Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

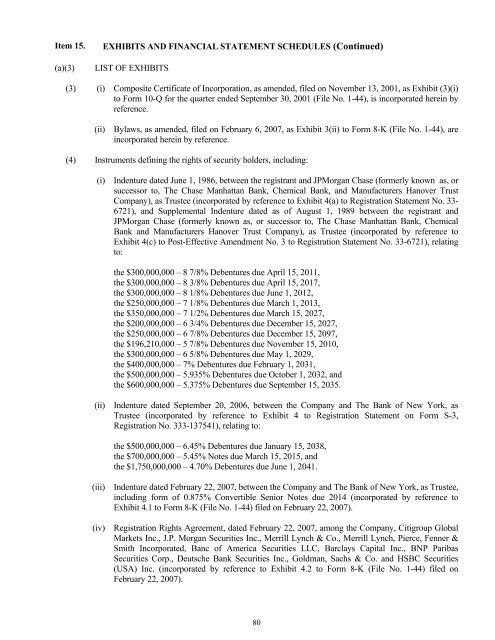

Item 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES (Continued)<br />

(a)(3) LIST OF EXHIBITS<br />

(3) (i) Composite Certificate of Incorporation, as amended, filed on November 13, 2001, as Exhibit (3)(i)<br />

to Form 10-Q for the quarter ended September 30, 2001 (File No. 1-44), is incorporated herein by<br />

reference.<br />

(ii) Bylaws, as amended, filed on February 6, 2007, as Exhibit 3(ii) to Form 8-K (File No. 1-44), are<br />

incorporated herein by reference.<br />

(4) Instruments defining the rights of security holders, including:<br />

(i) Indenture dated June 1, 1986, between the registrant and JPMorgan Chase (formerly known as, or<br />

successor to, The Chase Manhattan Bank, Chemical Bank, and Manufacturers Hanover Trust<br />

Company), as Trustee (incorporated by reference to Exhibit 4(a) to Registration Statement No. 33-<br />

6721), and Supplemental Indenture dated as of August 1, 1989 between the registrant and<br />

JPMorgan Chase (formerly known as, or successor to, The Chase Manhattan Bank, Chemical<br />

Bank and Manufacturers Hanover Trust Company), as Trustee (incorporated by reference to<br />

Exhibit 4(c) to Post-Effective Amendment No. 3 to Registration Statement No. 33-6721), relating<br />

to:<br />

the $300,000,000 – 8 7/8% Debentures due April 15, 2011,<br />

the $300,000,000 – 8 3/8% Debentures due April 15, 2017,<br />

the $300,000,000 – 8 1/8% Debentures due June 1, 2012,<br />

the $250,000,000 – 7 1/8% Debentures due March 1, 2013,<br />

the $350,000,000 – 7 1/2% Debentures due March 15, 2027,<br />

the $200,000,000 – 6 3/4% Debentures due December 15, 2027,<br />

the $250,000,000 – 6 7/8% Debentures due December 15, 2097,<br />

the $196,210,000 – 5 7/8% Debentures due November 15, 2010,<br />

the $300,000,000 – 6 5/8% Debentures due May 1, 2029,<br />

the $400,000,000 – 7% Debentures due February 1, 2031,<br />

the $500,000,000 – 5.935% Debentures due October 1, 2032, and<br />

the $600,000,000 – 5.375% Debentures due September 15, 2035.<br />

(ii) Indenture dated September 20, 2006, between the Company and The Bank of New York, as<br />

Trustee (incorporated by reference to Exhibit 4 to Registration Statement on Form S-3,<br />

Registration No. 333-137541), relating to:<br />

the $500,000,000 – 6.45% Debentures due January 15, 2038,<br />

the $700,000,000 – 5.45% Notes due March 15, 2015, and<br />

the $1,750,000,000 – 4.70% Debentures due June 1, 2041.<br />

(iii) Indenture dated February 22, 2007, between the Company and The Bank of New York, as Trustee,<br />

including form of 0.875% Convertible Senior Notes due 2014 (incorporated by reference to<br />

Exhibit 4.1 to Form 8-K (File No. 1-44) filed on February 22, 2007).<br />

(iv) Registration Rights Agreement, dated February 22, 2007, among the Company, Citigroup Global<br />

Markets Inc., J.P. Morgan Securities Inc., Merrill Lynch & Co., Merrill Lynch, Pierce, Fenner &<br />

Smith Incorporated, Banc of America Securities LLC, Barclays Capital Inc., BNP Paribas<br />

Securities Corp., Deutsche Bank Securities Inc., Goldman, Sachs & Co. and HSBC Securities<br />

(USA) Inc. (incorporated by reference to Exhibit 4.2 to Form 8-K (File No. 1-44) filed on<br />

February 22, 2007).<br />

80