Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

42<br />

Directors’ remuneration report<br />

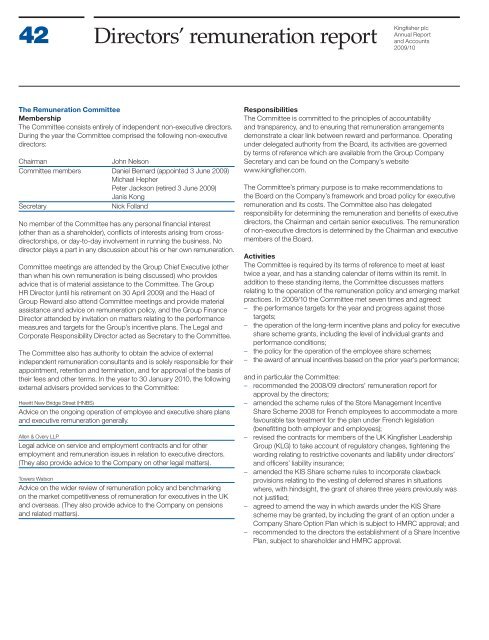

The Remuneration Committee<br />

Membership<br />

The Committee consists entirely of independent non-executive directors.<br />

During the year the Committee comprised the following non-executive<br />

directors:<br />

Chairman John Nelson<br />

Committee members Daniel Bernard (appointed 3 June 2009)<br />

Michael Hepher<br />

Peter Jackson (retired 3 June 2009)<br />

Janis Kong<br />

Secretary Nick Foll<strong>and</strong><br />

No member of the Committee has any personal fi nancial interest<br />

(other than as a shareholder), confl icts of interests arising from crossdirectorships,<br />

or day-to-day involvement in running the business. No<br />

director plays a part in any discussion about his or her own remuneration.<br />

Committee meetings are attended by the Group Chief Executive (other<br />

than when his own remuneration is being discussed) who provides<br />

advice that is of material assistance to the Committee. The Group<br />

HR Director (until his retirement on 30 April 2009) <strong>and</strong> the Head of<br />

Group Reward also attend Committee meetings <strong>and</strong> provide material<br />

assistance <strong>and</strong> advice on remuneration policy, <strong>and</strong> the Group Finance<br />

Director attended by invitation on matters relating to the performance<br />

measures <strong>and</strong> targets for the Group’s incentive plans. The Legal <strong>and</strong><br />

Corporate Responsibility Director acted as Secretary to the Committee.<br />

The Committee also has authority to obtain the advice of external<br />

independent remuneration consultants <strong>and</strong> is solely responsible for their<br />

appointment, retention <strong>and</strong> termination, <strong>and</strong> for approval of the basis of<br />

their fees <strong>and</strong> other terms. In the year to 30 January 2010, the following<br />

external advisers provided services to the Committee:<br />

Hewitt New Bridge Street (HNBS)<br />

Advice on the ongoing operation of employee <strong>and</strong> executive share plans<br />

<strong>and</strong> executive remuneration generally.<br />

Allen & Overy LLP<br />

Legal advice on service <strong>and</strong> employment contracts <strong>and</strong> for other<br />

employment <strong>and</strong> remuneration issues in relation to executive directors.<br />

(They also provide advice to the Company on other legal matters).<br />

Towers Watson<br />

Advice on the wider review of remuneration policy <strong>and</strong> benchmarking<br />

on the market competitiveness of remuneration for executives in the UK<br />

<strong>and</strong> overseas. (They also provide advice to the Company on pensions<br />

<strong>and</strong> related matters).<br />

Kingfi sher plc<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>and</strong> <strong>Accounts</strong><br />

2009/10<br />

Responsibilities<br />

The Committee is committed to the principles of accountability<br />

<strong>and</strong> transparency, <strong>and</strong> to ensuring that remuneration arrangements<br />

demonstrate a clear link between reward <strong>and</strong> performance. Operating<br />

under delegated authority from the Board, its activities are governed<br />

by terms of reference which are available from the Group Company<br />

Secretary <strong>and</strong> can be found on the Company’s website<br />

www.kingfi sher.com.<br />

The Committee’s primary purpose is to make recommendations to<br />

the Board on the Company’s framework <strong>and</strong> broad policy for executive<br />

remuneration <strong>and</strong> its costs. The Committee also has delegated<br />

responsibility for determining the remuneration <strong>and</strong> benefi ts of executive<br />

directors, the Chairman <strong>and</strong> certain senior executives. The remuneration<br />

of non-executive directors is determined by the Chairman <strong>and</strong> executive<br />

members of the Board.<br />

Activities<br />

The Committee is required by its terms of reference to meet at least<br />

twice a year, <strong>and</strong> has a st<strong>and</strong>ing calendar of items within its remit. In<br />

addition to these st<strong>and</strong>ing items, the Committee discusses matters<br />

relating to the operation of the remuneration policy <strong>and</strong> emerging market<br />

practices. In 2009/10 the Committee met seven times <strong>and</strong> agreed:<br />

– the performance targets for the year <strong>and</strong> progress against those<br />

targets;<br />

– the operation of the long-term incentive plans <strong>and</strong> policy for executive<br />

share scheme grants, including the level of individual grants <strong>and</strong><br />

performance conditions;<br />

– the policy for the operation of the employee share schemes;<br />

– the award of annual incentives based on the prior year’s performance;<br />

<strong>and</strong> in particular the Committee:<br />

– recommended the 2008/09 directors’ remuneration report for<br />

approval by the directors;<br />

– amended the scheme rules of the Store Management Incentive<br />

Share Scheme 2008 for French employees to accommodate a more<br />

favourable tax treatment for the plan under French legislation<br />

(benefi tting both employer <strong>and</strong> employees);<br />

– revised the contracts for members of the UK Kingfi sher Leadership<br />

Group (KLG) to take account of regulatory changes, tightening the<br />

wording relating to restrictive covenants <strong>and</strong> liability under directors’<br />

<strong>and</strong> offi cers’ liability insurance;<br />

– amended the KIS Share scheme rules to incorporate clawback<br />

provisions relating to the vesting of deferred shares in situations<br />

where, with hindsight, the grant of shares three years previously was<br />

not justifi ed;<br />

– agreed to amend the way in which awards under the KIS Share<br />

scheme may be granted, by including the grant of an option under a<br />

Company Share Option Plan which is subject to HMRC approval; <strong>and</strong><br />

– recommended to the directors the establishment of a Share Incentive<br />

Plan, subject to shareholder <strong>and</strong> HMRC approval.