Wiener Stadtwerke Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

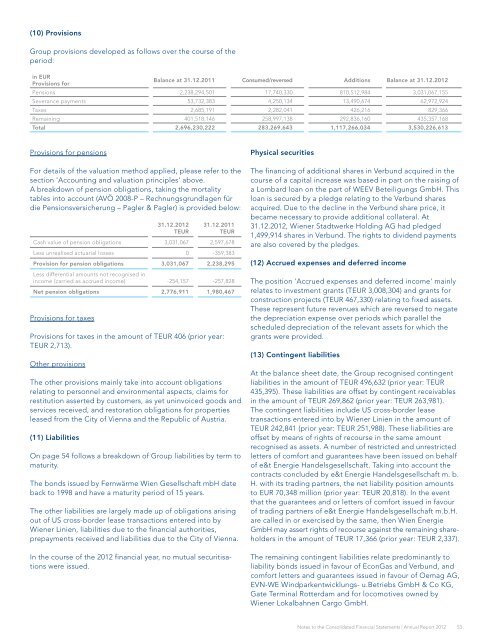

(10) provisions<br />

Group provisions developed as follows over the course of the<br />

period:<br />

in EUR<br />

provisions for<br />

Balance at 31.12.2011 Consumed/reversed Additions Balance at 31.12.<strong>2012</strong><br />

Pensions 2,238,294,501 17,740,330 810,512,984 3,031,067,155<br />

Severance payments 53,732,383 4,250,134 13,490,674 62,972,924<br />

Taxes 2,685,191 2,282,041 426,216 829,366<br />

Remaining 401,518,146 258,997,138 292,836,160 435,357,168<br />

Total 2,696,230,222 283,269,643 1,117,266,034 3,530,226,613<br />

Provisions for pensions<br />

For details of the valuation method applied, please refer to the<br />

section 'Accounting and valuation principles' above.<br />

A breakdown of pension obligations, taking the mortality<br />

tables into account (AVÖ 2008-P – Rechnungsgrundlagen für<br />

die Pensionsversicherung – Pagler & Pagler) is provided below:<br />

31.12.<strong>2012</strong><br />

TEUR<br />

31.12.2011<br />

TEUR<br />

Cash value of pension obligations 3,031,067 2,597,678<br />

Less unrealised actuarial losses 0 -359,383<br />

provision for pension obligations 3,031,067 2,238,295<br />

Less differential amounts not recognised in<br />

income (carried as accrued income) -254,157 -257,828<br />

net pension obligations 2,776,911 1,980,467<br />

Provisions for taxes<br />

Provisions for taxes in the amount of TEUR 406 (prior year:<br />

TEUR 2,713).<br />

Other provisions<br />

The other provisions mainly take into account obligations<br />

relating to personnel and environmental aspects, claims for<br />

restitution asserted by customers, as yet uninvoiced goods and<br />

services received, and restoration obligations for properties<br />

leased from the City of Vienna and the Republic of Austria.<br />

(11) Liabilities<br />

On page 54 follows a breakdown of Group liabilities by term to<br />

maturity.<br />

The bonds issued by Fernwärme Wien Gesellschaft mbH date<br />

back to 1998 and have a maturity period of 15 years.<br />

The other liabilities are largely made up of obligations arising<br />

out of US cross-border lease transactions entered into by<br />

<strong>Wiener</strong> Linien, liabilities due to the financial authorities,<br />

prepayments received and liabilities due to the City of Vienna.<br />

In the course of the <strong>2012</strong> financial year, no mutual securitisations<br />

were issued.<br />

physical securities<br />

The financing of additional shares in Verbund acquired in the<br />

course of a capital increase was based in part on the raising of<br />

a Lombard loan on the part of WEEV Beteiligungs GmbH. This<br />

loan is secured by a pledge relating to the Verbund shares<br />

acquired. Due to the decline in the Verbund share price, it<br />

became necessary to provide additional collateral. At<br />

31.12.<strong>2012</strong>, <strong>Wiener</strong> <strong>Stadtwerke</strong> Holding AG had pledged<br />

1,499,914 shares in Verbund. The rights to dividend payments<br />

are also covered by the pledges.<br />

(12) Accrued expenses and deferred income<br />

The position 'Accrued expenses and deferred income' mainly<br />

relates to investment grants (TEUR 3,008,304) and grants for<br />

construction projects (TEUR 467,330) relating to fixed assets.<br />

These represent future revenues which are reversed to negate<br />

the depreciation expense over periods which parallel the<br />

scheduled depreciation of the relevant assets for which the<br />

grants were provided.<br />

(13) Contingent liabilities<br />

At the balance sheet date, the Group recognised contingent<br />

liabilities in the amount of TEUR 496,632 (prior year: TEUR<br />

435,395). These liabilities are offset by contingent receivables<br />

in the amount of TEUR 269,862 (prior year: TEUR 263,981).<br />

The contingent liabilities include US cross-border lease<br />

transactions entered into by <strong>Wiener</strong> Linien in the amount of<br />

TEUR 242,841 (prior year: TEUR 251,988). These liabilities are<br />

offset by means of rights of recourse in the same amount<br />

recognised as assets. A number of restricted and unrestricted<br />

letters of comfort and guarantees have been issued on behalf<br />

of e&t Energie Handelsgesellschaft. Taking into account the<br />

contracts concluded by e&t Energie Handelsgesellschaft m. b.<br />

H. with its trading partners, the net liability position amounts<br />

to EUR 70,348 million (prior year: TEUR 20,818). In the event<br />

that the guarantees and or letters of comfort issued in favour<br />

of trading partners of e&t Energie Handelsgesellschaft m.b.H.<br />

are called in or exercised by the same, then Wien Energie<br />

GmbH may assert rights of recourse against the remaining share-<br />

holders in the amount of TEUR 17,366 (prior year: TEUR 2,337).<br />

The remaining contingent liabilities relate predominantly to<br />

liability bonds issued in favour of EconGas and Verbund, and<br />

comfort letters and guarantees issued in favour of Oemag AG,<br />

EVN-WE Windparkentwicklungs- u.Betriebs GmbH & Co KG,<br />

Gate Terminal Rotterdam and for locomotives owned by<br />

<strong>Wiener</strong> Lokalbahnen Cargo GmbH.<br />

Notes to the Consolidated Financial Statements | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

53