World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

World Mineral Production - NERC Open Research Archive - Natural ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

China remains the single biggest influence on the world lead<br />

market. The Chinese Government removed the 13 per cent<br />

export rebate on lead metal in September 2006, and<br />

subsequently imposed a 10 per cent export tax on refined lead<br />

on 1 June 2007. Chinese exports declined partly due to these<br />

changes in taxation. But also because of burgeoning domestic<br />

demand for lead-acid battery production and production at<br />

Chinese smelters was cut due to lead concentrate supply<br />

problems. China is now a net importer of lead concentrate<br />

which further fuelled the price rise. In July, Macquarie Bank<br />

speculated that smelter output cuts had lead to a global panic<br />

which caused the observed price rises (Mining Journal, 6 July<br />

2007).<br />

By September 2007, China’s exports of lead were at their<br />

lowest level for seven months, 74 per cent down, and exports<br />

for the first nine months of 2007 were half the level of the<br />

equivalent period in 2006. Overall, China’s reported<br />

production was down almost 11 per cent, contributing to a<br />

worldwide shortage (Hinde, 2007). By December China’s lead<br />

exports continued to fall by double-digit rates in December,<br />

according to the General Administration of Customs. Refined<br />

lead exports fell 77 per cent year-on-year to 13 152 tonnes in<br />

December. This took lead exports to 235 758 tonnes in 2007, a<br />

56.1 per cent decline from the previous year. China’s lead<br />

exports have continued to decline since a 10 per cent export<br />

tax was introduced last June.<br />

September saw further rapid price increases, driven by<br />

increased buying in the wake of a fire at Xstrata’s concentrator<br />

at their Mount Isa Mines in Queensland, Australia. The fire<br />

resulted in Xstrata losing up to 20 000 tonnes of lead<br />

concentrate production, which in itself is not that significant<br />

an amount, but again demonstrates how tight the market had<br />

become in the final quarter of 2007 (Meir, 2008).<br />

The US Federal Reserve also cut interest rates by 50 basis<br />

points on 18 September 1 , stimulating demand in the US and<br />

raising the price towards its maximum. The possibility of<br />

1 http://www.federalreserve.gov/fomc/fundsrate.htm<br />

54<br />

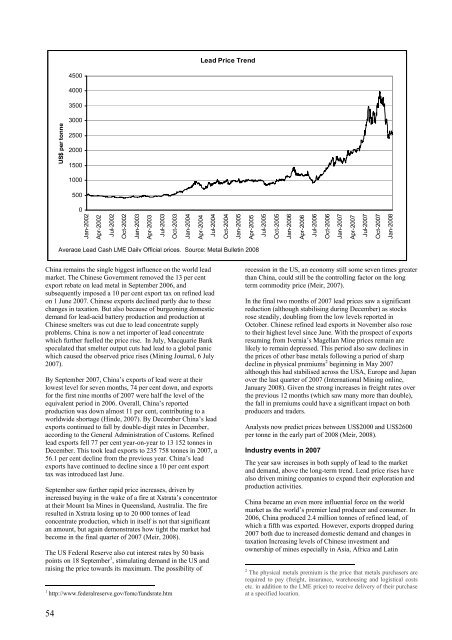

US$ per tonne<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

Jan-2002<br />

Apr-2002<br />

Jul-2002<br />

Oct-2002<br />

Jan-2003<br />

Apr-2003<br />

Jul-2003<br />

Lead Price Trend<br />

Average Lead Cash LME Daily Official prices. Source: Metal Bulletin 2008<br />

Oct-2003<br />

Jan-2004<br />

Apr-2004<br />

Jul-2004<br />

Oct-2004<br />

Jan-2005<br />

Apr-2005<br />

Jul-2005<br />

Oct-2005<br />

Jan-2006<br />

Apr-2006<br />

Jul-2006<br />

recession in the US, an economy still some seven times greater<br />

than China, could still be the controlling factor on the long<br />

term commodity price (Meir, 2007).<br />

In the final two months of 2007 lead prices saw a significant<br />

reduction (although stabilising during December) as stocks<br />

rose steadily, doubling from the low levels reported in<br />

October. Chinese refined lead exports in November also rose<br />

to their highest level since June. With the prospect of exports<br />

resuming from Ivernia’s Magellan Mine prices remain are<br />

likely to remain depressed. This period also saw declines in<br />

the prices of other base metals following a period of sharp<br />

decline in physical premiums 2 beginning in May 2007<br />

although this had stabilised across the USA, Europe and Japan<br />

over the last quarter of 2007 (International Mining online,<br />

January 2008). Given the strong increases in freight rates over<br />

the previous 12 months (which saw many more than double),<br />

the fall in premiums could have a significant impact on both<br />

producers and traders.<br />

Analysts now predict prices between US$2000 and US$2600<br />

per tonne in the early part of 2008 (Meir, 2008).<br />

Industry events in 2007<br />

Oct-2006<br />

The year saw increases in both supply of lead to the market<br />

and demand, above the long-term trend. Lead price rises have<br />

also driven mining companies to expand their exploration and<br />

production activities.<br />

China became an even more influential force on the world<br />

market as the world’s premier lead producer and consumer. In<br />

2006, China produced 2.4 million tonnes of refined lead, of<br />

which a fifth was exported. However, exports dropped during<br />

2007 both due to increased domestic demand and changes in<br />

taxation Increasing levels of Chinese investment and<br />

ownership of mines especially in Asia, Africa and Latin<br />

2 The physical metals premium is the price that metals purchasers are<br />

required to pay (freight, insurance, warehousing and logistical costs<br />

etc. in addition to the LME price) to receive delivery of their purchase<br />

at a specified location.<br />

Jan-2007<br />

Apr-2007<br />

Jul-2007<br />

Oct-2007<br />

Jan-2008