OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

v<br />

"f<br />

Class II shall not break wilfully the commodity<br />

tax certificate or commodity tax indication<br />

certificate pasted on the commodities under<br />

Class I or II which he possesses for the purpose<br />

of selling.<br />

In Article 18 paragraph 2, "(as for object of<br />

art and curios, that retailed)" shall be added next<br />

to "the commodities relating to the offence under<br />

the preceding paragraph".<br />

In Article 19 item 1, "or paragraph 2" shall<br />

be amended as "or paragraph 2 or Article 16-(2)<br />

paragraph 2"; and in item 2 of the same Article,<br />

"Article 16-(2)" shall be amended as "Article 16-<br />

(2) paragraph 1"; and the following one item<br />

shall be added to the same Article:<br />

3. A person who has violated the provision of<br />

Article 16-(3) paragraph 1 or 2<br />

Article 20 item 3 shall be made item 4 of the<br />

same Article; and the following one item shall<br />

be added next to item (2) of the same Article:<br />

3. A person who has violated the provisions<br />

of Article 16-(3) paragraph 3. *<br />

In Article 22-(2), "and Article 20 to the preceding<br />

Article inclusive" shall be amended as<br />

", Article 20 and the preceding Article".<br />

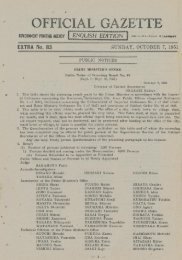

Supplementary Provisions :<br />

1 This Law shall come into force as from April<br />

1, 1951.<br />

2 In case a manufacturer has filed the return<br />

under paragraph 3 with respect to such artificial<br />

solid sweetening stuffs for seasoning made<br />

from saccharine or dulcin on which the commodity<br />

tax had already been imposed before<br />

the enforcement of this Law as was held by<br />

the manufacturer at the time of the enforcement<br />

of this Law, the saccharine or dulcin used<br />

as material shall be deemed to have been carried<br />

back to the manufactory at the date of<br />

enforcement of this Law.<br />

3 A person who holds in his manufactory the<br />

artificial solid sweetening stuffs for seasoning<br />

prescribed in the preceding paragraph 2 at the<br />

time of enforcement of this Law, shall report<br />

the material, quantity and storage place of the<br />

commodities to the taxation office having jurisdiction<br />

over the manufactory within a month<br />

from the enforcement of this Law (or before<br />

the commodities are carried out, if they are<br />

carried out of the manufactory within a month<br />

from the enforcement of this Law).<br />

4 A person who has, since before the enforcement<br />

of this Law, been manufacturing and will<br />

continue to manufacture the artificial solid<br />

sweetening stuffs for seasoning made from<br />

saccharine or dulcin shall report to that effect<br />

to the competent taxation office within a month<br />

after the enforcement of this Law,<br />

-5<br />

5 The report under the preceding paragraph shall<br />

be made by filing the return stating therein<br />

his address, name or title, name of commodities<br />

manufactured and his manufactory with the<br />

competent taxation office.<br />

6 A person who has made the report under the<br />

provision of paragraph 4 shall be deemed to<br />

have filed the return under the provisions of<br />

Article 15 of the Commodity Tax-Law on the<br />

day of enforcement of this Law.<br />

7 A person who has not made the report under<br />

the provisions of paragraph 4 shall be deemed<br />

not to have filed the return under the provisions<br />

of Article 15 of the Commodity Tax Law.<br />

8 The Anti-Imitation Stamps Law (Law No. 189<br />

of 1947) shall be partially amended as follows:<br />

In Article 1, "or commodity tax certificate<br />

under the provisions of Article 16-(2) of the<br />

Commodity Tax Law" shall be added next to<br />

"stamps", "or indication under the provision of<br />

Article 16-(2) of the Commodity Tax Law"<br />

shall be added next to "seals", "thereto" shall<br />

be amended as "to these seals, stamps and indications",<br />

and "or indication" shall be added<br />

next to "seal impressions".<br />

Minister of Finance<br />

IKEDA Hayato<br />

Prime Minister<br />

YOSHIDA Shigeru<br />

I hereby promulgate the Law for Partial Amendments<br />

to the National Tax Collection Law.<br />

Signed: HIROHITO, Seal of the Emperor<br />

This thirty-first day of the third month of<br />

the twenty-sixth year of Showa (March 31, 1951)<br />

Prime Minister<br />

YOSHIDA Shigeru<br />

Law No. 78<br />

Law for Partial Amendments to the National<br />

Tax Collection Law<br />

The National Tax Collection Law (Law No. 21<br />

of 1897) shall be partially amended as follows:<br />

In Article 2 paragraph ,1, ", demand charges<br />

for taxpayment and disposal charges of delinquency"<br />

shall be amended as "and disposal<br />

charges of delinquency" and "hereinafter the<br />

same in this Article" shall be deleted, and in<br />

paragraph 2 of the same Article, ", demand<br />

charges for taxpayment and disposal charges of<br />

delinquency" and "the collecting sum of the local<br />

public body" shall be respectively amended as<br />

"and disposal charges of delinquency" and "other<br />

national taxes, disposal charges of delinquency<br />

and collecting sum by the local public body";<br />

paragraph 3 of the same Article shall be deleted,<br />

and in paragraph 4 of the same Article, ", demand<br />

charges for taxpayment and disposal charges<br />

of delinquency" and "shall not be collected in preference<br />

to the collecting sum of the local public