Wiener Stadtwerke Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

due will be spread over a longer period (expected to be<br />

25 years). The Company acceded to this agreement on<br />

26 July 2005 and has recorded the pension obligations taking<br />

this agreement into account. The differential amount due and<br />

as not as yet recognised in profit/loss is carried as a separate<br />

position under prepayments and accrued income.<br />

provisions for pensions were calculated at 31.12.2011 in<br />

accordance with IAS 19 (Employee Benefits) applying the<br />

projected unit credit method and the corridor method. The<br />

following parameters and assumptions were applied to the<br />

calculations:<br />

31.12.2011<br />

Active Retired<br />

Discount rate 5.25 % 5.00 %<br />

Salary increase 3 % 0 %<br />

Pension increase 1.50 % 1.50 %<br />

Due to the revision of IAS 19 decided upon by the International<br />

Accounting Standards Board (IASB) on 16 June 2011 and<br />

subsequently adopted by the EU on 5 June <strong>2012</strong>, the corridor<br />

method for reporting pension obligations, applying the<br />

projected unit credit method, is no longer applicable to<br />

financial years starting on or after 1 January 2013.<br />

The impact of the revision of IAS 19 on the presentation of the<br />

assets, financial and earnings positions of the Group represent,<br />

in the opinion of the abovementioned Fachsenat für Handelsrecht<br />

und Revision, a well founded exceptional case as defined<br />

by Article 201, para. 2, of the Austrian Commercial Code (UGB)<br />

for a deviation from the principle of valuation consistency as<br />

laid down by Article 201, para. 2 (1), UGB.<br />

On a voluntary basis, the <strong>Wiener</strong> <strong>Stadtwerke</strong> Group has<br />

applied the revised approach at an earlier point in time and<br />

has recognised the provisions for pension obligations as at 31<br />

December <strong>2012</strong> applying actuarial principles on the basis of<br />

the entry-age normal method. The calculation applied an<br />

assumed interest rate of 2.5 percent (real interest rate) due to<br />

the current interest-related environment during the <strong>2012</strong><br />

financial year. As in the prior year, no discount for employee<br />

turnover was taken into account, a retirement age of 65 for<br />

both male and female employees was assumed, and the<br />

mortality table AVÖ 2008-P Rechnungsgrundlagen für die<br />

Pensionsversicherung – Pagler & Pagler was applied.<br />

Real interest rate<br />

31.12.2011<br />

2.5 %<br />

Pension increase beneficiary 1.8 %<br />

5.3. Other provisions<br />

The position 'Other provisions' recognises other provisions set<br />

up in appropriate amounts applying the principle of accounting<br />

prudence. A provision has been set up to account for any<br />

shortage of CO 2 emissions certificates.<br />

6. Foreign exchange receivables and payables<br />

Accounts receivable and accounts payable in other currencies<br />

are recognised at the exchange rate at which such accounts<br />

arose. In the event that the applicable exchange rates on the<br />

balance sheet date are lower (in the case of receivables) or<br />

higher (in the case of payables), then these positions are<br />

recognised at the exchange rates prevailing on the balance<br />

sheet date unless these positions have been hedged to<br />

eliminate currency-based risks.<br />

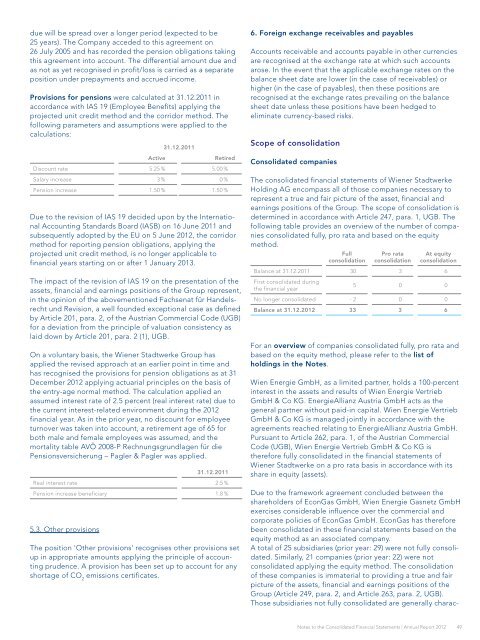

scope of consolidation<br />

Consolidated companies<br />

The consolidated financial statements of <strong>Wiener</strong> <strong>Stadtwerke</strong><br />

Holding AG encompass all of those companies necessary to<br />

represent a true and fair picture of the asset, financial and<br />

earnings positions of the Group. The scope of consolidation is<br />

determined in accordance with Article 247, para. 1, UGB. The<br />

following table provides an overview of the number of companies<br />

consolidated fully, pro rata and based on the equity<br />

method.<br />

Full<br />

consolidation<br />

pro rata<br />

consolidation<br />

At equity<br />

consolidation<br />

Balance at 31.12.2011 30 3 6<br />

First consolidated during<br />

the financial year<br />

5 0 0<br />

No longer consolidated - 2 0 0<br />

Balance at 31.12.<strong>2012</strong> 33 3 6<br />

For an overview of companies consolidated fully, pro rata and<br />

based on the equity method, please refer to the list of<br />

holdings in the notes.<br />

Wien Energie GmbH, as a limited partner, holds a 100-percent<br />

interest in the assets and results of Wien Energie Vertrieb<br />

GmbH & Co KG. EnergieAllianz Austria GmbH acts as the<br />

general partner without paid-in capital. Wien Energie Vertrieb<br />

GmbH & Co KG is managed jointly in accordance with the<br />

agreements reached relating to EnergieAllianz Austria GmbH.<br />

Pursuant to Article 262, para. 1, of the Austrian Commercial<br />

Code (UGB), Wien Energie Vertrieb GmbH & Co KG is<br />

therefore fully consolidated in the financial statements of<br />

<strong>Wiener</strong> <strong>Stadtwerke</strong> on a pro rata basis in accordance with its<br />

share in equity (assets).<br />

Due to the framework agreement concluded between the<br />

shareholders of EconGas GmbH, Wien Energie Gasnetz GmbH<br />

exercises considerable influence over the commercial and<br />

corporate policies of EconGas GmbH. EconGas has therefore<br />

been consolidated in these financial statements based on the<br />

equity method as an associated company.<br />

A total of 25 subsidiaries (prior year: 29) were not fully consolidated.<br />

Similarly, 21 companies (prior year: 22) were not<br />

consolidated applying the equity method. The consolidation<br />

of these companies is immaterial to providing a true and fair<br />

picture of the assets, financial and earnings positions of the<br />

Group (Article 249, para. 2, and Article 263, para. 2, UGB).<br />

Those subsidiaries not fully consolidated are generally charac-<br />

Notes to the Consolidated Financial Statements | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

49