Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46<br />

Directors’ remuneration report<br />

Kingfi sher plc<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>and</strong> <strong>Accounts</strong><br />

2009/10<br />

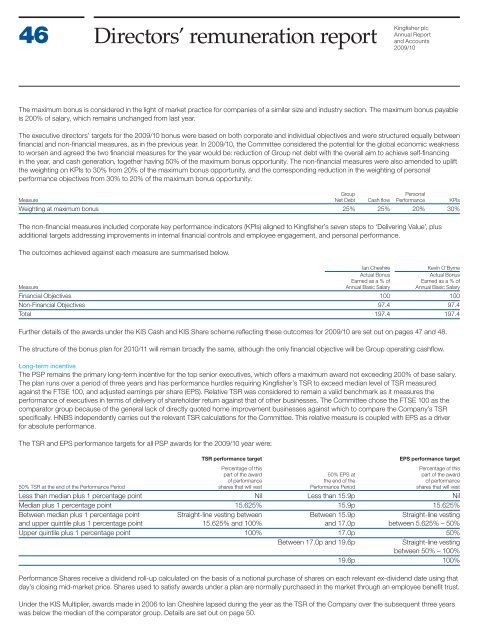

The maximum bonus is considered in the light of market practice for companies of a similar size <strong>and</strong> industry section. The maximum bonus payable<br />

is 200% of salary, which remains unchanged from last year.<br />

The executive directors’ targets for the 2009/10 bonus were based on both corporate <strong>and</strong> individual objectives <strong>and</strong> were structured equally between<br />

fi nancial <strong>and</strong> non-fi nancial measures, as in the previous year. In 2009/10, the Committee considered the potential for the global economic weakness<br />

to worsen <strong>and</strong> agreed the two fi nancial measures for the year would be: reduction of Group net debt with the overall aim to achieve self-fi nancing<br />

in the year, <strong>and</strong> cash generation, together having 50% of the maximum bonus opportunity. The non-fi nancial measures were also amended to uplift<br />

the weighting on KPIs to 30% from 20% of the maximum bonus opportunity, <strong>and</strong> the corresponding reduction in the weighting of personal<br />

performance objectives from 30% to 20% of the maximum bonus opportunity.<br />

Group Personal<br />

Measure Net Debt Cash fl ow Performance KPIs<br />

Weighting at maximum bonus 25% 25% 20% 30%<br />

The non-fi nancial measures included corporate key performance indicators (KPIs) aligned to Kingfi sher’s seven steps to ‘Delivering Value’, plus<br />

additional targets addressing improvements in internal fi nancial controls <strong>and</strong> employee engagement, <strong>and</strong> personal performance.<br />

The outcomes achieved against each measure are summarised below.<br />

Ian Cheshire Kevin O’Byrne<br />

Actual Bonus Actual Bonus<br />

Earned as a % of Earned as a % of<br />

Measure <strong>Annual</strong> Basic Salary <strong>Annual</strong> Basic Salary<br />

Financial Objectives 100 100<br />

Non-Financial Objectives 97.4 97.4<br />

Total 197.4 197.4<br />

Further details of the awards under the KIS Cash <strong>and</strong> KIS Share scheme refl ecting these outcomes for 2009/10 are set out on pages 47 <strong>and</strong> 48.<br />

The structure of the bonus plan for 2010/11 will remain broadly the same, although the only fi nancial objective will be Group operating cashfl ow.<br />

Long-term incentive<br />

The PSP remains the primary long-term incentive for the top senior executives, which offers a maximum award not exceeding 200% of base salary.<br />

The plan runs over a period of three years <strong>and</strong> has performance hurdles requiring Kingfi sher’s TSR to exceed median level of TSR measured<br />

against the FTSE 100, <strong>and</strong> adjusted earnings per share (EPS). Relative TSR was considered to remain a valid benchmark as it measures the<br />

performance of executives in terms of delivery of shareholder return against that of other businesses. The Committee chose the FTSE 100 as the<br />

comparator group because of the general lack of directly quoted home improvement businesses against which to compare the Company’s TSR<br />

specifi cally. HNBS independently carries out the relevant TSR calculations for the Committee. This relative measure is coupled with EPS as a driver<br />

for absolute performance.<br />

The TSR <strong>and</strong> EPS performance targets for all PSP awards for the 2009/10 year were:<br />

TSR performance target EPS performance target<br />

Percentage of this Percentage of this<br />

part of the award 50% EPS at part of the award<br />

of performance the end of the of performance<br />

50% TSR at the end of the Performance Period shares that will vest Performance Period shares that will vest<br />

Less than median plus 1 percentage point Nil Less than 15.9p Nil<br />

Median plus 1 percentage point 15.625% 15.9p 15.625%<br />

Between median plus 1 percentage point Straight-line vesting between Between 15.9p Straight-line vesting<br />

<strong>and</strong> upper quintile plus 1 percentage point 15.625% <strong>and</strong> 100% <strong>and</strong> 17.0p between 5.625% – 50%<br />

Upper quintile plus 1 percentage point 100% 17.0p 50%<br />

Between 17.0p <strong>and</strong> 19.6p Straight-line vesting<br />

between 50% – 100%<br />

19.6p 100%<br />

Performance Shares receive a dividend roll-up calculated on the basis of a notional purchase of shares on each relevant ex-dividend date using that<br />

day’s closing mid-market price. Shares used to satisfy awards under a plan are normally purchased in the market through an employee benefi t trust.<br />

Under the KIS Multiplier, awards made in 2006 to Ian Cheshire lapsed during the year as the TSR of the Company over the subsequent three years<br />

was below the median of the comparator group. Details are set out on page 50.