Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 13. Employee Benefit Plans (Continued)<br />

Plan Assets<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

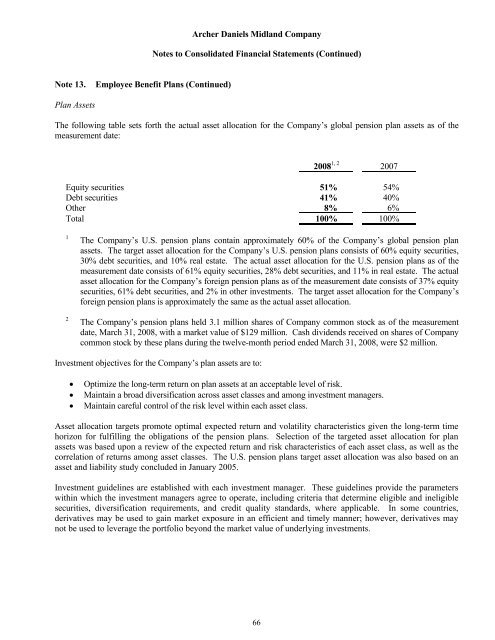

The following table sets forth the actual asset allocation for the Company’s global pension plan assets as of the<br />

measurement date:<br />

66<br />

2008 1, 2 2007<br />

Equity securities 51% 54%<br />

Debt securities 41% 40%<br />

Other 8% 6%<br />

Total 100% 100%<br />

1 The Company’s U.S. pension plans contain approximately 60% of the Company’s global pension plan<br />

assets. The target asset allocation for the Company’s U.S. pension plans consists of 60% equity securities,<br />

30% debt securities, and 10% real estate. The actual asset allocation for the U.S. pension plans as of the<br />

measurement date consists of 61% equity securities, 28% debt securities, and 11% in real estate. The actual<br />

asset allocation for the Company’s foreign pension plans as of the measurement date consists of 37% equity<br />

securities, 61% debt securities, and 2% in other investments. The target asset allocation for the Company’s<br />

foreign pension plans is approximately the same as the actual asset allocation.<br />

2 The Company’s pension plans held 3.1 million shares of Company common stock as of the measurement<br />

date, March 31, 2008, with a market value of $129 million. Cash dividends received on shares of Company<br />

common stock by these plans during the twelve-month period ended March 31, 2008, were $2 million.<br />

Investment objectives for the Company’s plan assets are to:<br />

• Optimize the long-term return on plan assets at an acceptable level of risk.<br />

• Maintain a broad diversification across asset classes and among investment managers.<br />

• Maintain careful control of the risk level within each asset class.<br />

Asset allocation targets promote optimal expected return and volatility characteristics given the long-term time<br />

horizon for fulfilling the obligations of the pension plans. Selection of the targeted asset allocation for plan<br />

assets was based upon a review of the expected return and risk characteristics of each asset class, as well as the<br />

correlation of returns among asset classes. The U.S. pension plans target asset allocation was also based on an<br />

asset and liability study concluded in January 2005.<br />

Investment guidelines are established with each investment manager. These guidelines provide the parameters<br />

within which the investment managers agree to operate, including criteria that determine eligible and ineligible<br />

securities, diversification requirements, and credit quality standards, where applicable. In some countries,<br />

derivatives may be used to gain market exposure in an efficient and timely manner; however, derivatives may<br />

not be used to leverage the portfolio beyond the market value of underlying investments.