World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

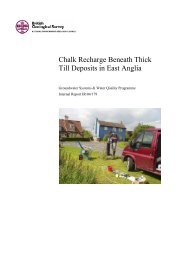

US$/lb<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1988<br />

1989<br />

1990<br />

Source: Industry reports<br />

1991<br />

increase in production to more than 5 000 tonnes. Since 2002,<br />

production in Kazakhstan increased by 89 per cent.<br />

Other significant producing countries include Russia, Niger,<br />

Namibia, USA and Uzbekistan. Russia’s production levels<br />

dropped in 2006 compared to 2005 and they were overtaken<br />

by production in Niger, which has risen by 12 per cent since<br />

2002. Namibia’s production has fallen for the past two years;<br />

however, this is expected to change in 2007 due to the opening<br />

of a new mine. <strong>Production</strong> in the USA has risen over the past<br />

four years, reversing a long term decline in uranium mining<br />

but this is still far short of the historical production levels from<br />

the 1970s. Uzbekistan saw a slight reduction in production in<br />

2006, but previously mine output increased by 41 per cent<br />

between 2002 and 2005.<br />

Prices<br />

Over 80 per cent of uranium is sold under long-term contracts<br />

(three to seven year terms), however, a spot market has been<br />

in existence for several years and this is frequently referred to<br />

when negotiating prices for long-term contracts. From 1988 to<br />

2004 spot market prices were very low, rising to a mere<br />

US$20/lb by the end of 2004. Since then, however, they have<br />

risen sharply reaching a height of US$138/lb in June 2007.<br />

This was followed by an equally sharp fall in the latter part of<br />

2007, before stabilising at around US$90/lb at the end of the<br />

year.<br />

The long-term industry average price has risen more slowly,<br />

but still significantly, from a low of just over US$9/lb in 2000<br />

to around US$95.00 at the end of 2007.<br />

Demand for uranium, for electricity generation, continues to<br />

be much higher than current mine production levels, with the<br />

shortfall being supplied by reprocessing, stockpiles or the<br />

conversion of weapons-grade uranium into fuel for power<br />

stations. Concerns over continuity of supply resulted in the<br />

increase in prices during the first part of the year. This was<br />

due in part to an increase in the number of nuclear reactors<br />

proposed or planned as a result of current international efforts<br />

to reduce carbon dioxide emissions. However, part of the<br />

increase during mid-2007 was probably caused by speculation<br />

1992<br />

1993<br />

1994<br />

Uranium Price Trends<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

2000<br />

2001<br />

Spot Price Long-term Price<br />

2002<br />

in the market. During the year, market speculators withdrew<br />

their interest and the concerns over security of supply in the<br />

near-term were relaxed, which both contributed to a price fall.<br />

Industry events in 2007<br />

2003<br />

March saw the first shipment of yellowcake (uranium oxide<br />

U3O 8) from the new Langer Heinrich Mine in Namibia.<br />

Langer Heinrich started production in late 2006 and is the first<br />

new uranium mine in the world for a decade, commissioned<br />

by Paladin Resources Ltd in 2002. Although commissioning<br />

difficulties reduced the production for 2007 from the<br />

2.6 million lbs per year forecast, the mine is expected to<br />

increase production during 2008 (Lawson, 2007a; Mining<br />

Magazine, 2007; Haycock, 2007a; Murray, R, 2007).<br />

Namibia’s other uranium mine, Rössing, which has been<br />

operating since the 1970s, announced this year that an<br />

investment of US$112 million would ensure that the life of the<br />

mine will be extended from 2016 to 2021. It is also expected<br />

to increase output by 12.5 per cent in 2008 (Mineweb, 2007;<br />

Mining Journal, 2007a).<br />

Also in Africa, the strong uranium price has encouraged<br />

significant exploration in Malawi, Zambia and Botswana, as<br />

well as at other locations in Namibia. Paladin Resources Ltd<br />

has successfully resolved the various concerns raised by six<br />

Civil Society Organisations regarding its proposed uranium<br />

mine at Kayelekera in Malawi. The mine is due to come on<br />

stream towards the end of 2008 or early 2009 (Jomo, 2007).<br />

The world’s largest uranium mining company, Cameco, has<br />

experienced a number of setbacks in 2007. Their developing<br />

mine, at Cigar Lake in Canada, experienced a rock fall and<br />

flooding in October 2006 and remediation has proved to be<br />

difficult, resulting in a delay to production start up into 2011<br />

(Kosich, 2007a; Lawson, 2007b; Mining Journal, 2007b). A<br />

problem of water inflow into the Rabbit Lake mine in<br />

November caused production to be suspended, although this<br />

was quickly rectified and the mine was back in production by<br />

the end of the year (Kosich, 2007b). Despite these difficulties,<br />

Cameco is predicted to increase revenue when their final 2007<br />

2004<br />

2005<br />

2006<br />

2007<br />

95