Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 13. Employee Benefit Plans (Continued)<br />

Archer Daniels Midland Company<br />

Notes to Consolidated Financial Statements (Continued)<br />

External consultants monitor the investment strategy and asset mix for the Company’s plan assets. To develop<br />

the Company’s expected long-term rate of return assumption on plan assets, the Company generally uses longterm<br />

historical return information for the targeted asset mix identified in asset and liability studies. Adjustments<br />

are made to the expected long-term rate of return assumption when deemed necessary based upon revised<br />

expectations of future investment performance of the overall investment markets. The expected long-term rate<br />

of return assumption used in computing 2008 net periodic pension cost for the pension plans was 7.6%.<br />

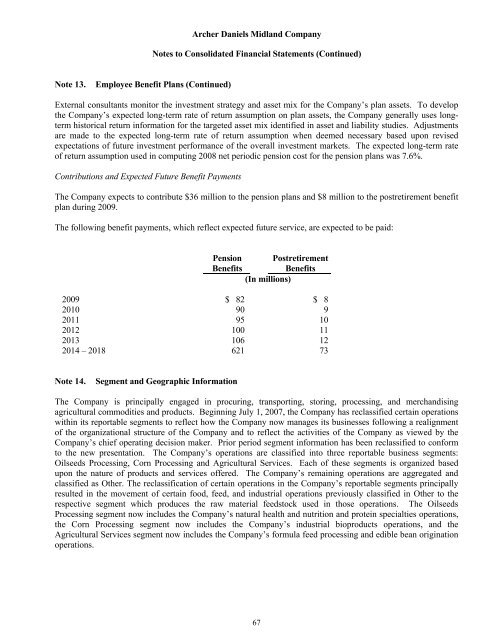

Contributions and Expected Future Benefit Payments<br />

The Company expects to contribute $36 million to the pension plans and $8 million to the postretirement benefit<br />

plan during 2009.<br />

The following benefit payments, which reflect expected future service, are expected to be paid:<br />

Pension Postretirement<br />

Benefits Benefits<br />

(In millions)<br />

2009 $ 82 $ 8<br />

2010 90 9<br />

2011 95 10<br />

2012 100 11<br />

2013 106 12<br />

2014 – 2018 621 73<br />

Note 14. Segment and Geographic Information<br />

The Company is principally engaged in procuring, transporting, storing, processing, and merchandising<br />

agricultural commodities and products. Beginning July 1, 2007, the Company has reclassified certain operations<br />

within its reportable segments to reflect how the Company now manages its businesses following a realignment<br />

of the organizational structure of the Company and to reflect the activities of the Company as viewed by the<br />

Company’s chief operating decision maker. Prior period segment information has been reclassified to conform<br />

to the new presentation. The Company’s operations are classified into three reportable business segments:<br />

Oilseeds Processing, Corn Processing and Agricultural Services. Each of these segments is organized based<br />

upon the nature of products and services offered. The Company’s remaining operations are aggregated and<br />

classified as Other. The reclassification of certain operations in the Company’s reportable segments principally<br />

resulted in the movement of certain food, feed, and industrial operations previously classified in Other to the<br />

respective segment which produces the raw material feedstock used in those operations. The Oilseeds<br />

Processing segment now includes the Company’s natural health and nutrition and protein specialties operations,<br />

the Corn Processing segment now includes the Company’s industrial bioproducts operations, and the<br />

Agricultural Services segment now includes the Company’s formula feed processing and edible bean origination<br />

operations.<br />

67