Annual Report 2007

Annual Report 2007

Annual Report 2007

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Legal Reserve – In accordance with the General Law for Financial<br />

System Institutions of Ecuador at least 10% of annual income must<br />

be allocated to a legal reserve until it reaches 50% of share capital.<br />

Retained Earnings – Based on the Resolutions Codification of the<br />

Ecuadorian Superintendency of Banks and Insurance and the Banking<br />

Board, the Superintendency of Banks and Insurance may require<br />

the Bank to not distribute entire or partial earnings to stockholders,<br />

but oblige such to be used to form a special reserve for an immediate<br />

capital increase. At December 31, <strong>2007</strong>, the Superintendency<br />

has placed no restrictions on the use of retained earnings.<br />

Externally Imposed Capital Requirements – In accordance with<br />

the General Law for Financial System Institutions of Ecuador and<br />

the Resolutions Codification of the Ecuadorian Superintendency<br />

of Banks and Insurance and the Banking Board, the Bank must<br />

maintain a 9% ratio between technical capital and the total of the<br />

amount weighted for risk of assets and contingencies. Furthermore,<br />

the technical capital may not be less than 4% of total assets<br />

plus contingencies.<br />

At December 31, <strong>2007</strong> and 2006, the Bank complied with the requirements<br />

of the Regulatory Entity.<br />

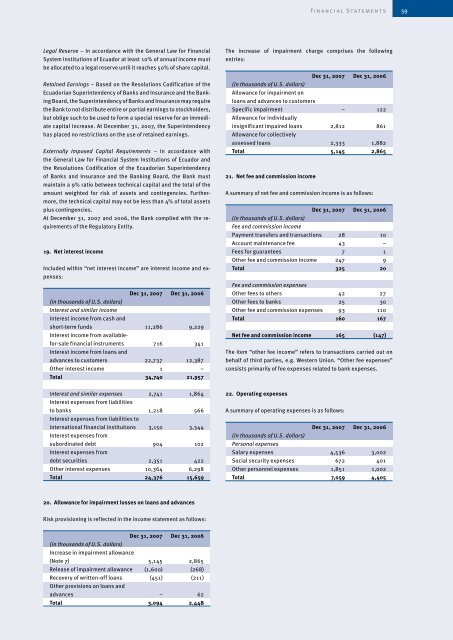

19. Net interest income<br />

Included within “net interest income” are interest income and expenses:<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

(in thousands of U.S. dollars)<br />

Interest and similar income<br />

Interest income from cash and<br />

short-term funds<br />

Interest income from available-<br />

11,286 9,229<br />

for-sale financial instruments<br />

Interest income from loans and<br />

716 341<br />

advances to customers 22,737 12,387<br />

Other interest income 1 –<br />

Total 34,740 21,957<br />

Interest and similar expenses<br />

Interest expenses from liabilities<br />

2,741 1,864<br />

to banks<br />

Interest expenses from liabilities to<br />

1,218 566<br />

international financial institutions<br />

Interest expenses from<br />

3,150 3,344<br />

subordinated debt<br />

Interest expenses from<br />

904 102<br />

debt securities 2,351 422<br />

Other interest expenses 10,364 6,298<br />

Total 24,376 15,659<br />

20. Allowance for impairment losses on loans and advances<br />

Risk provisioning is reflected in the income statement as follows:<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

(in thousands of U.S. dollars)<br />

Increase in impairment allowance<br />

(Note 7) 5,145 2,865<br />

Release of impairment allowance (1,600) (268)<br />

Recovery of written-off loans<br />

Other provisions on loans and<br />

(451) (211)<br />

advances – 62<br />

Total 3,094 2,448<br />

The increase of impairment charge comprises the following<br />

entries:<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

(in thousands of U.S. dollars)<br />

Allowance for impairment on<br />

loans and advances to customers<br />

Specific impairment<br />

Allowance for individually<br />

– 122<br />

insignificant impaired loans<br />

Allowance for collectively<br />

2,812 861<br />

assessed loans 2,333 1,882<br />

Total 5,145 2,865<br />

21. Net fee and commission income<br />

A summary of net fee and commission income is as follows:<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

(in thousands of U.S. dollars)<br />

Fee and commission income<br />

Payment transfers and transactions 28 10<br />

Account maintenance fee 43 –<br />

Fees for guarantees 7 1<br />

Other fee and commission income 247 9<br />

Total 325 20<br />

Fee and commission expenses<br />

Other fees to others 42 27<br />

Other fees to banks 25 30<br />

Other fee and commission expenses 93 110<br />

Total 160 167<br />

Net fee and commission income 165 (147)<br />

The item “other fee income” refers to transactions carried out on<br />

behalf of third parties, e.g. Western Union. “Other fee expenses”<br />

consists primarily of fee expenses related to bank expenses.<br />

22. Operating expenses<br />

A summary of operating expenses is as follows:<br />

F i n a n c i a l S tat e m e n t s<br />

Dec 31, <strong>2007</strong> Dec 31, 2006<br />

(in thousands of U.S. dollars)<br />

Personal expenses<br />

Salary expenses 4,536 3,002<br />

Social security expenses 672 401<br />

Other personnel expenses 1,851 1,002<br />

Total 7,059 4,405