Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 11. Income Taxes (Continued)<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

The Company is subject to income taxation in many jurisdictions around the world. Resolution of the related tax<br />

positions through negotiations with relevant tax authorities or through litigation may take years to complete.<br />

Therefore, it is difficult to predict the timing for resolution for tax positions. However, the Company does not<br />

anticipate that the total amount of unrecognized tax benefits will increase or decrease significantly in the next<br />

twelve months. Given the long periods of time involved in resolving tax positions, the Company does not expect<br />

that the recognition of unrecognized tax benefits will have a material impact on the Company’s effective income<br />

tax rate in any given period. If the total amount of unrecognized tax benefits were required to be recognized by the<br />

Company at one time, there would be a positive impact of $26 million on the tax expense for that period.<br />

The Company classifies interest on income tax-related balances as interest expense or interest income and classifies<br />

tax-related penalties as operating expense. At July 1, 2007, and June 30, 2008, respectively, the Company had<br />

accrued $14.4 million and $17.5 million of liabilities for interest and penalties on unrecognized tax benefits.<br />

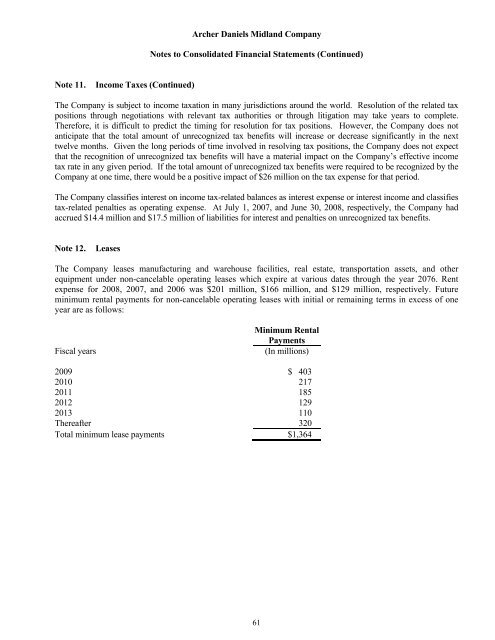

Note 12. Leases<br />

The Company leases manufacturing and warehouse facilities, real estate, transportation assets, and other<br />

equipment under non-cancelable operating leases which expire at various dates through the year 2076. Rent<br />

expense for 2008, 2007, and 2006 was $201 million, $166 million, and $129 million, respectively. Future<br />

minimum rental payments for non-cancelable operating leases with initial or remaining terms in excess of one<br />

year are as follows:<br />

Minimum Rental<br />

Payments<br />

Fiscal years (In millions)<br />

2009 $ 403<br />

2010 217<br />

2011 185<br />

2012 129<br />

2013 110<br />

Thereafter 320<br />

Total minimum lease payments $1,364<br />

61