Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 5. Investments in and Advances to Affiliates<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

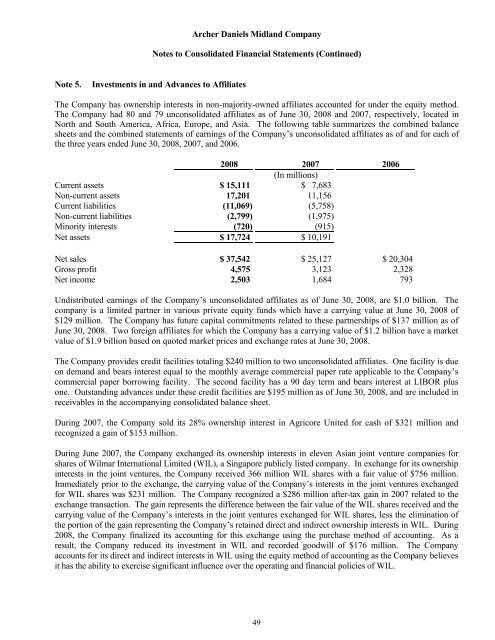

The Company has ownership interests in non-majority-owned affiliates accounted for under the equity method.<br />

The Company had 80 and 79 unconsolidated affiliates as of June 30, 2008 and 2007, respectively, located in<br />

North and South America, Africa, Europe, and Asia. The following table summarizes the combined balance<br />

sheets and the combined statements of earnings of the Company’s unconsolidated affiliates as of and for each of<br />

the three years ended June 30, 2008, 2007, and 2006.<br />

2008 2007 2006<br />

(In millions)<br />

Current assets $ 15,111 $ 7,683<br />

Non-current assets 17,201 11,156<br />

Current liabilities (11,069) (5,758)<br />

Non-current liabilities (2,799) (1,975)<br />

Minority interests (720) (915)<br />

Net assets $ 17,724 $ 10,191<br />

Net sales $ 37,542 $ 25,127 $ 20,304<br />

Gross profit 4,575 3,123 2,328<br />

Net income 2,503 1,684 793<br />

Undistributed earnings of the Company’s unconsolidated affiliates as of June 30, 2008, are $1.0 billion. The<br />

company is a limited partner in various private equity funds which have a carrying value at June 30, 2008 of<br />

$129 million. The Company has future capital commitments related to these partnerships of $137 million as of<br />

June 30, 2008. Two foreign affiliates for which the Company has a carrying value of $1.2 billion have a market<br />

value of $1.9 billion based on quoted market prices and exchange rates at June 30, 2008.<br />

The Company provides credit facilities totaling $240 million to two unconsolidated affiliates. One facility is due<br />

on demand and bears interest equal to the monthly average commercial paper rate applicable to the Company’s<br />

commercial paper borrowing facility. The second facility has a 90 day term and bears interest at LIBOR plus<br />

one. Outstanding advances under these credit facilities are $195 million as of June 30, 2008, and are included in<br />

receivables in the accompanying consolidated balance sheet.<br />

During 2007, the Company sold its 28% ownership interest in Agricore United for cash of $321 million and<br />

recognized a gain of $153 million.<br />

During June 2007, the Company exchanged its ownership interests in eleven Asian joint venture companies for<br />

shares of Wilmar International Limited (WIL), a Singapore publicly listed company. In exchange for its ownership<br />

interests in the joint ventures, the Company received 366 million WIL shares with a fair value of $756 million.<br />

Immediately prior to the exchange, the carrying value of the Company’s interests in the joint ventures exchanged<br />

for WIL shares was $231 million. The Company recognized a $286 million after-tax gain in 2007 related to the<br />

exchange transaction. The gain represents the difference between the fair value of the WIL shares received and the<br />

carrying value of the Company’s interests in the joint ventures exchanged for WIL shares, less the elimination of<br />

the portion of the gain representing the Company’s retained direct and indirect ownership interests in WIL. During<br />

2008, the Company finalized its accounting for this exchange using the purchase method of accounting. As a<br />

result, the Company reduced its investment in WIL and recorded goodwill of $176 million. The Company<br />

accounts for its direct and indirect interests in WIL using the equity method of accounting as the Company believes<br />

it has the ability to exercise significant influence over the operating and financial policies of WIL.<br />

49