Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

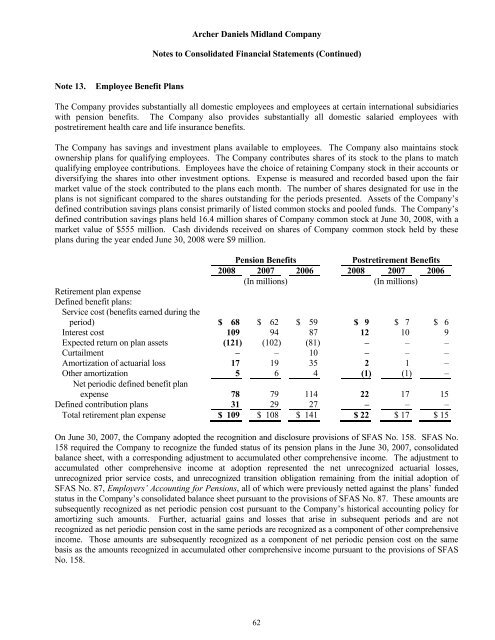

Note 13. Employee Benefit Plans<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

The Company provides substantially all domestic employees and employees at certain international subsidiaries<br />

with pension benefits. The Company also provides substantially all domestic salaried employees with<br />

postretirement health care and life insurance benefits.<br />

The Company has savings and investment plans available to employees. The Company also maintains stock<br />

ownership plans for qualifying employees. The Company contributes shares of its stock to the plans to match<br />

qualifying employee contributions. Employees have the choice of retaining Company stock in their accounts or<br />

diversifying the shares into other investment options. Expense is measured and recorded based upon the fair<br />

market value of the stock contributed to the plans each month. The number of shares designated for use in the<br />

plans is not significant compared to the shares outstanding for the periods presented. Assets of the Company’s<br />

defined contribution savings plans consist primarily of listed common stocks and pooled funds. The Company’s<br />

defined contribution savings plans held 16.4 million shares of Company common stock at June 30, 2008, with a<br />

market value of $555 million. Cash dividends received on shares of Company common stock held by these<br />

plans during the year ended June 30, 2008 were $9 million.<br />

Pension Benefits Postretirement Benefits<br />

2008 2007 2006 2008 2007 2006<br />

(In millions) (In millions)<br />

Retirement plan expense<br />

Defined benefit plans:<br />

Service cost (benefits earned during the<br />

period) $ 68 $ 62 $ 59 $ 9 $ 7 $ 6<br />

Interest cost 109 94 87 12 10 9<br />

Expected return on plan assets (121) (102) (81) – – –<br />

Curtailment – – 10 – – –<br />

Amortization of actuarial loss 17 19 35 2 1 –<br />

Other amortization<br />

Net periodic defined benefit plan<br />

5 6 4 (1) (1) –<br />

expense 78 79 114 22 17 15<br />

Defined contribution plans 31 29 27 – – –<br />

Total retirement plan expense $ 109 $ 108 $ 141 $ 22 $ 17 $ 15<br />

On June 30, 2007, the Company adopted the recognition and disclosure provisions of SFAS No. 158. SFAS No.<br />

158 required the Company to recognize the funded status of its pension plans in the June 30, 2007, consolidated<br />

balance sheet, with a corresponding adjustment to accumulated other comprehensive income. The adjustment to<br />

accumulated other comprehensive income at adoption represented the net unrecognized actuarial losses,<br />

unrecognized prior service costs, and unrecognized transition obligation remaining from the initial adoption of<br />

SFAS No. 87, Employers’ Accounting for Pensions, all of which were previously netted against the plans’ funded<br />

status in the Company’s consolidated balance sheet pursuant to the provisions of SFAS No. 87. These amounts are<br />

subsequently recognized as net periodic pension cost pursuant to the Company’s historical accounting policy for<br />

amortizing such amounts. Further, actuarial gains and losses that arise in subsequent periods and are not<br />

recognized as net periodic pension cost in the same periods are recognized as a component of other comprehensive<br />

income. Those amounts are subsequently recognized as a component of net periodic pension cost on the same<br />

basis as the amounts recognized in accumulated other comprehensive income pursuant to the provisions of SFAS<br />

No. 158.<br />

62