Policing Large Scale Disorder: Lessons from the disturbances of ...

Policing Large Scale Disorder: Lessons from the disturbances of ...

Policing Large Scale Disorder: Lessons from the disturbances of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Ev w32 Home Affairs Committee: Evidence<br />

3.2 While <strong>the</strong> insurance industry <strong>of</strong>fers policies to cover homes, businesses and vehicles against riot<br />

damage—and naturally we would encourage people to buy <strong>the</strong>se products, which can be tailored to all kinds<br />

<strong>of</strong> businesses, possessions and properties—<strong>the</strong> reality is that not everyone takes out insurance. We expect<br />

thousands <strong>of</strong> claims to be made under <strong>the</strong> Act by <strong>the</strong> uninsured and without it <strong>the</strong>y would be left uncompensated<br />

against acts <strong>of</strong> violence and looting which were no fault <strong>of</strong> <strong>the</strong>ir own. We believe that, just as victims <strong>of</strong> crime<br />

can be compensated under <strong>the</strong> Criminal Injuries Compensation Scheme, victims <strong>of</strong> <strong>the</strong> recent riots should also<br />

be afforded compensation for <strong>the</strong>ir losses.<br />

3.3 Insurers can, <strong>of</strong> course, recover some <strong>of</strong> <strong>the</strong>ir outlay under <strong>the</strong> Act, but it will, by no means, be all <strong>of</strong><br />

<strong>the</strong>ir outlay. Business, home and car insurance <strong>of</strong>fer wider coverage than is available under <strong>the</strong> Act (for<br />

example, home insurers <strong>of</strong>fer contents cover on a “new for old” basis, whereas <strong>the</strong> Act is likely to compensate<br />

on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> value <strong>of</strong> <strong>the</strong> item taking into account any depreciation) and insurers will not be able to<br />

recover <strong>the</strong>ir costs where policy coverage exceeds <strong>the</strong> protection provided under <strong>the</strong> Act.<br />

3.4 It should also be noted that business, home and motor insurance markets are all highly competitive and<br />

operate on very tight margins. Contrary to how <strong>the</strong> industry is <strong>of</strong>ten portrayed, pr<strong>of</strong>its, where <strong>the</strong>y exist, are<br />

not excessive. Riot is a standard feature <strong>of</strong> property insurance in <strong>the</strong> UK. However, <strong>the</strong> availability and price<br />

<strong>of</strong> <strong>the</strong>se products is determined to a large degree by claims experience. The existence <strong>of</strong> <strong>the</strong> Riot Damages Act<br />

is taken into account by insurers when <strong>the</strong>y are deciding whe<strong>the</strong>r to <strong>of</strong>fer cover to a customer and <strong>the</strong> premium,<br />

terms and conditions <strong>the</strong>y wish to <strong>of</strong>fer.<br />

3.5 Without <strong>the</strong> comfort that insurers take <strong>from</strong> <strong>the</strong> existence <strong>of</strong> <strong>the</strong> Act and <strong>the</strong> fact that <strong>the</strong>y can recover a<br />

proportion <strong>of</strong> <strong>the</strong>ir losses under it, <strong>the</strong> insurance market is likely to behave differently than it currently does.<br />

Insurers would be more likely to seek to try to assess <strong>the</strong> risk <strong>of</strong> rioting and <strong>the</strong> likely cost <strong>of</strong> rioting in<br />

particular areas and for particular businesses and properties. Claims experience would, undoubtedly be a more<br />

significant factor in <strong>the</strong> minds <strong>of</strong> underwriters. Consequently, customers based in those areas which had suffered<br />

<strong>from</strong> riots would be more likely to see <strong>the</strong>ir premiums rise and <strong>the</strong> terms and conditions change (for example,<br />

through higher excesses for riot or even riot exclusion clauses) than is <strong>the</strong> case with <strong>the</strong> protection afforded to<br />

insurers and <strong>the</strong>ir customers by <strong>the</strong> Riots Damages Act.<br />

3.6 In conclusion, <strong>the</strong>refore, while it may seem to some to be perverse for insurers to be apparent<br />

beneficiaries under <strong>the</strong> Riot Damages Act, <strong>the</strong> reality is that <strong>the</strong> insured public are <strong>the</strong> real beneficiaries because<br />

<strong>the</strong>y benefit <strong>from</strong> <strong>the</strong> wide availability <strong>of</strong> coverage against riots throughout <strong>the</strong> UK (in contrast to many<br />

insurance markets) and <strong>from</strong> lower property insurance premiums than would be <strong>the</strong> case if <strong>the</strong> Act was not<br />

in force.<br />

September 2011<br />

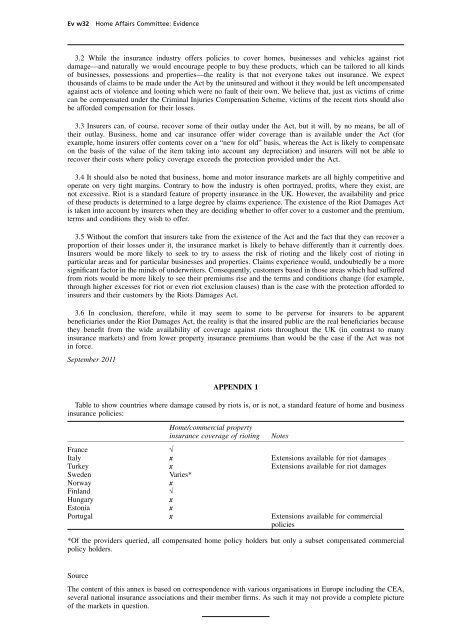

APPENDIX 1<br />

Table to show countries where damage caused by riots is, or is not, a standard feature <strong>of</strong> home and business<br />

insurance policies:<br />

Home/commercial property<br />

insurance coverage <strong>of</strong> rioting Notes<br />

France √<br />

Italy x Extensions available for riot damages<br />

Turkey x Extensions available for riot damages<br />

Sweden Varies*<br />

Norway x<br />

Finland √<br />

Hungary x<br />

Estonia x<br />

Portugal x Extensions available for commercial<br />

policies<br />

*Of <strong>the</strong> providers queried, all compensated home policy holders but only a subset compensated commercial<br />

policy holders.<br />

Source<br />

The content <strong>of</strong> this annex is based on correspondence with various organisations in Europe including <strong>the</strong> CEA,<br />

several national insurance associations and <strong>the</strong>ir member firms. As such it may not provide a complete picture<br />

<strong>of</strong> <strong>the</strong> markets in question.