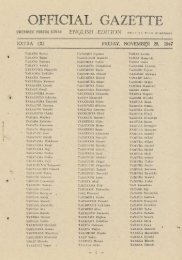

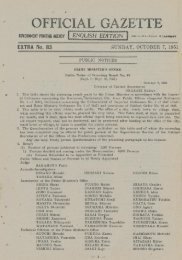

OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

item 6 of the same paragraph; and the following<br />

three items shall foe added next to item 2 of the<br />

same paragraph:<br />

?>. In case the tax collection was postponed<br />

in accordance with Article 7 paragraph 1 or<br />

in, accordance with Article 9 of Law No. 175<br />

of 1947;<br />

4. In case the delinquency disposal was suspended<br />

in accordance with Article 12 paragraph<br />

1;<br />

5. In case the delinquency disposal was postponed<br />

in accordance with Article 12-(2) paragraph<br />

1.<br />

The following one paragraph shall be added in<br />

the same Article:<br />

The demand under paragraph 1 shall possess<br />

the validity of interruption of prescription regardless<br />

of the provision of Article 153 of the<br />

Civil Code.<br />

In Article 10 item (1), "the demand charges<br />

and" shall be deleted.<br />

Article 12 shall be amended as follows:<br />

Article 12. The Government may, if a delinquent<br />

taxtpayer falls under any of the following items,<br />

suspend the exercise of disposal of delinquency:<br />

1. In case the value of the property to be attached<br />

seems to be less than the total of disposal<br />

charges of delinquency and of the credit<br />

to be collected in preference to the national<br />

tax in accordance with Article 3;<br />

2. In case there remain the national tax and<br />

disposal charges of delinquency to be collected,<br />

even if the whole of the property to be<br />

attached is subject to the disposal of delinquency<br />

;<br />

3. In case it is feared that the livelihood of<br />

a delinquent taxpayer becomes seriously difficult<br />

if the disposal of delinquency is made;<br />

4. In ease a delinquent taxpayer's whereabout<br />

can not be known and his property to be<br />

attached can not be known.<br />

The Government shall, if it has suspended<br />

the exercise of delinquency disposal in accordance<br />

with the preceding Article, notify a delinquenqt<br />

taxpayer to that effect.<br />

The Government shall, in case it has suspended<br />

the exercise of delinquency disposal in<br />

accordance with paragraph 1 item 1 or 3, if<br />

there, exists any property attached with respect<br />

to the national tax and disposal chai'ges of<br />

delinquency for which the exercise of delinquency<br />

disposal has been suspended, release the attachment<br />

concerned.<br />

In case a delinquent taxpayer falls under any<br />

of the following items within a three-year-period<br />

after the suspension of the exercise of delinquency<br />

disposal under paragraph 1, the Goveminent<br />

shall release the suspension of the<br />

exercise. In this case, the Government shall<br />

notify a delinquent taxpayer to that effect:<br />

10<br />

1. In case the exercise of delinquency disposal<br />

has been suspended in accordance with paragraph<br />

1 item 1 and a fact under the same<br />

item has come not to exist, and also there is<br />

no fact under item 3 of the same paragraph;<br />

2. In case the exercise of delinquency disposal<br />

has been suspended in accordance with paragraph<br />

1 item 2 and any property to be attached<br />

has come to exist, and also there are<br />

no facts under items 1 and 3 of the same<br />

paragraph ;<br />

3. In case the exercise of delinquency disposal<br />

ihas been suspended in accordance with paragraph<br />

1 item 3 and a fact under the same<br />

item has come not to exist and also there is<br />

no fact under item 1 of the same paragraph;<br />

4. In, case the exercise of delinquency disposal<br />

has been suspended in accordance with paragraph<br />

1 item 4 and a fact'under the same item<br />

has come not to exist and also there is no fact<br />

under items 1 and 3 of the same paragraph.<br />

The obligation of payment of the national<br />

tax and disposal charges of delinquency for<br />

wihich the jexercise of delinquency disposal has<br />

been suspended shall lapse on the day when a<br />

three-year-period has passed after the susipenpension<br />

of the exercise, unless the suspension<br />

has been released in accordance with the preceding<br />

paragraph.<br />

The suspension of delinquency disposal under<br />

paragraph 1 shall not preclude the advance of<br />

prescription.<br />

Article 12-(2). Except for a case falling under<br />

Article 7 paragraph 1, in case it is feared that<br />

the business of a delinquent taxpayer is seriously<br />

impeded if the delinquency disposal is taken<br />

and also in case it seems more favorable for<br />

purposes of collection of national tax and of<br />

disposal charges of delinquency to suspend the<br />

exercise of the delinquency disposal than to make<br />

the exercise immediately, the Government may<br />

put off the exercise a£ delinquency disposal<br />

against the Whole or a part of national tax and<br />

disposal charges of delinquency by designating<br />

a certain term not exceeding two years.<br />

The Government shall, if it has put off the<br />

exercise of delinquency disposal under the provisions<br />

of the preceding paragraph, notify a<br />

delinquent taxpayer to that effect.<br />

Within a term for which the exercise of delinquency<br />

disposal has been put off in accordance<br />

with paragraph 1, if a deliquent taxpayer falls<br />

under any of the following items, the Government<br />

shall release the putting-off of the exercise.<br />

In this ease the Government shall notify a<br />

r delinquent taxpayer to that effect:<br />

1. In case there occurs a fact under each item<br />

of Article 4-(l) ;