World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Colombia showing the largest increase of 66 per cent from 39<br />

to 66 million tonnes. Australian production (the fourth largest<br />

producer) increased by 13 per cent.<br />

Prices<br />

The pricing of coal is complex, based on coal type, net<br />

calorific value and content of impurities such as sulphur.<br />

Additionally, the cost of transportation comprises a large<br />

proportion of the delivered price of coal. Coal is chiefly sold<br />

under long-term contracts that ‘fix’ the price of coal over the<br />

term of the contract, usually with an escalator based on<br />

inflation. Prices are normally quoted on a well-established<br />

world spot market.<br />

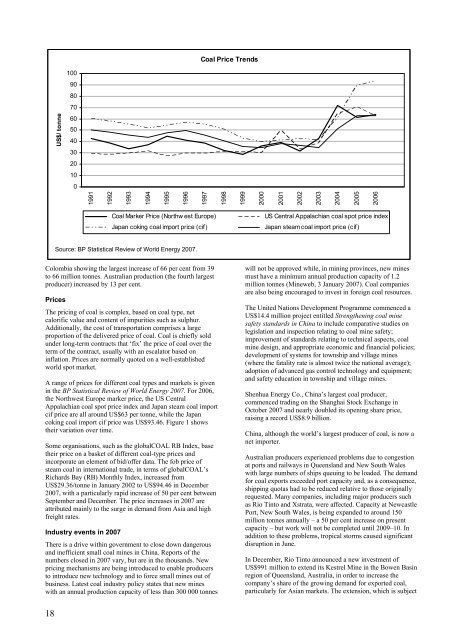

A range of prices for different coal types and markets is given<br />

in the BP Statistical Review of <strong>World</strong> Energy 2007. For 2006,<br />

the Northwest Europe marker price, the US Central<br />

Appalachian coal spot price index and Japan steam coal import<br />

cif price are all around US$63 per tonne, while the Japan<br />

coking coal import cif price was US$93.46. Figure 1 shows<br />

their variation over time.<br />

Some organisations, such as the globalCOAL RB Index, base<br />

their price on a basket of different coal-type prices and<br />

incorporate an element of bid/offer data. The fob price of<br />

steam coal in international trade, in terms of globalCOAL’s<br />

Richards Bay (RB) Monthly Index, increased from<br />

US$29.36/tonne in January 2002 to US$94.46 in December<br />

2007, with a particularly rapid increase of 50 per cent between<br />

September and December. The price increases in 2007 are<br />

attributed mainly to the surge in demand from Asia and high<br />

freight rates.<br />

Industry events in 2007<br />

There is a drive within government to close down dangerous<br />

and inefficient small coal mines in China. Reports of the<br />

numbers closed in 2007 vary, but are in the thousands. New<br />

pricing mechanisms are being introduced to enable producers<br />

to introduce new technology and to force small mines out of<br />

business. Latest coal industry policy states that new mines<br />

with an annual production capacity of less than 300 000 tonnes<br />

18<br />

US$/ tonne<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

Coal Price Trends<br />

1997<br />

1998<br />

1999<br />

Coal Marker Price (Northw est Europe) US Central Appalachian coal spot price index<br />

Japan coking coal import price (cif) Japan steam coal import price (cif)<br />

Source: BP Statistical Review of <strong>World</strong> Energy 2007.<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

will not be approved while, in mining provinces, new mines<br />

must have a minimum annual production capacity of 1.2<br />

million tonnes (Mineweb, 3 January 2007). Coal companies<br />

are also being encouraged to invest in foreign coal resources.<br />

The United Nations Development Programme commenced a<br />

US$14.4 million project entitled Strengthening coal mine<br />

safety standards in China to include comparative studies on<br />

legislation and inspection relating to coal mine safety;<br />

improvement of standards relating to technical aspects, coal<br />

mine design, and appropriate economic and financial policies;<br />

development of systems for township and village mines<br />

(where the fatality rate is almost twice the national average);<br />

adoption of advanced gas control technology and equipment;<br />

and safety education in township and village mines.<br />

Shenhua Energy Co., China’s largest coal producer,<br />

commenced trading on the Shanghai Stock Exchange in<br />

October 2007 and nearly doubled its opening share price,<br />

raising a record US$8.9 billion.<br />

China, although the world’s largest producer of coal, is now a<br />

net importer.<br />

Australian producers experienced problems due to congestion<br />

at ports and railways in Queensland and New South Wales<br />

with large numbers of ships queuing to be loaded. The demand<br />

for coal exports exceeded port capacity and, as a consequence,<br />

shipping quotas had to be reduced relative to those originally<br />

requested. Many companies, including major producers such<br />

as Rio Tinto and Xstrata, were affected. Capacity at Newcastle<br />

Port, New South Wales, is being expanded to around 150<br />

million tonnes annually – a 50 per cent increase on present<br />

capacity – but work will not be completed until 2009–10. In<br />

addition to these problems, tropical storms caused significant<br />

disruption in June.<br />

In December, Rio Tinto announced a new investment of<br />

US$991 million to extend its Kestrel Mine in the Bowen Basin<br />

region of Queensland, Australia, in order to increase the<br />

company’s share of the growing demand for exported coal,<br />

particularly for Asian markets. The extension, which is subject