Fair Trade: Overview, Impact, Challenges - Are you looking for one ...

Fair Trade: Overview, Impact, Challenges - Are you looking for one ...

Fair Trade: Overview, Impact, Challenges - Are you looking for one ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Fair</strong> <strong>Trade</strong>: <strong>Overview</strong>, <strong>Impact</strong>, <strong>Challenges</strong><br />

Annex 4: Case Study - Cocoa in Ghana<br />

From 1966/67 to 1976/77 many firms were again licensed to buy cocoa on behalf of<br />

the Cocobod. The monopoly buying system was again introduced <strong>for</strong> the period<br />

1977/78 to 1991/92 but since 1992/93 many companies (currently 19) have been<br />

licensed to buy cocoa on behalf of the Cocobod. The re-introduction of competition<br />

in the internal marketing of cocoa was based on the assumption that farmers would<br />

receive higher prices as the buyers compete to buy the cocoa. The producer price<br />

announced by government is now regarded as a floor price.<br />

External trade in cocoa has been the preserve of the Cocoa Marketing Company since<br />

1947/48. It is possible that the external cocoa trade will be liberalized in the near<br />

future, although the exact speed and extent of any such liberalisation is not yet clear.<br />

The option currently under consideration is to allow LBCs to export 30% of their<br />

purchases with the remaining 70% exported by the CMC. This is to test whether<br />

complete liberalization of the external trade will be in the best interests of the country<br />

(Ministry of Finance, 1999).<br />

The LBCs that would be allowed to export would be those that purchase 10,000 mt<br />

each in two previous cocoa seasons and can demonstrate appropriate export knowhow<br />

(Ministry of Finance, 1999). The LBCs which purchase less than the required<br />

volume of cocoa be<strong>for</strong>e export is permitted, would be able to negotiate with other<br />

LBCs or CMC to export on their behalf.<br />

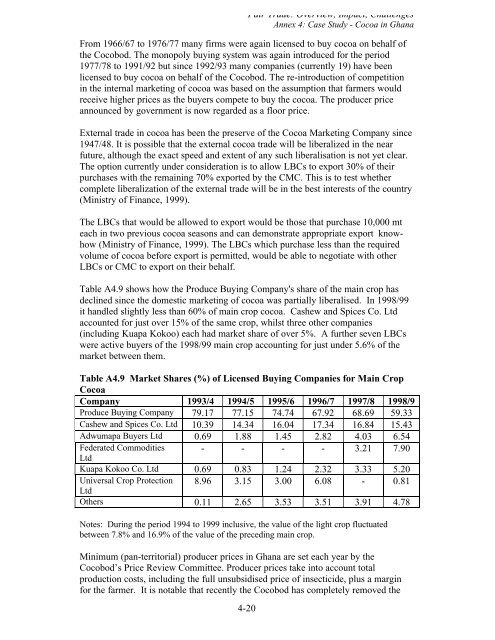

Table A4.9 shows how the Produce Buying Company's share of the main crop has<br />

declined since the domestic marketing of cocoa was partially liberalised. In 1998/99<br />

it handled slightly less than 60% of main crop cocoa. Cashew and Spices Co. Ltd<br />

accounted <strong>for</strong> just over 15% of the same crop, whilst three other companies<br />

(including Kuapa Kokoo) each had market share of over 5%. A further seven LBCs<br />

were active buyers of the 1998/99 main crop accounting <strong>for</strong> just under 5.6% of the<br />

market between them.<br />

Table A4.9 Market Shares (%) of Licensed Buying Companies <strong>for</strong> Main Crop<br />

Cocoa<br />

Company 1993/4 1994/5 1995/6 1996/7 1997/8 1998/9<br />

Produce Buying Company 79.17 77.15 74.74 67.92 68.69 59.33<br />

Cashew and Spices Co. Ltd 10.39 14.34 16.04 17.34 16.84 15.43<br />

Adwumapa Buyers Ltd 0.69 1.88 1.45 2.82 4.03 6.54<br />

Federated Commodities<br />

Ltd<br />

- - - - 3.21 7.90<br />

Kuapa Kokoo Co. Ltd 0.69 0.83 1.24 2.32 3.33 5.20<br />

Universal Crop Protection<br />

Ltd<br />

8.96 3.15 3.00 6.08 - 0.81<br />

Others 0.11 2.65 3.53 3.51 3.91 4.78<br />

Notes: During the period 1994 to 1999 inclusive, the value of the light crop fluctuated<br />

between 7.8% and 16.9% of the value of the preceding main crop.<br />

Minimum (pan-territorial) producer prices in Ghana are set each year by the<br />

Cocobod’s Price Review Committee. Producer prices take into account total<br />

production costs, including the full unsubsidised price of insecticide, plus a margin<br />

<strong>for</strong> the farmer. It is notable that recently the Cocobod has completely removed the<br />

4-20

![CynefinFramework final [Read-Only]](https://img.yumpu.com/19017304/1/190x135/cynefinframework-final-read-only.jpg?quality=85)