Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 8. Shareholders’ Equity (Continued)<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

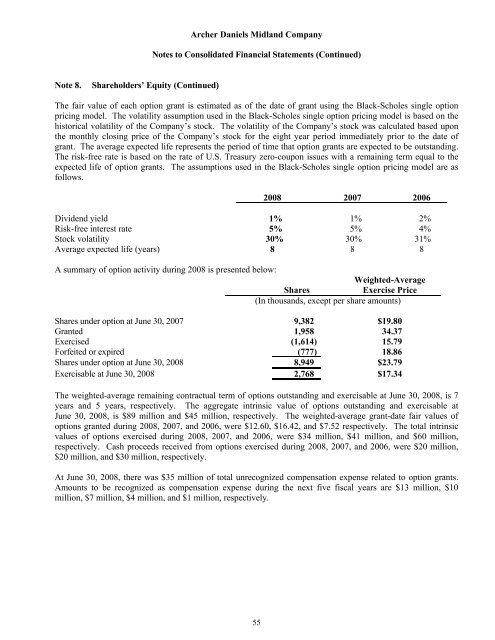

The fair value of each option grant is estimated as of the date of grant using the Black-Scholes single option<br />

pricing model. The volatility assumption used in the Black-Scholes single option pricing model is based on the<br />

historical volatility of the Company’s stock. The volatility of the Company’s stock was calculated based upon<br />

the monthly closing price of the Company’s stock for the eight year period immediately prior to the date of<br />

grant. The average expected life represents the period of time that option grants are expected to be outstanding.<br />

The risk-free rate is based on the rate of U.S. Treasury zero-coupon issues with a remaining term equal to the<br />

expected life of option grants. The assumptions used in the Black-Scholes single option pricing model are as<br />

follows.<br />

55<br />

2008 2007 2006<br />

Dividend yield 1% 1% 2%<br />

Risk-free interest rate 5% 5% 4%<br />

Stock volatility 30% 30% 31%<br />

Average expected life (years) 8 8 8<br />

A summary of option activity during 2008 is presented below:<br />

Weighted-Average<br />

Shares<br />

Exercise Price<br />

(In thousands, except per share amounts)<br />

Shares under option at June 30, 2007<br />

9,382<br />

$19.80<br />

Granted 1,958 34.37<br />

Exercised (1,614) 15.79<br />

Forfeited or expired (777) 18.86<br />

Shares under option at June 30, 2008 8,949 $23.79<br />

Exercisable at June 30, 2008 2,768 $17.34<br />

The weighted-average remaining contractual term of options outstanding and exercisable at June 30, 2008, is 7<br />

years and 5 years, respectively. The aggregate intrinsic value of options outstanding and exercisable at<br />

June 30, 2008, is $89 million and $45 million, respectively. The weighted-average grant-date fair values of<br />

options granted during 2008, 2007, and 2006, were $12.60, $16.42, and $7.52 respectively. The total intrinsic<br />

values of options exercised during 2008, 2007, and 2006, were $34 million, $41 million, and $60 million,<br />

respectively. Cash proceeds received from options exercised during 2008, 2007, and 2006, were $20 million,<br />

$20 million, and $30 million, respectively.<br />

At June 30, 2008, there was $35 million of total unrecognized compensation expense related to option grants.<br />

Amounts to be recognized as compensation expense during the next five fiscal years are $13 million, $10<br />

million, $7 million, $4 million, and $1 million, respectively.