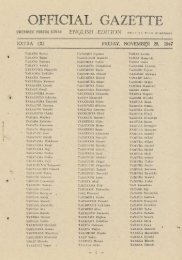

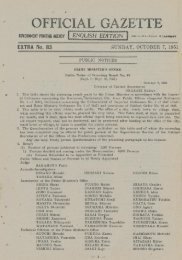

OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

y local public bodies (meaning the collecting<br />

sum by local public bodies as provided for in<br />

paragraph 1 of the same Article; hereinafter<br />

the same).<br />

4 The provision of Article 2 paragraph 7 of the<br />

.new Law shall apply to the priority in collection<br />

between national taxes and disposal charges<br />

of delinquency to be collected after the enforcement<br />

of this Law.<br />

5 The provisions of Article 4-(2) and Article 4-<br />

(3) of the new Law shall apply to the national<br />

taxes and disposal charges of delinquency concerning<br />

decedent (including general bequestee)<br />

in case the succession has begun or corporation<br />

ihas ibeen amalgamated after the enforcement of<br />

this Law or corporation to be dissolved due to<br />

amalgamation; provided that, as for the national<br />

taxes and disposal charges of delinquency<br />

concerning decedent in case the succession has<br />

begun before the enforcement of this Law, the<br />

old Law shall still prevail.<br />

6 The provisions of Article 4-(4) of the new<br />

Law shall apply to the national taxes and disposal<br />

charges of delinquency concerning corpora*<br />

tion which 'has distributed or delivered the residual<br />

assets after the enforcement of this Law.<br />

7 The provisions of Article 4-(6) and Article 4-<br />

(7) shall apply to the national taxes and disposal<br />

charge of delinquency which have not been paid<br />

after the enforcement of this Law.<br />

$ The provisions of Article 8 and Article 9 paragraiph<br />

9 item 3 of the new Law shall also apply<br />

to the interest on delinquent tax and delinquent<br />

additional tax on national taxes of which collection<br />

is actually suspended in accordance with<br />

the provisions of Article 9 of the Law concerning<br />

the Reduction, Exemption and Postponement<br />

of Collection of Tax for Sufferers from Calamity<br />

at the time of enforcement of this Law; provided<br />

that amount of the interest on delinquent tax<br />

and delinquent additional tax which is allowed<br />

to be exempted in accordance with, the provisions<br />

of Article 8 and Article 9 paragraph 9 item<br />

3 of the new Law shall be limited to the amount<br />

corresponding to the term after the enforcement<br />

of this Law.<br />

9 The provisions of Article 9 paragraphs 2 and<br />

10 of the new Law shall apply to the demand of<br />

taxpayment made after the enforcement of this<br />

Law.<br />

10 With respect to the collection of demand charges<br />

for taxpayment concerning the demand for<br />

taxpayment made before the enforcement of<br />

this Law, the old Law shall still prevail; provided<br />

that, this shall not prevent the application<br />

of the provision of paragraph 2.<br />

]1 With respect to the -refund and appropriation<br />

if there is overpaid money in demand charges<br />

for taxpaynient collected before the enforcement<br />

12<br />

of this Law,and those collected* Ln accordance<br />

with the provision, of the preceding paragraph<br />

and appropriation of national taxes, demand<br />

charges and disposal charges for taxpayment,<br />

refund additional money under the provisions<br />

of Article 31-(6) of the National Tax Collection<br />

Law, refund under the provisions of Article<br />

36 paragraph 3 or Article 36-(2) paragraph 3<br />

of the Income Tax Law (Law No. 27 of 1947)<br />

(including additional money under the provisions<br />

of Article 36 paragraph 6 or Article 36-(2)<br />

paragraph 3 of the same Law) and refund under<br />

the provision of Article 26-(3) paragraph<br />

4 of the Corporation Tax Law (Law No. 28<br />

of 1947) (including additional money under the<br />

iprovision of (paragraph 6 of the same Article)<br />

for the demand charges for taxpayment to foe<br />

collected under the provisions of the preceding<br />

paragraph, the old Law shall still prevail.<br />

12 The provisions of Article 15 of the new Law<br />

shall apply if the cancellation of action is required<br />

after the enforcement of this Law; provided<br />

that, if it has been required 'before the<br />

enforcement of this Law, the old Law shall<br />

still prevail.<br />

13 The provisions of Article 16 paragraph 1<br />

items 3 and 4 and Article 17 of the new Law<br />

shall apply to the attachment made after the<br />

enforcement of this Law, and as to the attachment<br />

which has been made before the enforcement<br />

of this Law, the old Law shall still prevail.*<br />

14 The provision of Article 31 of the new Law<br />

shall apply to the disposal of delinquency concerning<br />

the delinquency actually existing at the<br />

time of enforcement of this Law.<br />

15 With respect to the application of the provision<br />

of Article 31-(6) paragraph 4 of the new<br />

Law, the farm final return shall, for the time<br />

being, be deemed to be final return.<br />

16 In paragraph 17, "old national taxes" shall<br />

mean the following national taxes:<br />

1. Income tax for the fiscal year 1949-50 and<br />

before (including income tax withheld from<br />

the earned income and retirement income paid<br />

before December 31, 1949) ;<br />

2. Corporation tax for the accounting period<br />

of corporation ending before March 31, 1950<br />

(including the period which is deemed to be<br />

one accounting period in accordance with the<br />

provision of Article 21 of the Corporation<br />

Tax Law not amended by the Law for Partial<br />

Amendments to the Corporation Tax Law<br />

(Law No. 72 of 1950) (excluding the'corporation<br />

tax on income from liquidation) ;<br />

3. Accessions tax on the succession which began<br />

before December 31, 1949 and gift tax on<br />

the* donation made before the said day;