Wiener Stadtwerke Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The internal ratings of banks providing funding (assessments<br />

based on the Internal Ratings-Based Approach defined by<br />

Basel II) are drawn upon in order to assess the Group‘s<br />

creditworthiness. These regularly confirm the outstanding<br />

creditworthiness of <strong>Wiener</strong> <strong>Stadtwerke</strong>.<br />

The contingent liabilities of the <strong>Wiener</strong> <strong>Stadtwerke</strong> Group on<br />

the balance sheet date amount to EUR 496.6 million, around<br />

14.0 percent higher than a year earlier. This position primarily<br />

recognises US cross-border leasing transactions entered into by<br />

<strong>Wiener</strong> Linien, which are offset by means of rights of recourse in<br />

the same amount carried as assets, in addition to partly restricted<br />

and partly unrestricted comfort letters issued on behalf of<br />

e&t Energie Handelsgesellschaft m.b.H. As in the prior year,<br />

these contingent liabilities have been recorded under the<br />

balance sheet total as a net liability position (being the balance<br />

of energy purchase and sale contracts valued at market prices<br />

quoted on 31 December <strong>2012</strong>). Taking into account the<br />

contracts concluded by e&t Energie Handelsgesellschaft m.b.H.<br />

with its trading partners, the net liability position amounts to<br />

EUR 70.3 million (prior year: EUR 20.8 million), which accounts<br />

for the majority of the increase. The liabilities associated with<br />

e&t are partially offset by receivables in the amount of<br />

EUR 17.4 million.<br />

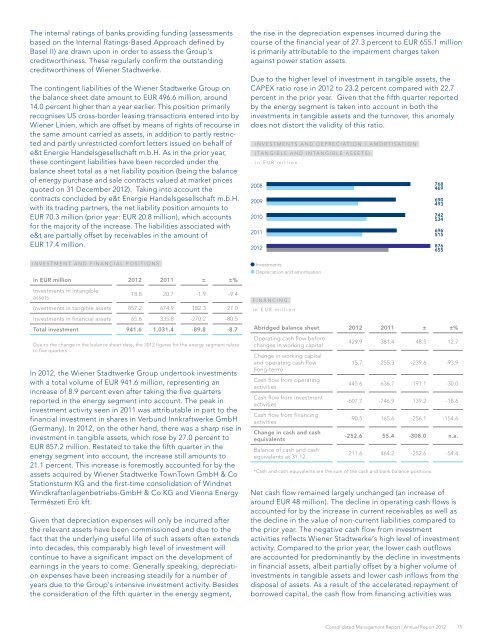

INVESTMENT AND FINANCIAL POSITIONS<br />

in EUR million <strong>2012</strong> 2011 ± ±%<br />

Investments in intangible<br />

assets<br />

18.8 20.7 -1.9 -9.4<br />

Investments in tangible assets 857.2 674.9 182.3 27.0<br />

Investments in financial assets 65.6 335.8 -270.2 -80.5<br />

Total investment 941.6 1,031.4 -89.8 -8.7<br />

Due to the change in the balance sheet date, the <strong>2012</strong> figures for the energy segment relate<br />

to five quarters<br />

In <strong>2012</strong>, the <strong>Wiener</strong> <strong>Stadtwerke</strong> Group undertook investments<br />

with a total volume of EUR 941.6 million, representing an<br />

increase of 8.9 percent even after taking the five quarters<br />

reported in the energy segment into account. The peak in<br />

investment activity seen in 2011 was attributable in part to the<br />

financial investment in shares in Verbund Innkraftwerke GmbH<br />

(Germany). In <strong>2012</strong>, on the other hand, there was a sharp rise in<br />

investment in tangible assets, which rose by 27.0 percent to<br />

EUR 857.2 million. Restated to take the fifth quarter in the<br />

energy segment into account, the increase still amounts to<br />

21.1 percent. This increase is foremostly accounted for by the<br />

assets acquired by <strong>Wiener</strong> <strong>Stadtwerke</strong> TownTown GmbH & Co<br />

Stationsturm KG and the first-time consolidation of Windnet<br />

Windkraftanlagenbetriebs-GmbH & Co KG and Vienna Energy<br />

Természeti Erö kft.<br />

Given that depreciation expenses will only be incurred after<br />

the relevant assets have been commissioned and due to the<br />

fact that the underlying useful life of such assets often extends<br />

into decades, this comparably high level of investment will<br />

continue to have a significant impact on the development of<br />

earnings in the years to come. Generally speaking, depreciation<br />

expenses have been increasing steadily for a number of<br />

years due to the Group‘s intensive investment activity. Besides<br />

the consideration of the fifth quarter in the energy segment,<br />

the rise in the depreciation expenses incurred during the<br />

course of the financial year of 27.3 percent to EUR 655.1 million<br />

is primarily attributable to the impairment charges taken<br />

against power station assets.<br />

Due to the higher level of investment in tangible assets, the<br />

CAPEx ratio rose in <strong>2012</strong> to 23.2 percent compared with 22.7<br />

percent in the prior year. Given that the fifth quarter reported<br />

by the energy segment is taken into account in both the<br />

investments in tangible assets and the turnover, this anomaly<br />

does not distort the validity of this ratio.<br />

INVESTMENTS AND DEPRECIATION / AMORTISATION<br />

(TANGIBLE AND INTANGIBLE ASSETS)<br />

in EUR million<br />

2008 768<br />

469<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Investments<br />

Depreciation and amortisation<br />

FINANCING<br />

in EUR million<br />

690<br />

493<br />

742<br />

534<br />

696<br />

515<br />

876<br />

655<br />

Abridged balance sheet <strong>2012</strong> 2011 ± ±%<br />

Operating cash flow before<br />

changes in working capital<br />

429.9 381.4 48.5 12.7<br />

Change in working capital<br />

and operating cash flow<br />

(long-term)<br />

Cash flow from operating<br />

activities<br />

Cash flow from investment<br />

activities<br />

Cash flow from financing<br />

activities<br />

Change in cash and cash<br />

equivalents<br />

Balance of cash and cash<br />

equivalents at 31.12.<br />

15.7 255.3 -239.6 -93.9<br />

445.6 636.7 -191.1 -30.0<br />

-607.7 -746.9 139.2 -18.6<br />

-90.5 165.6 -256.1 -154.6<br />

-252.6 55.4 -308.0 n.a.<br />

211.6 464.2 -252.6 -54.4<br />

*Cash and cash equivalents are the sum of the cash and bank balance positions.<br />

Net cash flow remained largely unchanged (an increase of<br />

around EUR 48 million). The decline in operating cash flows is<br />

accounted for by the increase in current receivables as well as<br />

the decline in the value of non-current liabilities compared to<br />

the prior year. The negative cash flow from investment<br />

activities reflects <strong>Wiener</strong> <strong>Stadtwerke</strong>‘s high level of investment<br />

activity. Compared to the prior year, the lower cash outflows<br />

are accounted for predominantly by the decline in investments<br />

in financial assets, albeit partially offset by a higher volume of<br />

investments in tangible assets and lower cash inflows from the<br />

disposal of assets. As a result of the accelerated repayment of<br />

borrowed capital, the cash flow from financing activities was<br />

Consolidated Management <strong>Report</strong> | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

15