SCB Prospectus - Announcements - Bursa Malaysia

SCB Prospectus - Announcements - Bursa Malaysia

SCB Prospectus - Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company No. 462648-V<br />

10. FINANCIAL INFORMATION (CONT’D)<br />

long term projects secured during the said financial year, which contributed RM37.95<br />

million of revenue for that financial year. The increase was mainly due to the<br />

aggressive sales and marketing efforts and the result of government stimulus<br />

packages in Singapore, which resulted in an increase in spending in the infrastructure<br />

segment especially in power distribution and security of public buildings. This resulted<br />

in a substantial growth in the power and electric utility and construction industries<br />

which requires SCADA systems in the transmission and distribution of electricity and<br />

for monitoring and operation of the surveillance system.<br />

The Willowglen Group recorded a lower revenue of RM27.66 million for the six (6)<br />

months ended 30 June 2010 or a decrease of 11.51% as compared to the<br />

corresponding period in 2009. The decrease in revenue was mainly due to the fact<br />

that most of the projects have been completed in 2009 as a result of the stimulus<br />

package announced by the Singapore Government, resulting in a general reduction in<br />

the number of projects awarded during the beginning of the year. However,<br />

management expects that earnings growth from its Singapore operations will be<br />

supported by the fact that the overall economic conditions are improving in<br />

Singapore.<br />

Gross Profit<br />

Despite the increased in revenue, the Willowglen Group’s gross profit margin was<br />

reduced from 44.25% to 33.95% as compared to the FYE 31 December 2006. This<br />

was mainly due to increased competition in the water, housing and power industry.<br />

The competition that exists in the market has caused players in the industry to reduce<br />

prices to attract customers to engage their services. To mitigate this risk, our Group<br />

implemented cost cutting strategies which include sourcing for contractors that offer<br />

better pricing and terms. We had also reduced the amount of work sub-contracted out<br />

to third parties in order to preserve our operating margins. Management is of the<br />

opinion that, based on the industry survey as well as from the past engagements of<br />

the Group, the average margins by segments should are:-<br />

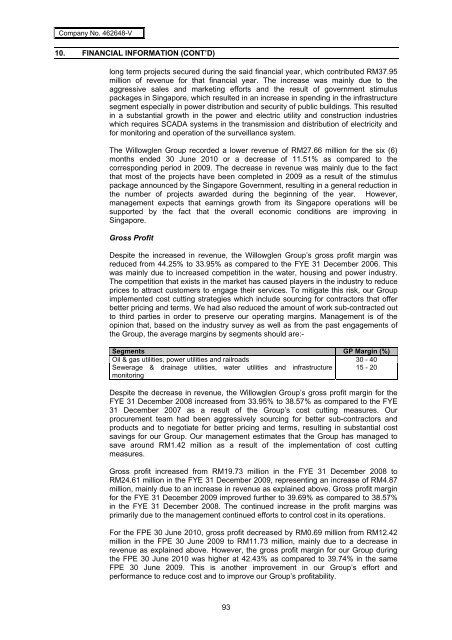

Segments GP Margin (%)<br />

Oil & gas utilities, power utilities and railroads 30 - 40<br />

Sewerage & drainage utilities, water utilities and infrastructure<br />

monitoring<br />

15 - 20<br />

Despite the decrease in revenue, the Willowglen Group’s gross profit margin for the<br />

FYE 31 December 2008 increased from 33.95% to 38.57% as compared to the FYE<br />

31 December 2007 as a result of the Group’s cost cutting measures. Our<br />

procurement team had been aggressively sourcing for better sub-contractors and<br />

products and to negotiate for better pricing and terms, resulting in substantial cost<br />

savings for our Group. Our management estimates that the Group has managed to<br />

save around RM1.42 million as a result of the implementation of cost cutting<br />

measures.<br />

Gross profit increased from RM19.73 million in the FYE 31 December 2008 to<br />

RM24.61 million in the FYE 31 December 2009, representing an increase of RM4.87<br />

million, mainly due to an increase in revenue as explained above. Gross profit margin<br />

for the FYE 31 December 2009 improved further to 39.69% as compared to 38.57%<br />

in the FYE 31 December 2008. The continued increase in the profit margins was<br />

primarily due to the management continued efforts to control cost in its operations.<br />

For the FPE 30 June 2010, gross profit decreased by RM0.69 million from RM12.42<br />

million in the FPE 30 June 2009 to RM11.73 million, mainly due to a decrease in<br />

revenue as explained above. However, the gross profit margin for our Group during<br />

the FPE 30 June 2010 was higher at 42.43% as compared to 39.74% in the same<br />

FPE 30 June 2009. This is another improvement in our Group’s effort and<br />

performance to reduce cost and to improve our Group’s profitability.<br />

93