Annual Report 2007

Annual Report 2007

Annual Report 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

e held in March 2008. Dividends declared in cash or distributed<br />

to Ecuadorian or foreign shareholders are not subject to any additional<br />

withholding.<br />

Income Tax, Employee Profit-Sharing Deferred and INNFA Income<br />

Deferred – The financial statements reflect the impact of prepaid<br />

taxes and employee profit-sharing on taxable income or deductions<br />

included in the balance sheet as temporary differences. These<br />

temporary differences are generated by comparing the financial<br />

statements prepared in accordance with the requirements of the<br />

Ecuadorian Superintendency of Banks and Insurance with financial<br />

statements prepared in accordance with International Financial<br />

<strong>Report</strong>ing Standards. Further differences result from reconciliation<br />

items determined following application of tax resolutions. Net tax<br />

rates used to calculate the income tax, employee profit-sharing and<br />

the INNFA provision for the year ended December 31, <strong>2007</strong> were<br />

25%, 15% and 2% respectively, the combined nominal tax rate for<br />

income tax, employee profit-sharing and INNFA income is 37.52%.<br />

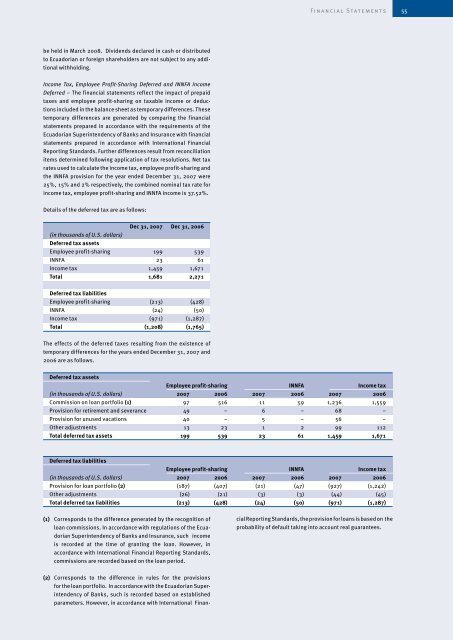

Details of the deferred tax are as follows:<br />

(in thousands of U.S. dollars)<br />

Deferred tax assets<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

Employee profit-sharing 199 539<br />

INNFA 23 61<br />

Income tax 1,459 1,671<br />

Total 1,681 2,271<br />

Deferred tax liabilities<br />

Employee profit-sharing (213) (428)<br />

INNFA (24) (50)<br />

Income tax (971) (1,287)<br />

Total (1,208) (1,765)<br />

The effects of the deferred taxes resulting from the existence of<br />

temporary differences for the years ended December 31, <strong>2007</strong> and<br />

2006 are as follows.<br />

Deferred tax assets<br />

Employee profit-sharing INNFA Income tax<br />

(in thousands of U.S. dollars) <strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

Commission on loan portfolio (1) 97 516 11 59 1,236 1,559<br />

Provision for retirement and severance 49 – 6 – 68 –<br />

Provision for unused vacations 40 – 5 – 56 –<br />

Other adjustments 13 23 1 2 99 112<br />

Total deferred tax assets 199 539 23 61 1,459 1,671<br />

Deferred tax liabilities<br />

Employee profit-sharing INNFA Income tax<br />

(in thousands of U.S. dollars) <strong>2007</strong> 2006 <strong>2007</strong> 2006 <strong>2007</strong> 2006<br />

Provision for loan portfolio (2) (187) (407) (21) (47) (927) (1,242)<br />

Other adjustments (26) (21) (3) (3) (44) (45)<br />

Total deferred tax liabilities (213) (428) (24) (50) (971) (1,287)<br />

(1) Corresponds to the difference generated by the recognition of<br />

loan commissions. In accordance with regulations of the Ecuadorian<br />

Superintendency of Banks and Insurance, such income<br />

is recorded at the time of granting the loan. However, in<br />

accordance with International Financial <strong>Report</strong>ing Standards,<br />

commissions are recorded based on the loan period.<br />

(2) Corresponds to the difference in rules for the provisions<br />

for the loan portfolio. In accordance with the Ecuadorian Superintendency<br />

of Banks, such is recorded based on established<br />

parameters. However, in accordance with International Finan-<br />

F i n a n c i a l S tat e m e n t s<br />

cial <strong>Report</strong>ing Standards, the provision for loans is based on the<br />

probability of default taking into account real guarantees.