(70) Therefore, the risk of sulphuric acid dew point attack ... - DTI Home

(70) Therefore, the risk of sulphuric acid dew point attack ... - DTI Home

(70) Therefore, the risk of sulphuric acid dew point attack ... - DTI Home

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

European (CEE) countries. The market in CEE countries is likely to be<br />

enhanced as <strong>the</strong> EU enlarges as trade with <strong>the</strong>m will become easier and <strong>the</strong>y<br />

will be striving to meet EU environmental standards. Turkey was identified as<br />

a good market due to low gas prices and a large demand for electricity. The<br />

Middle East was identified as a market with good potential due to <strong>the</strong><br />

abundance <strong>of</strong> open cycle gas turbine plant that could be retr<strong>of</strong>itted with<br />

HRSGs for improved efficiency by operating in combined cycle mode or for<br />

power augmentation by turbine inlet chilling. One consultee identified Italy<br />

and Spain as good markets for oil replacement plant and <strong>the</strong> Middle East for<br />

desalination plant.<br />

The market in China is expanding rapidly, but is viewed as a difficult place to<br />

do business. This is due to <strong>the</strong> bureaucracy <strong>of</strong> complying with <strong>the</strong> local codes<br />

and standards and <strong>the</strong> fierce competition from local manufacturers. The<br />

market in Indonesia is also apparently growing, but competition from Chinese<br />

manufacturers is stiff here too.<br />

A number <strong>of</strong> o<strong>the</strong>r markets were identified by consultees as still being active,<br />

despite <strong>the</strong> general depression <strong>of</strong> <strong>the</strong> CHP market throughout Europe<br />

associated with falling electricity prices and rising gas prices. Within Europe<br />

<strong>the</strong> markets in France, Spain, Italy, Germany and Scandinavia are perceived as<br />

being most active for <strong>the</strong> development <strong>of</strong> CHP projects. German and<br />

Scandinavian markets are seen as being more highly regulated still (less<br />

competitive pressure on wholesale electricity prices) and <strong>the</strong>re is price support<br />

for CHP schemes in Germany for a limited period. Some new CHP schemes in<br />

Germany benefit from a guaranteed feed in price. France, Spain and Italy also<br />

have support mechanisms in place for CHP.<br />

6.4 UK Market<br />

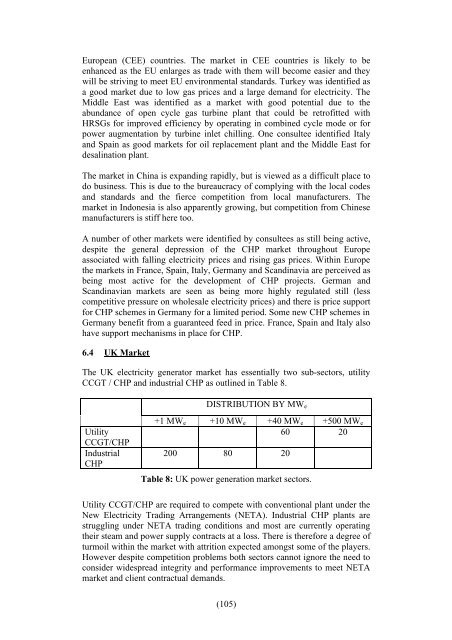

The UK electricity generator market has essentially two sub-sectors, utility<br />

CCGT / CHP and industrial CHP as outlined in Table 8.<br />

Utility<br />

CCGT/CHP<br />

Industrial<br />

CHP<br />

DISTRIBUTION BY MWe<br />

+1 MWe +10 MWe +40 MWe +500 MWe<br />

60 20<br />

200 80 20<br />

Table 8: UK power generation market sectors.<br />

Utility CCGT/CHP are required to compete with conventional plant under <strong>the</strong><br />

New Electricity Trading Arrangements (NETA). Industrial CHP plants are<br />

struggling under NETA trading conditions and most are currently operating<br />

<strong>the</strong>ir steam and power supply contracts at a loss. There is <strong>the</strong>refore a degree <strong>of</strong><br />

turmoil within <strong>the</strong> market with attrition expected amongst some <strong>of</strong> <strong>the</strong> players.<br />

However despite competition problems both sectors cannot ignore <strong>the</strong> need to<br />

consider widespread integrity and performance improvements to meet NETA<br />

market and client contractual demands.<br />

(105)