2004-05 Annual Report - Australia Post

2004-05 Annual Report - Australia Post

2004-05 Annual Report - Australia Post

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Australia</strong> <strong>Post</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2004</strong>/<strong>05</strong> Financial and Statutory <strong>Report</strong>s<br />

Notes to and forming part of the financial statements<br />

| 92 |<br />

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>05</strong><br />

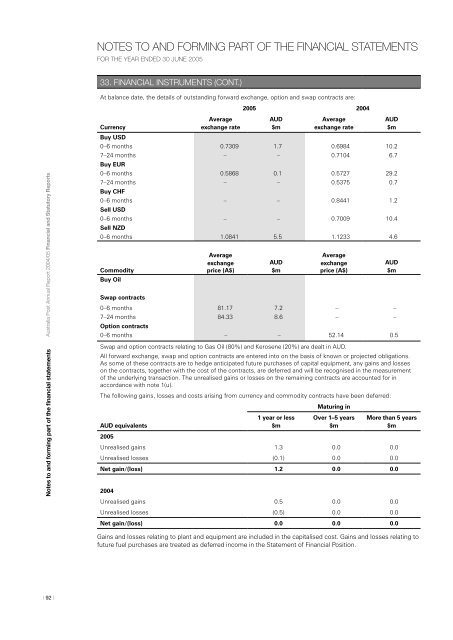

33. FINANCIAL INSTRUMENTS (CONT.)<br />

At balance date, the details of outstanding forward exchange, option and swap contracts are:<br />

Currency<br />

Buy USD<br />

Average<br />

exchange rate<br />

20<strong>05</strong> <strong>2004</strong><br />

AUD<br />

$m<br />

Average<br />

exchange rate<br />

0–6 months 0.7309 1.7 0.6984 10.2<br />

7–24 months – – 0.7104 6.7<br />

Buy EUR<br />

0–6 months 0.5868 0.1 0.5727 29.2<br />

7–24 months – – 0.5375 0.7<br />

Buy CHF<br />

0–6 months – – 0.8441 1.2<br />

Sell USD<br />

0–6 months – – 0.7009 10.4<br />

Sell NZD<br />

0–6 months 1.0841 5.5 1.1233 4.6<br />

Commodity<br />

Buy Oil<br />

Swap contracts<br />

Average<br />

exchange<br />

price (A$)<br />

AUD<br />

$m<br />

Average<br />

exchange<br />

price (A$)<br />

0–6 months 81.17 7.2 – –<br />

7–24 months 84.33 8.6 – –<br />

Option contracts<br />

0–6 months – – 52.14 0.5<br />

Swap and option contracts relating to Gas Oil (80%) and Kerosene (20%) are dealt in AUD.<br />

All forward exchange, swap and option contracts are entered into on the basis of known or projected obligations.<br />

As some of these contracts are to hedge anticipated future purchases of capital equipment, any gains and losses<br />

on the contracts, together with the cost of the contracts, are deferred and will be recognised in the measurement<br />

of the underlying transaction. The unrealised gains or losses on the remaining contracts are accounted for in<br />

accordance with note 1(u).<br />

The following gains, losses and costs arising from currency and commodity contracts have been deferred:<br />

AUD equivalents<br />

20<strong>05</strong><br />

1 year or less<br />

$m<br />

Maturing in<br />

Over 1–5 years<br />

$m<br />

AUD<br />

$m<br />

AUD<br />

$m<br />

More than 5 years<br />

$m<br />

Unrealised gains 1.3 0.0 0.0<br />

Unrealised losses (0.1) 0.0 0.0<br />

Net gain/(loss) 1.2 0.0 0.0<br />

<strong>2004</strong><br />

Unrealised gains 0.5 0.0 0.0<br />

Unrealised losses (0.5) 0.0 0.0<br />

Net gain/(loss) 0.0 0.0 0.0<br />

Gains and losses relating to plant and equipment are included in the capitalised cost. Gains and losses relating to<br />

future fuel purchases are treated as deferred income in the Statement of Financial Position.