The report is available in English with a French summary - KCE

The report is available in English with a French summary - KCE

The report is available in English with a French summary - KCE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>KCE</strong> Reports 120 Plasma 33<br />

GEOGRAPHICAL DIMENSION OF THIS INDUSTRY:<br />

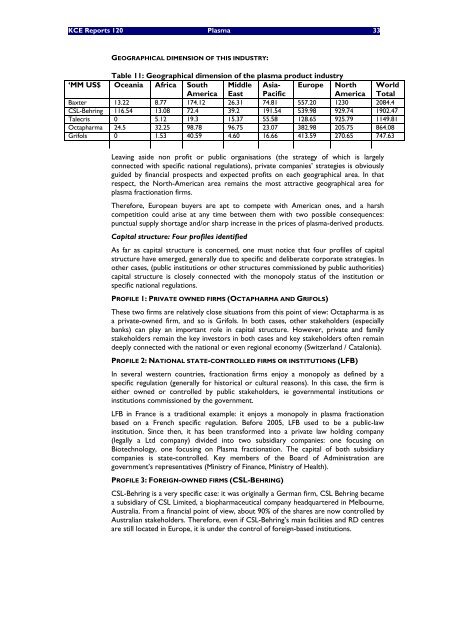

Table 11: Geographical dimension of the plasma product <strong>in</strong>dustry<br />

‘MM US$ Oceania Africa South Middle Asia- Europe North World<br />

America East Pacific<br />

America Total<br />

Baxter 13.22 8.77 174.12 26.31 74.81 557.20 1230 2084.4<br />

CSL-Behr<strong>in</strong>g 116.54 13.08 72.4 39.2 191.54 539.98 929.74 1902.47<br />

Talecr<strong>is</strong> 0 5.12 19.3 15.37 55.58 128.65 925.79 1149.81<br />

Octapharma 24.5 32.25 98.78 96.75 23.07 382.98 205.75 864.08<br />

Grifols 0 1.53 40.59 4.60 16.66 413.59 270.65 747.63<br />

Leav<strong>in</strong>g aside non profit or public organ<strong>is</strong>ations (the strategy of which <strong>is</strong> largely<br />

connected <strong>with</strong> specific national regulations), private companies’ strategies <strong>is</strong> obviously<br />

guided by f<strong>in</strong>ancial prospects and expected profits on each geographical area. In that<br />

respect, the North-American area rema<strong>in</strong>s the most attractive geographical area for<br />

plasma fractionation firms.<br />

<strong>The</strong>refore, European buyers are apt to compete <strong>with</strong> American ones, and a harsh<br />

competition could ar<strong>is</strong>e at any time between them <strong>with</strong> two possible consequences:<br />

punctual supply shortage and/or sharp <strong>in</strong>crease <strong>in</strong> the prices of plasma-derived products.<br />

Capital structure: Four profiles identified<br />

As far as capital structure <strong>is</strong> concerned, one must notice that four profiles of capital<br />

structure have emerged, generally due to specific and deliberate corporate strategies. In<br />

other cases, (public <strong>in</strong>stitutions or other structures comm<strong>is</strong>sioned by public authorities)<br />

capital structure <strong>is</strong> closely connected <strong>with</strong> the monopoly status of the <strong>in</strong>stitution or<br />

specific national regulations.<br />

PROFILE 1: PRIVATE OWNED FIRMS (OCTAPHARMA AND GRIFOLS)<br />

<strong>The</strong>se two firms are relatively close situations from th<strong>is</strong> po<strong>in</strong>t of view: Octapharma <strong>is</strong> as<br />

a private-owned firm, and so <strong>is</strong> Grifols. In both cases, other stakeholders (especially<br />

banks) can play an important role <strong>in</strong> capital structure. However, private and family<br />

stakeholders rema<strong>in</strong> the key <strong>in</strong>vestors <strong>in</strong> both cases and key stakeholders often rema<strong>in</strong><br />

deeply connected <strong>with</strong> the national or even regional economy (Switzerland / Catalonia).<br />

PROFILE 2: NATIONAL STATE-CONTROLLED FIRMS OR INSTITUTIONS (LFB)<br />

In several western countries, fractionation firms enjoy a monopoly as def<strong>in</strong>ed by a<br />

specific regulation (generally for h<strong>is</strong>torical or cultural reasons). In th<strong>is</strong> case, the firm <strong>is</strong><br />

either owned or controlled by public stakeholders, ie governmental <strong>in</strong>stitutions or<br />

<strong>in</strong>stitutions comm<strong>is</strong>sioned by the government.<br />

LFB <strong>in</strong> France <strong>is</strong> a traditional example: it enjoys a monopoly <strong>in</strong> plasma fractionation<br />

based on a <strong>French</strong> specific regulation. Before 2005, LFB used to be a public-law<br />

<strong>in</strong>stitution. S<strong>in</strong>ce then, it has been transformed <strong>in</strong>to a private law hold<strong>in</strong>g company<br />

(legally a Ltd company) divided <strong>in</strong>to two subsidiary companies: one focus<strong>in</strong>g on<br />

Biotechnology, one focus<strong>in</strong>g on Plasma fractionation. <strong>The</strong> capital of both subsidiary<br />

companies <strong>is</strong> state-controlled. Key members of the Board of Adm<strong>in</strong><strong>is</strong>tration are<br />

government’s representatives (M<strong>in</strong><strong>is</strong>try of F<strong>in</strong>ance, M<strong>in</strong><strong>is</strong>try of Health).<br />

PROFILE 3: FOREIGN-OWNED FIRMS (CSL-BEHRING)<br />

CSL-Behr<strong>in</strong>g <strong>is</strong> a very specific case: it was orig<strong>in</strong>ally a German firm, CSL Behr<strong>in</strong>g became<br />

a subsidiary of CSL Limited, a biopharmaceutical company headquartered <strong>in</strong> Melbourne,<br />

Australia. From a f<strong>in</strong>ancial po<strong>in</strong>t of view, about 90% of the shares are now controlled by<br />

Australian stakeholders. <strong>The</strong>refore, even if CSL-Behr<strong>in</strong>g’s ma<strong>in</strong> facilities and RD centres<br />

are still located <strong>in</strong> Europe, it <strong>is</strong> under the control of foreign-based <strong>in</strong>stitutions.