Henkel Annual Report 2011 - Henkel AG & Co. KGaA Annual Report ...

Henkel Annual Report 2011 - Henkel AG & Co. KGaA Annual Report ...

Henkel Annual Report 2011 - Henkel AG & Co. KGaA Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

128 <strong>Co</strong>nsolidated financial statements<br />

Notes to the consolidated statement of financial position<br />

<strong>Henkel</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

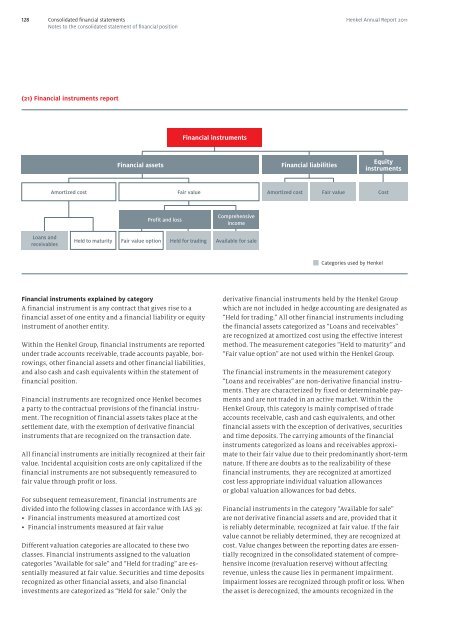

(21) Financial instruments report<br />

Loans and<br />

receivables<br />

Amortized cost<br />

Held to maturity<br />

Financial instruments explained by category<br />

A financial instrument is any contract that gives rise to a<br />

financial asset of one entity and a financial liability or equity<br />

instrument of another entity.<br />

Within the <strong>Henkel</strong> Group, financial instruments are reported<br />

under trade accounts receivable, trade accounts payable, borrowings,<br />

other financial assets and other financial liabilities,<br />

and also cash and cash equivalents within the statement of<br />

financial position.<br />

Financial instruments are recognized once <strong>Henkel</strong> becomes<br />

a party to the contractual provisions of the financial instrument.<br />

The recognition of financial assets takes place at the<br />

settlement date, with the exemption of derivative financial<br />

instruments that are recognized on the transaction date.<br />

All financial instruments are initially recognized at their fair<br />

value. Incidental acquisition costs are only capitalized if the<br />

financial instruments are not subsequently remeasured to<br />

fair value through profit or loss.<br />

For subsequent remeasurement, financial instruments are<br />

divided into the following classes in accordance with IAS 39:<br />

• Financial instruments measured at amortized cost<br />

• Financial instruments measured at fair value<br />

Different valuation categories are allocated to these two<br />

classes. Financial instruments assigned to the valuation<br />

categories “Available for sale” and “Held for trading” are essentially<br />

measured at fair value. Securities and time deposits<br />

recognized as other financial assets, and also financial<br />

investments are categorized as “Held for sale.” Only the<br />

Financial instruments<br />

Financial assets Financial liabilities<br />

Fair value option<br />

Profit and loss<br />

Categories used by <strong>Henkel</strong><br />

Equity<br />

instruments<br />

Fair value Amortized cost Fair value <strong>Co</strong>st<br />

Held for trading<br />

<strong>Co</strong>mprehensive<br />

income<br />

Available for sale<br />

derivative financial instruments held by the <strong>Henkel</strong> Group<br />

which are not included in hedge accounting are designated as<br />

“Held for trading.” All other financial instruments including<br />

the financial assets categorized as “Loans and receivables”<br />

are recognized at amortized cost using the effective interest<br />

method. The measurement categories “Held to maturity” and<br />

“Fair value option” are not used within the <strong>Henkel</strong> Group.<br />

The financial instruments in the measurement category<br />

“Loans and receivables” are nonderivative financial instruments.<br />

They are characterized by fixed or determinable payments<br />

and are not traded in an active market. Within the<br />

<strong>Henkel</strong> Group, this category is mainly comprised of trade<br />

accounts receivable, cash and cash equivalents, and other<br />

financial assets with the exception of derivatives, securities<br />

and time deposits. The carrying amounts of the financial<br />

instruments categorized as loans and receivables approximate<br />

to their fair value due to their predominantly shortterm<br />

nature. If there are doubts as to the realizability of these<br />

financial instruments, they are recognized at amortized<br />

cost less appropriate individual valuation allowances<br />

or global valuation allowances for bad debts.<br />

Financial instruments in the category “Available for sale”<br />

are not derivative financial assets and are, provided that it<br />

is reliably determinable, recognized at fair value. If the fair<br />

value cannot be reliably determined, they are recognized at<br />

cost. Value changes between the reporting dates are essentially<br />

recognized in the consolidated statement of comprehensive<br />

income (revaluation reserve) without affecting<br />

revenue, unless the cause lies in permanent impairment.<br />

Impairment losses are recognized through profit or loss. When<br />

the asset is derecognized, the amounts recognized in the