OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

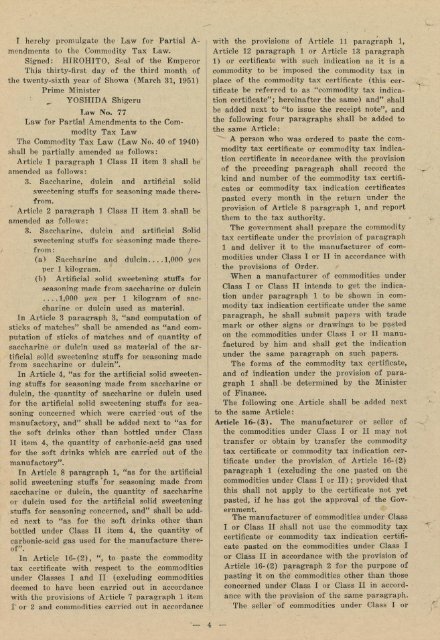

I hereby promulgate the Law for Partial Amendments<br />

to the Commodity Tax Law.<br />

Signed: HIROHITQ, Seal of the Emperor<br />

Thjs thirty-first day of the third month of<br />

the twenty-sixth year of Showa (March 31, 1951)<br />

Prime Minister<br />

YOSHIDA Shigeru<br />

Law No. 77<br />

Law for Partial Amendments to the Commodity<br />

Tax Law<br />

The Commodity Tax Law (Law No. 40 of 1940)<br />

shall be partially amended as follows:<br />

Article 1 paragraph 1 Class II item 3 shall be<br />

amended as follows:<br />

3. Saccharine, dulcin and artificial solid<br />

sweetening stuffs for seasoning made therefrom.<br />

Article 2 paragraph 1 Class IT item 3 shall be<br />

amended as follows:<br />

3. Saccharine, dulcin and artificial Solid<br />

sweetening stuffs for seasoning made therefrom:<br />

(a) Saccharine and dulcin.,..1,000 yen<br />

per 1 kilogram.<br />

(b) Artificial solid sweetening stuffs for<br />

seasoning made from saccharine or dulcin<br />

..,.1,000 yen per 1 kilogram of saccharine<br />

or dulcin used as material.<br />

In Article 3 paragraph 3, "and computation of<br />

sticks of matches" shall be amended as "and computation<br />

of sticks of matches and of quantity of<br />

saccharine or dulcin used as material of the artificial<br />

solid sweetening stuffs for seasoning made<br />

from saccharine or dulcin".<br />

In Article 4, "as for the artificial solid sweetening<br />

stuffs for seasoning made from saccharine or<br />

dulcin, the quantity of saccharine or dulcin used<br />

for the artificial solid sweetening stuffs for seasoning<br />

concerned which were carried out of the<br />

manufactory, and" shall be added next to "as for<br />

the soft drinks other than bottled under Class<br />

II item 4, the quantity of carbonic-acid gas used<br />

for the soft drinks which are carried out of the<br />

manufactory".<br />

In Article 8 paragraph 1, "as for the artificial<br />

solid sweetening stuffs 'for seasoning made from<br />

saccharine or dulcin, the quantity of saccharine<br />

or dulcin used for the artificial solid sweetening<br />

stuffs for seasoning concerned, and" shall be added<br />

next to "as for the soft drinks other than<br />

bottled under Class II item 4, the quantity of<br />

carbonic-acid gas used for the manufacture thereof".<br />

In Article 16-(2), ", to paste the commodity<br />

tax certificate with respect to the commodities<br />

under Classes I and II (excluding commodities<br />

deemed to have been carried out in accordance<br />

with the provisions of Article 7 paragraph 1 item<br />

T or 2 and commodities carried out in accordance<br />

with the provisions of Article 11 paragraph 1,<br />

Article 12 paragraph 1 or Article 13 paragraph<br />

1) or certificate with such indication as it is a<br />

commodity to be imposed the commodity tax in<br />

place of the commodity tax certificate (this certificate<br />

be referred to as "commodity tax indication<br />

certificate"; hereinafter the same) and" shall<br />

be added next to "to issue the receipt note", and<br />

the following four paragraphs shall be added to<br />

the same Article:<br />

"'*"A person who was ordered to paste the commodity<br />

tax certificate or commodity tax indication<br />

certificate in accordance with the provision<br />

of the preceding paragraph shall record the<br />

kind and number of the commodity tax certificates<br />

or commodity tax indication certificates<br />

pasted every month in the return under the<br />

provision of Article 8 paragraph 1, and report<br />

them to the tax authority.<br />

The government shall prepare the commodity<br />

tax certificate under the provision of paragraph<br />

1 and deliver it to the manufacturer of commodities<br />

under Class I or II in accordance with<br />

the provisions of Order.<br />

When a manufacturer of commodities under<br />

Class I or Class II intends to get the indication<br />

under paragraph 1 to be shown in commodity<br />

tax indication certificate under the same<br />

paragraph, he shall submit papers with trade<br />

mark or other signs or drawings to be pasted<br />

on the commodities under Class I or II manufactured<br />

by him and shall get the indication<br />

under the same paragraph on such papers.<br />

The forms of the commodity tax certificate,<br />

and of indication under the provision of paragraph<br />

1 shall be determined by the Minister<br />

of Finance.<br />

The following one Article shall be added next<br />

to the same Article:<br />

Article 16-(3). The manufacturer or seller of<br />

the commodities under Class I or II may not<br />

transfer or obtain by transfer the commodity<br />

tax certificate or commodity tax indication certificate<br />

under the provision of Article 16-(2)<br />

paragraph 1 (excluding the one pasted on the<br />

commodities under Class I or II) ; provided that<br />

this shall not apply to the certificate not yet<br />

pasted, if he has got the approval of the Government.<br />

The manufacturer of commodities under Class<br />

I or Class II shall not use the commodity tax<br />

certificate or commodity tax indication certificate<br />

pasted on the commodities under Class I<br />

or Class II in accordance with the provision of<br />

Article 16-(2) paragraph 2 for the purpose of<br />

pasting it on the commodities other than those<br />

concerned under Class I or Class II in accordance<br />

with the provision of the same paragraph.<br />

The seller of commodities under Class I or<br />

4-