Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

104<br />

Notes to the Company<br />

fi nancial statements<br />

9 Net pension liability continued<br />

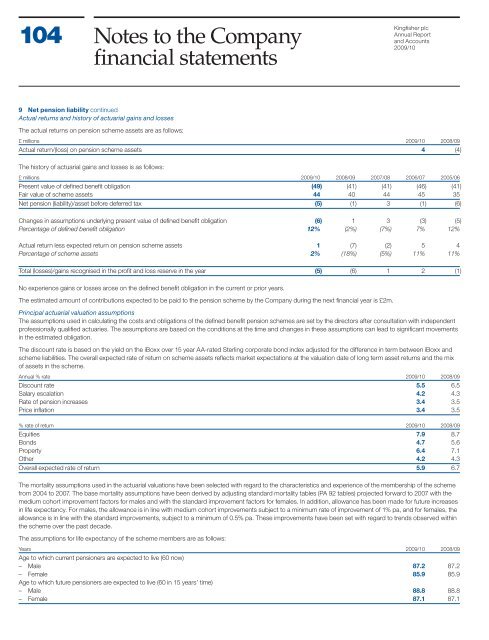

Actual returns <strong>and</strong> history of actuarial gains <strong>and</strong> losses<br />

The actual returns on pension scheme assets are as follows:<br />

Kingfi sher plc<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>and</strong> <strong>Accounts</strong><br />

2009/10<br />

£ millions 2009/10 2008/09<br />

Actual return/(loss) on pension scheme assets 4 (4)<br />

The history of actuarial gains <strong>and</strong> losses is as follows:<br />

£ millions 2009/10 2008/09 2007/08 2006/07 2005/06<br />

Present value of defi ned benefi t obligation (49) (41) (41) (46) (41)<br />

Fair value of scheme assets 44 40 44 45 35<br />

Net pension (liability)/asset before deferred tax (5) (1) 3 (1) (6)<br />

Changes in assumptions underlying present value of defi ned benefi t obligation (6) 1 3 (3) (5)<br />

Percentage of defi ned benefi t obligation 12% (2%) (7%) 7% 12%<br />

Actual return less expected return on pension scheme assets 1 (7) (2) 5 4<br />

Percentage of scheme assets 2% (18%) (5%) 11% 11%<br />

Total (losses)/gains recognised in the profi t <strong>and</strong> loss reserve in the year (5) (6) 1 2 (1)<br />

No experience gains or losses arose on the defi ned benefi t obligation in the current or prior years.<br />

The estimated amount of contributions expected to be paid to the pension scheme by the Company during the next fi nancial year is £2m.<br />

Principal actuarial valuation assumptions<br />

The assumptions used in calculating the costs <strong>and</strong> obligations of the defi ned benefi t pension schemes are set by the directors after consultation with independent<br />

professionally qualifi ed actuaries. The assumptions are based on the conditions at the time <strong>and</strong> changes in these assumptions can lead to signifi cant movements<br />

in the estimated obligation.<br />

The discount rate is based on the yield on the iBoxx over 15 year AA-rated Sterling corporate bond index adjusted for the difference in term between iBoxx <strong>and</strong><br />

scheme liabilities. The overall expected rate of return on scheme assets refl ects market expectations at the valuation date of long term asset returns <strong>and</strong> the mix<br />

of assets in the scheme.<br />

<strong>Annual</strong> % rate 2009/10 2008/09<br />

Discount rate 5.5 6.5<br />

Salary escalation 4.2 4.3<br />

Rate of pension increases 3.4 3.5<br />

Price infl ation 3.4 3.5<br />

% rate of return 2009/10 2008/09<br />

Equities 7.9 8.7<br />

Bonds 4.7 5.6<br />

Property 6.4 7.1<br />

Other 4.2 4.3<br />

Overall expected rate of return 5.9 6.7<br />

The mortality assumptions used in the actuarial valuations have been selected with regard to the characteristics <strong>and</strong> experience of the membership of the scheme<br />

from 2004 to 2007. The base mortality assumptions have been derived by adjusting st<strong>and</strong>ard mortality tables (PA 92 tables) projected forward to 2007 with the<br />

medium cohort improvement factors for males <strong>and</strong> with the st<strong>and</strong>ard improvement factors for females. In addition, allowance has been made for future increases<br />

in life expectancy. For males, the allowance is in line with medium cohort improvements subject to a minimum rate of improvement of 1% pa, <strong>and</strong> for females, the<br />

allowance is in line with the st<strong>and</strong>ard improvements, subject to a minimum of 0.5% pa. These improvements have been set with regard to trends observed within<br />

the scheme over the past decade.<br />

The assumptions for life expectancy of the scheme members are as follows:<br />

Years 2009/10 2008/09<br />

Age to which current pensioners are expected to live (60 now)<br />

– Male 87.2 87.2<br />

– Female 85.9 85.9<br />

Age to which future pensioners are expected to live (60 in 15 years’ time)<br />

– Male 88.8 88.8<br />

– Female 87.1 87.1