Wiener Stadtwerke Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

terised by low turnover. The total assets of these subsidiaries<br />

represent less than two percent of the consolidated balance<br />

sheet total.<br />

Pursuant to Article 249, para 1, of the UGB, the company<br />

Gemeinnützige Wohnungs- und Siedlungsgesellschaft of<br />

<strong>Wiener</strong> <strong>Stadtwerke</strong> GmbH was not consolidated.<br />

A foreign subsidiary was consolidated in the Group‘s financial<br />

statements for the first time in <strong>2012</strong>; this necessitated translating<br />

the relevant results into euro.<br />

A list of the Group’s holdings may be obtained directly from<br />

the offices of the parent company.<br />

Changes in the scope of consolidation<br />

during the financial year<br />

During the period under review, the companies Parkraum Wien<br />

Management GmbH, WSTW TownTown GmbH & Co Stationsturm<br />

KG, Windnet Windkraftanlagenbetriebs GmbH, Windnet<br />

Windkraftanlagebetriebs GmbH & Co KG and Vienna Energy<br />

Természeti Erö KFT were included in the scope of full consolidation<br />

for the first time. The offsetting of the value of the<br />

parent company‘s investments against the pro rata equity of<br />

the subsidiaries was based on the time they were acquired.<br />

The companies STPM Städtische Parkraummanagement GmbH<br />

and WIPARK Garagen GmbH were merged. Furthermore, the<br />

company <strong>Wiener</strong> <strong>Stadtwerke</strong> Beteiligungsmanagement GmbH<br />

merged with <strong>Wiener</strong> <strong>Stadtwerke</strong> Vermögensverwaltung GmbH.<br />

Consolidation principles<br />

Capital consolidation applied the book value method.<br />

Differential amounts arising in the periods up to and including<br />

the 2008 financial year between the valuations of equity<br />

investments and the proportional share of equity in subsidiaries<br />

were recognised under the position 'Capital reserves' in<br />

accordance with Article 261, para. 1, of the Austrian Commercial<br />

Code. Shares in subsidiaries not held by the Group are<br />

recognised under the position 'Minority interests'.<br />

During the consolidation of liabilities, licences, prepayments<br />

made, lendings, accounts receivable – trade, other receivables<br />

and accrued income are offset against the corresponding<br />

liabilities and provisions.<br />

All Group-internal expenses and income are offset in the<br />

course of the expenses and income consolidation of the<br />

Group subsidiaries in accordance with Article 257, para. 1, of<br />

the UGB. In the event of Group-internal construction work, the<br />

associated revenues are reclassified as own work capitalised.<br />

intercompany results within the Group are recognised in<br />

income and eliminated in accordance with the principal of<br />

materiality. No elimination of intercompany results has been<br />

applied to companies valued applying the equity method<br />

given that their influence on the overall standing of the Group<br />

is immaterial.<br />

50 <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | Notes to the Consolidated Financial Statements<br />

Deferred tax assets based on intercompany results, and<br />

resulting from the different accounting options available<br />

during the preparation of the consolidated financial statements<br />

as opposed to the financial statements of the individual<br />

subsidiaries, are no longer recognised following a Group-<br />

internal consolidated tax agreement effective since 2005. The<br />

untaxed reserves (with the exception of investment allowances)<br />

recognised in the financial statements of the subsidiaries are,<br />

therefore, carried under the position retained earnings without<br />

any corresponding deferral of taxes.<br />

The differential amounts resulting from the capital accounting<br />

of companies recognised applying the equity method are<br />

determined according to the same principles applied to fully<br />

consolidated companies. Wherever possible and material,<br />

these valuations are adjusted to correspond to group-wide<br />

valuation methods.<br />

These consolidated financial statements are based to a certain<br />

extent on estimations and assumptions which have an influence<br />

on the values of assets and liabilities, the representation of<br />

other obligations on the balance sheet date, and on details of<br />

revenues and expenses during the period under review. The<br />

actual figures and amounts may deviate from these estimations.<br />

notes to the consolidated balance sheet<br />

The numbering of the following explanations (Notes) relates to<br />

that provided in the Consolidated Balance Sheet and the<br />

Consolidated Profit and Loss Account. The numbering is<br />

sequential and is without other relevance.<br />

(1) Fixed assets<br />

For details of developments in specific fixed asset positions<br />

and a breakdown of depreciation and amortisation by asset<br />

type for the financial year <strong>2012</strong>, please refer to the table<br />

entitled Statement of Changes in Tangible and Intangible<br />

Assets.<br />

The land value element of developed plots of land amounts to<br />

TEUR 208,681 (prior year: TEUR 197,376).<br />

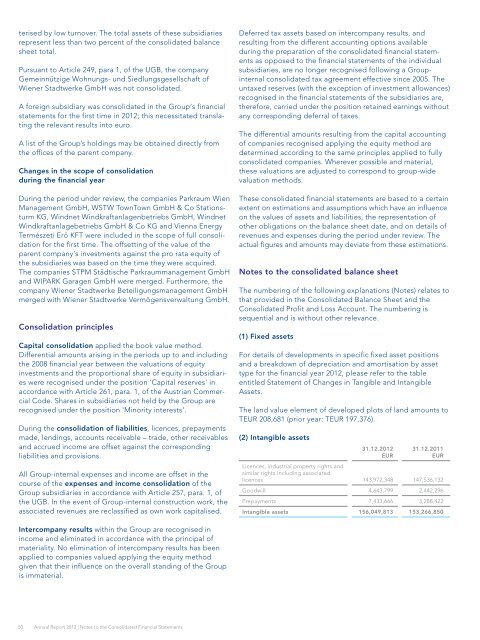

(2) intangible assets<br />

31.12.<strong>2012</strong><br />

EUR<br />

31.12.2011<br />

EUR<br />

Licences, industrial property rights and<br />

similar rights including associated<br />

licences 143,972,348 147,536,132<br />

Goodwill 4,643,799 2,442,296<br />

Prepayments 7,433,666 3,288,422<br />

intangible assets 156,049,813 153,266,850