OFFICIAL GAZETTE

OFFICIAL GAZETTE

OFFICIAL GAZETTE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

V<br />

^<br />

A<br />

\<br />

V<br />

the following matters shall be entered, and the<br />

report shall be filed with the chief of competent<br />

taxation office having jurisdiction over the place<br />

of payment of pay (in case there are two<br />

or more places of payment, the place of payment<br />

of the main pay) :<br />

1. Name of a person who is liable to file the<br />

report and his domicile (or the residence in<br />

case there is no domicile within the enforcement<br />

area of the Law);<br />

2. Name or title of payer of the pay;<br />

3. Kind of insurance, title of insurer, insured<br />

amount, name of insurance policy holder<br />

and name, domicile, date of birth and relationship<br />

with the reporter of recipient of<br />

insured amount, and the amount of insurance<br />

premium paid in the course of the year;<br />

4. Other relevant matters. *<br />

Article 46 paragraphs 1 to 5 inclusive shall be<br />

deleted; and in paragraph 6 of the same Article,<br />

"and par. 1, par. 2 or par. 4" shall be deleted.<br />

Article 49 shall be amended as follows:<br />

Article 49. The public notice under Art. 10-(3)<br />

par. 7 of the Law and the other public notice<br />

to be made for information in accordance with<br />

other laws shall be made in way of publishing in<br />

the official gazette the name of persons to whom<br />

such information is to be made and the matters<br />

to be informed.<br />

In Article 51, "from March 15 to 31 of the same<br />

month each year" shall be amended as "from April<br />

15 to 30 of the same month each year".<br />

In Article 52 paragraph 1 item (2), " ,farm final<br />

return, revised final return or revised farm final<br />

return" shall be amended as "or revised final return".<br />

In Article 54, "par. 6 of the same Article" shall<br />

be amended as "par. 4 of the same Article".<br />

In Article 59-(2), "farm final return", and<br />

" , revised farm return" shall be deleted.<br />

Supplementary Provisions :<br />

1 This Cabinet Order shall come into force as<br />

from April 1, 1951.<br />

2 In the Income Tax- Law Enforcement Regulations<br />

after amendments, the provisions concern-<br />

ing withholding of earned income and retire-<br />

ment income shall apply to the earned income<br />

and retirement income to be paid on or after<br />

April 1, 1951 and the other provisions shall ap-<br />

ply to the income tax for 1,951 or thereafter.<br />

Minister of Finance<br />

IKEDA Hayato"<br />

Prime Minister<br />

YOSHIDA Shigeru<br />

25<br />

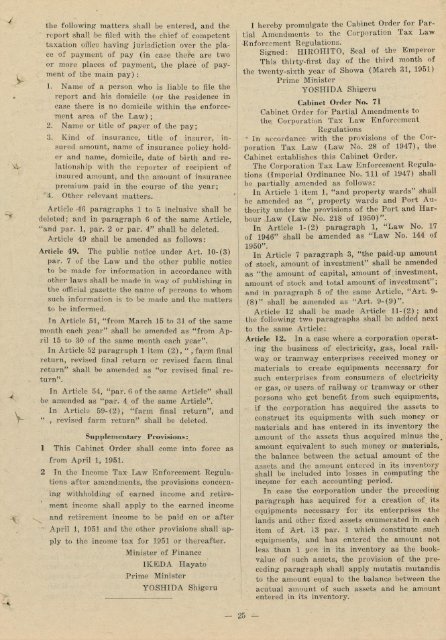

I hereby promulgate the Cabinet Order for Partial<br />

Amendments to the Corporation Tax Law<br />

Enforcement Regulations.<br />

Signed: H1R0HIT0, Seal of the Emperor<br />

This thirty-first day of the third month of<br />

the twenty-sixth year of Showa (March 31, 1951)<br />

Prime Minister<br />

YOSHIDA Shigeru<br />

Cabinet Order No. 71<br />

Cabinet Order for Partial Amendments to<br />

the Corporation Tax Law Enforcement<br />

Regulations<br />

* In accordance with the provisions of the Corporation<br />

Tax Law (Law No. 28 of 3947), the<br />

Cabinet establishes this Cabinet Order.<br />

The Corporation Tax Law Enforcement Regulations<br />

(imperial Ordinance No. Ill of 1947) shall<br />

be partially amended as follows:<br />

In Article 1 item 1, "and property wards" shall<br />

be amended as ", property wards and Port Authority<br />

under the provisions of the Port and Harbour<br />

Law (Law No. 218 of 1950)".<br />

In Article l-(2) paragraph 1, "Law No. 17<br />

of 1946" shall be amended as "Law No. 144 of<br />

1950".<br />

In Article 7 paragraph 3, "the paid-up amount<br />

of stock, amount of investment" shall be amended<br />

as "the amount of capital, amount of investment,<br />

amount of stock and total amount of investment";<br />

and in paragraph 5 of the same Article, "Art. 9-<br />

(8)" shall be amended as "Art. 9-(9)".<br />

Article 12 shall be made Article 11-(2); and<br />

the following two paragraphs shall be added next<br />

to the same Article:<br />

Article 12. In a case where a corporation operat-<br />

^ ing the business of electricity, gas, local railway<br />

or tramway enterprises received money or<br />

materials to create equipments necessary for<br />

such enterprises from consumers of electricity<br />

or gas, or users of railway or tramway or other<br />

persons who get benefit from such equipments,<br />

if the corporation has acquired the assets to<br />

construct its equipments with such money or<br />

materials and has entered in its inventory the<br />

amount of the assets thus acquired minus the^<br />

amount equivalent to such money or materials,<br />

the balance between the actual amount of the<br />

assets and the amount entered in its inventory<br />

shall be included into losses in computing the<br />

income for each accounting period.<br />

In case the corporation under the preceding<br />

paragraph has acquired for a creation of its<br />

equipments necessary for its enterprises the<br />

lands and other fixed assets enumerated in each<br />

item of Art. 13 par. 1 which constitute such<br />

equipments, and has entered the amount not<br />

less than 1 yen in its inventory as the bookvalue<br />

of such assets, the provision of the preceding<br />

paragraph shall apply mutatis mutandis<br />

to the amount equal to the balance between the<br />

acutual amount of such assets and he amount<br />

entered in its inventory.