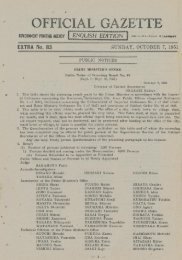

OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Article 12-(2). The provision of the preceding<br />

paragraph shall not apply to a case where the<br />

effect that the balance between the actual amount<br />

of assets and the amount entered in the<br />

inventory is included into business expenses according1<br />

to the preceding Article is not stated<br />

in the return under Articles 18 to 21 inclusive<br />

of the Law.<br />

The provision of Art. 9 par. 2 shall apply<br />

mutatis mutandis to the case under the preceding<br />

paragraph.<br />

In Article 16, "the paid-up amount" shall be<br />

amended as "the face value (as for the share<br />

of a corporation issuing no-par stock, the amount<br />

obtained by dividing the amount of capital of the<br />

corporation concerned at the time when the share<br />

was redeemed by the total number of the issued<br />

stock) ".<br />

Article 17-(3) shall be amended as follows:<br />

Article 17-(3). The expenditure incurred to a<br />

corporation as result that the corporation paid<br />

the national tax and the cost to coercive collection<br />

or the imposition of the local public body<br />

in accordance with the provision of Art. 4-(6)<br />

or Art. 4-(7) of the National Tax Collection<br />

Law (Law No. 21 of 1897) or Art. 10-(2) or<br />

Art. 11-(3) of the Local Tax Law (Law No.<br />

226 of 1950) for a delinquent taxpayer (including<br />

a special collector; hereinafter the same)<br />

who is a shareholder, partner or investor (including<br />

the expenditure incurred as a result<br />

that the corporation did not exercise the right<br />

of claiming the compensation accruing because<br />

of the payment) shall not be included in the<br />

business expense in computing the income for<br />

the accounting period for which the expenditure<br />

was incurred.<br />

In case the corporation received money or<br />

other property from the taxpayer under the<br />

preceding paragraph as a result that the corporation<br />

exercised the right of claiming the compensation<br />

in or after the accounting period for<br />

which the expenditure under the same paragraph<br />

was incurred, the amount of the property thus<br />

received up to the amount of the expenditure<br />

under the same paragraph shall not be included<br />

in the gross income in computing the income for<br />

the accounting period in which the corporation<br />

received the money or other property.<br />

In Article 19, "paid-up amount" shall be amended<br />

as "the value" and the following one paragraph<br />

shall be added to the same Article:<br />

With regard to the application of the provision<br />

of the preceding paragraph, the value of<br />

the new share shall be the face value or invested<br />

amount; provided, that if the new share<br />

concerned is the share of the amalgamating<br />

corporation which issued the no-par stock due<br />

to amalgamation, such value shall be the a-<br />

26<br />

mount obtained by dividing the increased capital<br />

due to amalgamation (or the amount of capital<br />

at the time of the establishment of the new<br />

corporation, if new corporation was established<br />

due, to amalgamation) by the total number of<br />

the share issued due to the amalgamation conicerned.<br />

In Article 19á"(2) paragraph 1, "the paid-up<br />

amount of new share" shall be amended as "the<br />

paid-up amount for new share"; in paragraph 2<br />

of the same Article, "the book value under the<br />

preceding paragraph" as "the book value to be<br />

given to the old and new shares"; and the following<br />

two Articles shall be added next to the<br />

same Article:<br />

Article 19-(3). In case a corporation has acquired<br />

the share on the following causes in connection<br />

with its owned stock (hereinafter referred<br />

to as "old share" in this Article), the book<br />

value to be given to the old share and the acquired<br />

share (hereinafter referred to as "new<br />

share" in this Article) after the acquisition of<br />

the share shall, if under item 1, be the amount<br />

obtained by dividing the total amount of the<br />

acquisition cost of the old share and face value<br />

of the new share (or the issue price, if the<br />

new share is non-par stock) by the number<br />

of new share acquired for an old share concerned<br />

plus 1, and shall, if under item 2, be the<br />

amount obtained by dividing the acquisition cost<br />

of the old share (if some amount are deemed to<br />

be the amount received as dividend in accordance<br />

with the provision of Art. 9-(6) par. 2<br />

item,4 of he Law due to he transfer to he<br />

capital account under the same item, the acquisition<br />

cost of the old share plus the amount<br />

deemed to be the amount recieved as dividend)<br />

by the same number:<br />

1. If the issuing corporation of the old share<br />

concerned has distributed its profit in stock;<br />

2. If the issuing corporation of the old share<br />

has transferred its reserve to the capital account<br />

and has issued the share due to the<br />

transfer to the capital account.<br />

In case the issuing corporation of shares held<br />

by another corporation transferred its reserve<br />

under the provision of Art. 16 of the Law to<br />

the capital account but did not issue the share<br />

due to the transfer to capital account, the book<br />

value of the share to be given by a holding<br />

corporation after the transfer shall be the ac-<br />

*quisition cost of the share concerned plus the<br />

amount deemed in accordance with the provision<br />

of Art. 9-(6) par. 2 item 4 of the Law<br />

to be the amount received as dividend of profit<br />

for a share concerned due to the transfer.<br />

Article 19-(4). In case a corporation has acquired<br />

the stock due to the splits or consolidation<br />

of shares (hereinafter referred to as "old share"