OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

y<br />

V<br />

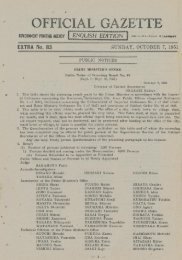

4. Commodity tax which was imposed on the<br />

commodities carried out of the manufactory<br />

before December 31, 1949;<br />

5, Transaction tax, non-war damaged houses<br />

tax, non-war sufferers tax, increased income<br />

tax, property tax, war indemnity special tax<br />

and extraordinary excess profits tax.<br />

17 In cases where a taxpayer has any cause<br />

coming under the items of Article 7 paragraph<br />

1 and other reasonable causes, if the Government<br />

recognizes that the taxpayer can not pay<br />

or the Government can not collect the whole<br />

or a part of old national taxes in cash (including<br />

the tax amount, arrearage and disposal<br />

charges of delinquency as prescribed by Cabinet<br />

Order which are to be collected- or to be paid<br />

in addition to the old national taxes; hereinafter<br />

the same) which are to be collected or<br />

to be paid due to the causes concerned, the<br />

Government may postpone the collection of the<br />

tax concerned by designating the period not<br />

exceeding two years, upon the application of<br />

,the taxpayer concerned, to the extent of amount<br />

recognized impossible to be collected or paid.<br />

In this case, the postponement of tax collection<br />

may be made by the installment collection.<br />

18 As for the postponement of collection under<br />

the provision of the preceding paragraph, the<br />

provisions of Article 7-(2) to Article 8 inclusive<br />

and Article 9 paragraph 9 item 8 of the<br />

new Law shall, considering the postponement<br />

Eof collection concerned as the one under the<br />

provision of Article 7 paragraph 1 of the new<br />

Law, apply thereto; provided that, only for the<br />

case where the tax amount of which collection<br />

is to be postponed exceeds 100,000 yen and it<br />

is recognized to be necessary for securing the<br />

collection of the tax amount concerned, the Government<br />

may collect the security corresponding<br />

to the amount of which collection is postponed.<br />

For the application of the provisions of Article<br />

8 of the new Law, the postponement of tax<br />

collection under the provision of Article 7 paragraph<br />

1 item 1 or 2 of the new Law shall be<br />

deemed to be the one under the provision of<br />

paragraph 1 item 1 or 2 of the same Article.<br />

19 As for the person who has not paid the national<br />

taxes due to the causes comingunder any<br />

item of Article 7 paragraph 1 of the new Law,<br />

the Government may, upon his application, reduce<br />

the amount computed by multiplying the<br />

unpaid arrearage charges concerning the national<br />

taxes by the rate of more than 8 sen<br />

per diem per 100 yen of the tax amount to<br />

the amount computed by multiplying the amount<br />

by the rate of 8 sen per diem per 100 yen of<br />

tax amount.<br />

-13<br />

20 As for a person who has not paid the additional<br />

tax (meaning the tax amount provided<br />

for in Article 2 of the Law for Exceptions to<br />

Arearage Charges, Etc. on National Taxes (Law<br />

No. 78 of 1950); hereinafter the same) due<br />

to the causes coming under any item of Article<br />

7 paragraph 1 of the new Law, the Government<br />

may, upon his application, \reduce the<br />

amount corresponding to the period prior to<br />

December 31, 1949 among the additional taxes<br />

concerned to the amount computed at the rate of<br />

4 sen per diem per 100 yen of the tax amount.<br />

21 If the national tax which has been paid or<br />

collected or is paid or is collected with additions1<br />

tax falls under any one of the cases<br />

enumerated below, the Government may, upon<br />

the application of a taxpayer, reduce the amount<br />

corresponding to the period prior to December<br />

31, 1949 to the amount computed at the rate<br />

of 4 sen per diem per 100 yen; provided that,<br />

if the taxpayer1 has committed the fraud or<br />

other illegal act with respect to the national<br />

taxes, this shall not apply thereto:<br />

1. Where the national tax was corrected or<br />

determined after one year or more from the<br />

due date"of filing;<br />

2. Where the national tax was reported in a<br />

revised return filed after the correction or<br />

determination, or was concerned with the<br />

connection ;<br />

3. Where the national tax was reported after<br />

the due date on account of such inevitable<br />

cause as interruption of communication or<br />

traffic.<br />

22 In case the additional tax was reduced in<br />

accordance with the provision of the preceding<br />

paragraph, the Government may reduce, upon<br />

the application of the taxpayer, such portion<br />

of that additional tax or of the arrearage<br />

charges on the delinquent national taxes paid<br />

or collected with the additional tax or to be so<br />

paid or collected as has been computed at the<br />

rate of more than 8 sen per diem per 100 yen<br />

of the tax to a portion computed at the rate<br />

of 8 sen per diem per 100 yen of the tax.<br />

23 Such portion of the Additional tax or arrearage<br />

charges paid or collected before the enforcement<br />

of this Law as has become an excess<br />

on account of the reduction under the provisions<br />

of the preceding two paragraphs, shall be refunded<br />

or credited against the unpaid national<br />

taxes, demand charges, arrearage charges or<br />

disposal charges only in cases where the request<br />

for refund has been made by June 30, 1951.<br />

24 The provisions of Article 31-(6) of the National<br />

Tax Collection Law shall not apply in<br />

cases where th> amount of the additional taxes