OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

4T ',<br />

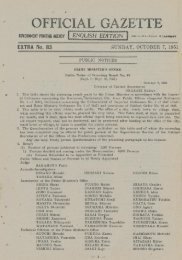

MINISTERIAL ORDINANCES<br />

Ministry of Finance Ordinance No. 17<br />

March 31, 1951<br />

In accordance with the provisions of the Income<br />

lax Law (Law No. 27 of 1947) and the Income<br />

Tax Law Enforcement Regulations (Imperial Ordinance<br />

No. 110 of 1947), the Ministerial Ordinance<br />

for Partial Amendments to the Income Tax<br />

Law Enforcement Rules shall be established as<br />

follows :<br />

Minister of Finance<br />

IKEDA Hayato<br />

Ministerial Ordinance for Partial Amendments<br />

to the Income Tax Law Enforcement<br />

Rules<br />

The Income Tax Law Enforcement Rules (Ministerial<br />

Ordinance No. 29 of 1947) shall be partially<br />

amended as follows:<br />

In Article 1, "Article 12-(6) of the Regulations<br />

or Article 12-(7) of the Regulations" shall be<br />

amended as "Article 12-(11) of the Regulations<br />

or Article 12-(12) of the Regulations".<br />

In Article 6, "Article 12-(4)" shall be amended<br />

as "Article 12-(9) paragraph 1".<br />

In Article 8, "Article 12-(6)" shall be amended<br />

as "Article 12-(11)".<br />

In Article 9, "Article 26-(4)" shall be amended<br />

as "Article 26-(3)".<br />

In Article 14 paragraph 3, "Article 12-(4)"<br />

shall be amended as "Article 12-(9)" and "Article<br />

12-(5)" as "Article 12-(10)".<br />

In Article 20, ", Article 40 of the Regulations<br />

or Article 46 paragraph 4 of the Regulations"<br />

shall be amended as "or Article 40 of the Regulations".<br />

In Article 21, "or Article 46 paragraph 4 of<br />

the Regulations" shall be deleted.<br />

In Article 22, "In a case where the excess amount<br />

as provided for in Article 40 of the Law<br />

is to be appropriated for the income tax to be<br />

withheld in the last pay for the year concerned<br />

or in the pay for the following year in accordance<br />

with the provisions of Article 46 paragraphs<br />

1 and 2 of the Regulations" shall be amended as<br />

"In a case where the excess amount as provided<br />

for in Article 40 of the Law is to be appropriated<br />

for the income tax to be withheld from the last<br />

pay of the year and then if there is still excess<br />

amount, the said excess amount is to be appro-<br />

Diiated for the income tax to be withheld from<br />

the pay of the ensuing year" and "as provided<br />

for in Article 46 paragraph 1 of the Regulations"<br />

as "as provided for in the same Article."<br />

The following Article shall be added next to<br />

Article 24:<br />

Article 24-(2). A person who became to pay<br />

newly salaries, pays, wages, yearly allowances,<br />

annuities, pensions, bonuses or other pays of<br />

-38<br />

similar nature within the enforcement area of<br />

the Law (excluding the payer of the pay coming<br />

under the provision of Article 42 of the Regulations.)<br />

shall file to the chief of competent<br />

taxation office a report stating therein matters<br />

as enumerated below within one month after<br />

the day on which he became to pay,the pays concerned<br />

in accordance with the provision of Article<br />

60 of the Law:<br />

(1) Name or title of the payer of the pay and<br />

place where pay is paid;<br />

(2) Date at which he became to pay the pays;<br />

(3) Number of persons classified by positions<br />

of employees;<br />

(4) Other relevant matters.<br />

A person who had paid salaries, pays, wages,<br />

yearly allowances, annuities, pensions, bonuses<br />

or other pays of similar nature within the enforcement<br />

area of the Law ^excluding the payer<br />

of the pay coming under the provision of Article<br />

42 of the Regulations.), if he did not become<br />

to pay those pays, shall report that effect<br />

to the chief of competent taxation office within<br />

one month after the day on which he did not<br />

become to pay the pays concerned.<br />

In Article 30 paragraph 1 item (2), "paid-up<br />

amount" shall be amended as "value under the<br />

provision of Article 61-(2) paragraph 2 of the<br />

Law" and in paragraph 3 of the same Article,<br />

"if the amount as enumerated in each item ofN<br />

Article 61-(2) paragraph 1 of the Law (in a case<br />

where the amount is paid or delivered in several<br />

installments, the cumulative total of the amount)<br />

is less than 5,000 yen" shall be amended as "with<br />

respect to the shareholder, partner or- investor<br />

who accepted the amount as enumerated in each<br />

item of Article 61-(2) paragraph 1 of the Law<br />

(in a case where the amount is paid or delivered<br />

in several installments, the cumulative total of the<br />

amount) if the said amount is less than 5,000 yen"<br />

and paragraph 4 of the same Article shall be<br />

deleted and the following two Articles shall be<br />

added next to the same Article:<br />

Article 30-(2). In a case where a corporation<br />

having its head office or principal place of business<br />

within the enforcement area of the Law<br />

has transferred its reserves as provided for in<br />

Article 16 of the Corporation Tax Law into<br />

capital account, it shall notice to the chief of<br />

competent taxation office, in the document stating<br />

therein the matters as enumerated in below<br />

in addition to the amount as provided for in<br />

Article 61-(3) of the Law separately for each<br />

member of corporation or investor at the time<br />

of transfer of reserves into capital account,<br />

within one month after the date of the said<br />

transfer into capital account (or by January<br />

31 of the following year, of the year in which<br />

the corporation transfers, with respect to the