World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

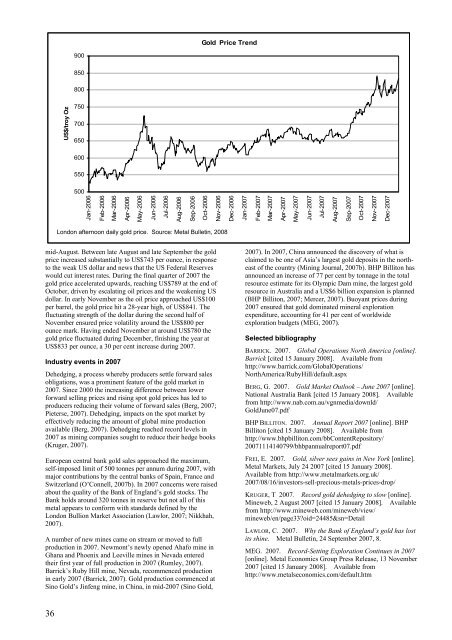

mid-August. Between late August and late September the gold<br />

price increased substantially to US$743 per ounce, in response<br />

to the weak US dollar and news that the US Federal Reserves<br />

would cut interest rates. During the final quarter of 2007 the<br />

gold price accelerated upwards, reaching US$789 at the end of<br />

October, driven by escalating oil prices and the weakening US<br />

dollar. In early November as the oil price approached US$100<br />

per barrel, the gold price hit a 28-year high, of US$841. The<br />

fluctuating strength of the dollar during the second half of<br />

November ensured price volatility around the US$800 per<br />

ounce mark. Having ended November at around US$780 the<br />

gold price fluctuated during December, finishing the year at<br />

US$833 per ounce, a 30 per cent increase during 2007.<br />

Industry events in 2007<br />

Dehedging, a process whereby producers settle forward sales<br />

obligations, was a prominent feature of the gold market in<br />

2007. Since 2000 the increasing difference between lower<br />

forward selling prices and rising spot gold prices has led to<br />

producers reducing their volume of forward sales (Berg, 2007;<br />

Pieterse, 2007). Dehedging, impacts on the spot market by<br />

effectively reducing the amount of global mine production<br />

available (Berg, 2007). Dehedging reached record levels in<br />

2007 as mining companies sought to reduce their hedge books<br />

(Kruger, 2007).<br />

European central bank gold sales approached the maximum,<br />

self-imposed limit of 500 tonnes per annum during 2007, with<br />

major contributions by the central banks of Spain, France and<br />

Switzerland (O’Connell, 2007b). In 2007 concerns were raised<br />

about the quality of the Bank of England’s gold stocks. The<br />

Bank holds around 320 tonnes in reserve but not all of this<br />

metal appears to conform with standards defined by the<br />

London Bullion Market Association (Lawlor, 2007; Nikkhah,<br />

2007).<br />

A number of new mines came on stream or moved to full<br />

production in 2007. Newmont’s newly opened Ahafo mine in<br />

Ghana and Phoenix and Leeville mines in Nevada entered<br />

their first year of full production in 2007 (Rumley, 2007).<br />

Barrick’s Ruby Hill mine, Nevada, recommenced production<br />

in early 2007 (Barrick, 2007). Gold production commenced at<br />

Sino Gold’s Jinfeng mine, in China, in mid-2007 (Sino Gold,<br />

36<br />

US$/troy Oz<br />

900<br />

850<br />

800<br />

750<br />

700<br />

650<br />

600<br />

550<br />

500<br />

Jan-2006<br />

Feb-2006<br />

Mar-2006<br />

Apr-2006<br />

May-2006<br />

London afternoon daily gold price. Source: Metal Bulletin, 2008<br />

Jun-2006<br />

Jul-2006<br />

Aug-2006<br />

Sep-2006<br />

Gold Price Trend<br />

Oct-2006<br />

Nov-2006<br />

Dec-2006<br />

Jan-2007<br />

Feb-2007<br />

Mar-2007<br />

Apr-2007<br />

May-2007<br />

Jun-2007<br />

2007). In 2007, China announced the discovery of what is<br />

claimed to be one of Asia’s largest gold deposits in the northeast<br />

of the country (Mining Journal, 2007b). BHP Billiton has<br />

announced an increase of 77 per cent by tonnage in the total<br />

resource estimate for its Olympic Dam mine, the largest gold<br />

resource in Australia and a US$6 billion expansion is planned<br />

(BHP Billiton, 2007; Mercer, 2007). Buoyant prices during<br />

2007 ensured that gold dominated mineral exploration<br />

expenditure, accounting for 41 per cent of worldwide<br />

exploration budgets (MEG, 2007).<br />

Selected bibliography<br />

Jul-2007<br />

Aug-2007<br />

BARRICK. 2007. Global Operations North America [online].<br />

Barrick [cited 15 January 2008]. Available from<br />

http://www.barrick.com/GlobalOperations/<br />

NorthAmerica/RubyHill/default.aspx<br />

BERG, G. 2007. Gold Market Outlook – June 2007 [online].<br />

National Australia Bank [cited 15 January 2008]. Available<br />

from http://www.nab.com.au/vgnmedia/downld/<br />

GoldJune07.pdf<br />

BHP BILLITON. 2007. Annual Report 2007 [online]. BHP<br />

Billiton [cited 15 January 2008]. Available from<br />

http://www.bhpbilliton.com/bbContentRepository/<br />

20071114140799/bhbpannualreport07.pdf<br />

FREI, E. 2007. Gold, silver sees gains in New York [online].<br />

Metal Markets, July 24 2007 [cited 15 January 2008].<br />

Available from http://www.metalmarkets.org.uk/<br />

2007/08/16/investors-sell-precious-metals-prices-drop/<br />

KRUGER, T 2007. Record gold dehedging to slow [online].<br />

Mineweb, 2 August 2007 [cited 15 January 2008]. Available<br />

from http://www.mineweb.com/mineweb/view/<br />

mineweb/en/page33?oid=24485&sn=Detail<br />

LAWLOR, C. 2007. Why the Bank of England’s gold has lost<br />

its shine. Metal Bulletin, 24 September 2007, 8.<br />

MEG. 2007. Record-Setting Exploration Continues in 2007<br />

[online]. Metal Economics Group Press Release, 13 November<br />

2007 [cited 15 January 2008]. Available from<br />

http://www.metalseconomics.com/default.htm<br />

Sep-2007<br />

Oct-2007<br />

Nov-2007<br />

Dec-2007