Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

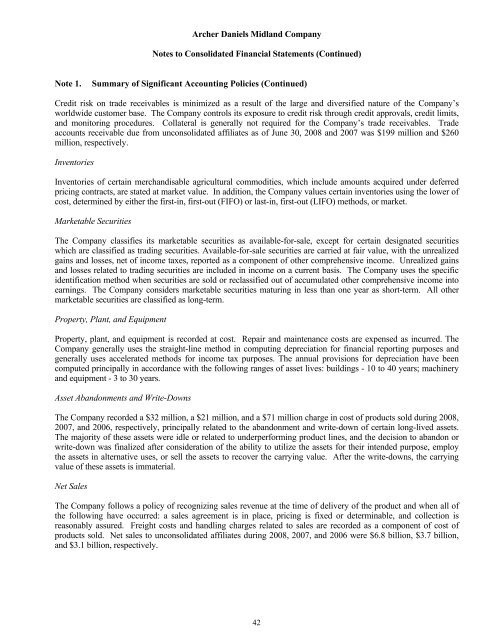

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

Note 1. Summary of Significant Accounting Policies (Continued)<br />

Credit risk on trade receivables is minimized as a result of the large and diversified nature of the Company’s<br />

worldwide customer base. The Company controls its exposure to credit risk through credit approvals, credit limits,<br />

and monitoring procedures. Collateral is generally not required for the Company’s trade receivables. Trade<br />

accounts receivable due from unconsolidated affiliates as of June 30, 2008 and 2007 was $199 million and $260<br />

million, respectively.<br />

Inventories<br />

Inventories of certain merchandisable agricultural commodities, which include amounts acquired under deferred<br />

pricing contracts, are stated at market value. In addition, the Company values certain inventories using the lower of<br />

cost, determined by either the first-in, first-out (FIFO) or last-in, first-out (LIFO) methods, or market.<br />

Marketable Securities<br />

The Company classifies its marketable securities as available-for-sale, except for certain designated securities<br />

which are classified as trading securities. Available-for-sale securities are carried at fair value, with the unrealized<br />

gains and losses, net of income taxes, reported as a component of other comprehensive income. Unrealized gains<br />

and losses related to trading securities are included in income on a current basis. The Company uses the specific<br />

identification method when securities are sold or reclassified out of accumulated other comprehensive income into<br />

earnings. The Company considers marketable securities maturing in less than one year as short-term. All other<br />

marketable securities are classified as long-term.<br />

Property, Plant, and Equipment<br />

Property, plant, and equipment is recorded at cost. Repair and maintenance costs are expensed as incurred. The<br />

Company generally uses the straight-line method in computing depreciation for financial reporting purposes and<br />

generally uses accelerated methods for income tax purposes. The annual provisions for depreciation have been<br />

computed principally in accordance with the following ranges of asset lives: buildings - 10 to 40 years; machinery<br />

and equipment - 3 to 30 years.<br />

Asset Abandonments and Write-Downs<br />

The Company recorded a $32 million, a $21 million, and a $71 million charge in cost of products sold during 2008,<br />

2007, and 2006, respectively, principally related to the abandonment and write-down of certain long-lived assets.<br />

The majority of these assets were idle or related to underperforming product lines, and the decision to abandon or<br />

write-down was finalized after consideration of the ability to utilize the assets for their intended purpose, employ<br />

the assets in alternative uses, or sell the assets to recover the carrying value. After the write-downs, the carrying<br />

value of these assets is immaterial.<br />

Net Sales<br />

The Company follows a policy of recognizing sales revenue at the time of delivery of the product and when all of<br />

the following have occurred: a sales agreement is in place, pricing is fixed or determinable, and collection is<br />

reasonably assured. Freight costs and handling charges related to sales are recorded as a component of cost of<br />

products sold. Net sales to unconsolidated affiliates during 2008, 2007, and 2006 were $6.8 billion, $3.7 billion,<br />

and $3.1 billion, respectively.<br />

42