Wiener Stadtwerke Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Accounting and valuation principles<br />

1. general principles<br />

The financial statements of all consolidated companies have<br />

been prepared on the basis of uniform accounting and<br />

valuation principles.<br />

The consolidated financial statements have been prepared in<br />

accordance with the principles of correct accounting and<br />

valuation, and in compliance with general accounting standards,<br />

with the aim of providing a true and fair presentation of<br />

the assets, financial and earnings positions of the Group. The<br />

consolidated profit and loss account has been prepared on the<br />

basis of the nature-of-expense method. These consolidated<br />

financial statements have been prepared in accordance with<br />

the principle of completeness.<br />

The assets and liabilities of consolidated subsidiaries<br />

recognised in the Group financial statements have been<br />

uniformly valued, in line with Article 260 of the Austrian<br />

Commercial Code, on the basis of the valuation methods<br />

applied to the consolidated financial statements of the parent<br />

company. The principles of individual valuation and a going<br />

concern have been applied to the valuation of individual assets<br />

and liabilities.<br />

The principle of accounting prudence has been applied,<br />

particularly in that only gains realised on or before the balance<br />

sheet date are reported as such. All identifiable risks and<br />

impending losses existing or incurred either during the <strong>2012</strong><br />

financial year or in earlier periods have been taken into<br />

account.<br />

2. Fixed assets<br />

2.1. Intangible assets and tangible assets<br />

Intangible and tangible assets are recognised at their cost of<br />

acquisition or manufacture and, where subject to depreciation<br />

or amortisation, are depreciated or amortised applying the<br />

straight line method based on standard commercial useful<br />

lives. Low-value items with acquisition costs below EUR 400.00<br />

are depreciated fully in the year of their acquisition.<br />

The amortisation of goodwill is linear and takes account of the<br />

commercial useful life of such assets.<br />

Additions in the first half of any given financial period are<br />

generally subject to full-year depreciation in the year of their<br />

acquisition, while those acquired in the second half of any<br />

given financial period are subject to half-year depreciation in<br />

the first year.<br />

In the case of those subsidiaries affected by a change in their<br />

balance sheet date, depreciation and amortisation for a<br />

three-month period have been reported in the figures for their<br />

respective short fiscal years.<br />

Unforeseen declines in asset value have been taken into<br />

account by means of impairment charges.<br />

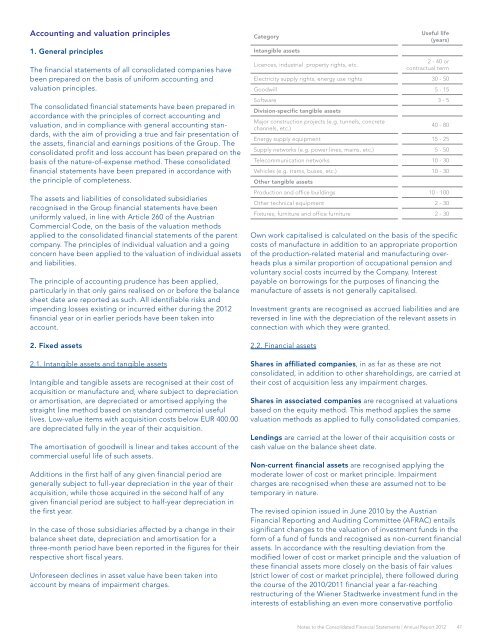

Category<br />

intangible assets<br />

Useful life<br />

(years)<br />

Licences, industrial property rights, etc.<br />

2 - 40 or<br />

contractual term<br />

Electricity supply rights, energy use rights 30 - 50<br />

Goodwill 5 - 15<br />

Software<br />

Division-specific tangible assets<br />

3 - 5<br />

Major construction projects (e.g. tunnels, concrete<br />

channels, etc.)<br />

40 - 80<br />

Energy supply equipment 15 - 25<br />

Supply networks (e.g. power lines, mains, etc.) 5 - 50<br />

Telecommunication networks 10 - 30<br />

Vehicles (e.g. trams, buses, etc.) 10 - 30<br />

Other tangible assets<br />

Production and office buildings 10 - 100<br />

Other technical equipment 2 - 30<br />

Fixtures, furniture and office furniture 2 - 30<br />

Own work capitalised is calculated on the basis of the specific<br />

costs of manufacture in addition to an appropriate proportion<br />

of the production-related material and manufacturing overheads<br />

plus a similar proportion of occupational pension and<br />

voluntary social costs incurred by the Company. Interest<br />

payable on borrowings for the purposes of financing the<br />

manufacture of assets is not generally capitalised.<br />

Investment grants are recognised as accrued liabilities and are<br />

reversed in line with the depreciation of the relevant assets in<br />

connection with which they were granted.<br />

2.2. Financial assets<br />

shares in affiliated companies, in as far as these are not<br />

consolidated, in addition to other shareholdings, are carried at<br />

their cost of acquisition less any impairment charges.<br />

shares in associated companies are recognised at valuations<br />

based on the equity method. This method applies the same<br />

valuation methods as applied to fully consolidated companies.<br />

Lendings are carried at the lower of their acquisition costs or<br />

cash value on the balance sheet date.<br />

non-current financial assets are recognised applying the<br />

moderate lower of cost or market principle. Impairment<br />

charges are recognised when these are assumed not to be<br />

temporary in nature.<br />

The revised opinion issued in June 2010 by the Austrian<br />

Financial <strong>Report</strong>ing and Auditing Committee (AFRAC) entails<br />

significant changes to the valuation of investment funds in the<br />

form of a fund of funds and recognised as non-current financial<br />

assets. In accordance with the resulting deviation from the<br />

modified lower of cost or market principle and the valuation of<br />

these financial assets more closely on the basis of fair values<br />

(strict lower of cost or market principle), there followed during<br />

the course of the 2010/2011 financial year a far-reaching<br />

restructuring of the <strong>Wiener</strong> <strong>Stadtwerke</strong> investment fund in the<br />

interests of establishing an even more conservative portfolio<br />

Notes to the Consolidated Financial Statements | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

47