energy segment into account, to marginally negative EBIT of<br />

EUR -2.5 million.<br />

Following the release of capital reserves and the allocation of<br />

retained earnings, the profit/loss for the year <strong>2012</strong> amounted<br />

to a consolidated loss of EUR -788.6 million.<br />

profitability and earnings quality<br />

The development of profitability across a five-year horizon<br />

reflects the difficult environment faced by the energy sector in<br />

recent years which has had a tangible impact on earnings<br />

despite the effectiveness of countermeasures and steps to<br />

increase efficiency. Restated to eliminate the extraordinary<br />

items mentioned above, ROCE amounted to 4.5 percent.<br />

DEVELOPMENT OF WSTW GROUP<br />

in EUR million<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Financial result in<br />

EUR million<br />

8.3<br />

ROCE in % EBIT margin in %<br />

EBIT (restated)<br />

EBIT margin =<br />

(Turnover restated to eliminate own electricity production)<br />

ROCE (Return on Average Capital Employed) =<br />

15.3<br />

21.2<br />

EBIT (adjusted)<br />

(average capital employed)<br />

26.8<br />

-2.5 4.5 5.4<br />

EBIT restated = EBIT + interest-bearing provisions for pensions + effect of grant-funded investments<br />

EBIT adjusted = EBIT restated + minority interests<br />

Capital employed = (EBIT adjusted + untaxed reserves + interest-bearing loans + provisions for pensions -<br />

non-current financial assets - securities held-for-sale - cash and cash in bank)<br />

Restated to exclude the result of the fifth quarter in the energy<br />

segment, the challenging circumstances facing the energy<br />

sector become even clearer.<br />

6.4<br />

5.8<br />

7.7<br />

6.7<br />

Consolidated Management <strong>Report</strong> | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

7.6<br />

7.1<br />

7.0<br />

9.2<br />

13