SCB Prospectus - Announcements - Bursa Malaysia

SCB Prospectus - Announcements - Bursa Malaysia

SCB Prospectus - Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Company No. 462648-V<br />

10. FINANCIAL INFORMATION (CONT’D)<br />

10.3.8 Liquidity and Capital Resources<br />

Our Group's main sources of liquidity and capital consists of a combination of internal<br />

sources of funds derived mainly from cash generated from operations as well as<br />

external sources of funds from capital contribution by our existing shareholders.<br />

(a) Cash Flows<br />

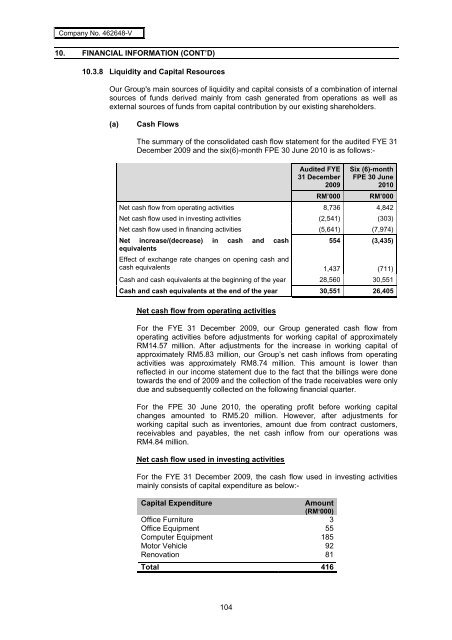

The summary of the consolidated cash flow statement for the audited FYE 31<br />

December 2009 and the six(6)-month FPE 30 June 2010 is as follows:-<br />

104<br />

Audited FYE<br />

31 December<br />

2009<br />

Six (6)-month<br />

FPE 30 June<br />

2010<br />

RM’000 RM’000<br />

Net cash flow from operating activities 8,736 4,842<br />

Net cash flow used in investing activities (2,541) (303)<br />

Net cash flow used in financing activities (5,641) (7,974)<br />

Net increase/(decrease) in cash and cash<br />

554 (3,435)<br />

equivalents<br />

Effect of exchange rate changes on opening cash and<br />

cash equivalents 1,437 (711)<br />

Cash and cash equivalents at the beginning of the year 28,560 30,551<br />

Cash and cash equivalents at the end of the year 30,551 26,405<br />

Net cash flow from operating activities<br />

For the FYE 31 December 2009, our Group generated cash flow from<br />

operating activities before adjustments for working capital of approximately<br />

RM14.57 million. After adjustments for the increase in working capital of<br />

approximately RM5.83 million, our Group’s net cash inflows from operating<br />

activities was approximately RM8.74 million. This amount is lower than<br />

reflected in our income statement due to the fact that the billings were done<br />

towards the end of 2009 and the collection of the trade receivables were only<br />

due and subsequently collected on the following financial quarter.<br />

For the FPE 30 June 2010, the operating profit before working capital<br />

changes amounted to RM5.20 million. However, after adjustments for<br />

working capital such as inventories, amount due from contract customers,<br />

receivables and payables, the net cash inflow from our operations was<br />

RM4.84 million.<br />

Net cash flow used in investing activities<br />

For the FYE 31 December 2009, the cash flow used in investing activities<br />

mainly consists of capital expenditure as below:-<br />

Capital Expenditure Amount<br />

(RM‘000)<br />

Office Furniture 3<br />

Office Equipment 55<br />

Computer Equipment 185<br />

Motor Vehicle 92<br />

Renovation 81<br />

Total 416