Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

Download full Annual Report and Accounts - Kingfisher

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26<br />

Risks<br />

Kingfi sher plc<br />

<strong>Annual</strong> <strong>Report</strong><br />

<strong>and</strong> <strong>Accounts</strong><br />

2009/10<br />

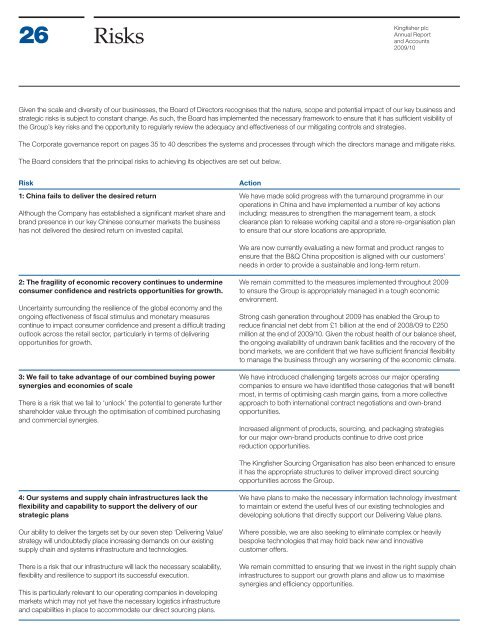

Given the scale <strong>and</strong> diversity of our businesses, the Board of Directors recognises that the nature, scope <strong>and</strong> potential impact of our key business <strong>and</strong><br />

strategic risks is subject to constant change. As such, the Board has implemented the necessary framework to ensure that it has suffi cient visibility of<br />

the Group’s key risks <strong>and</strong> the opportunity to regularly review the adequacy <strong>and</strong> effectiveness of our mitigating controls <strong>and</strong> strategies.<br />

The Corporate governance report on pages 35 to 40 describes the systems <strong>and</strong> processes through which the directors manage <strong>and</strong> mitigate risks.<br />

The Board considers that the principal risks to achieving its objectives are set out below.<br />

Risk Action<br />

1: China fails to deliver the desired return<br />

We have made solid progress with the turnaround programme in our<br />

operations in China <strong>and</strong> have implemented a number of key actions<br />

Although the Company has established a signifi cant market share <strong>and</strong> including: measures to strengthen the management team, a stock<br />

br<strong>and</strong> presence in our key Chinese consumer markets the business clearance plan to release working capital <strong>and</strong> a store re-organisation plan<br />

has not delivered the desired return on invested capital.<br />

to ensure that our store locations are appropriate.<br />

2: The fragility of economic recovery continues to undermine<br />

consumer confi dence <strong>and</strong> restricts opportunities for growth.<br />

Uncertainty surrounding the resilience of the global economy <strong>and</strong> the<br />

ongoing effectiveness of fi scal stimulus <strong>and</strong> monetary measures<br />

continue to impact consumer confi dence <strong>and</strong> present a diffi cult trading<br />

outlook across the retail sector, particularly in terms of delivering<br />

opportunities for growth.<br />

3: We fail to take advantage of our combined buying power<br />

synergies <strong>and</strong> economies of scale<br />

There is a risk that we fail to ‘unlock’ the potential to generate further<br />

shareholder value through the optimisation of combined purchasing<br />

<strong>and</strong> commercial synergies.<br />

4: Our systems <strong>and</strong> supply chain infrastructures lack the<br />

fl exibility <strong>and</strong> capability to support the delivery of our<br />

strategic plans<br />

Our ability to deliver the targets set by our seven step ‘Delivering Value’<br />

strategy will undoubtedly place increasing dem<strong>and</strong>s on our existing<br />

supply chain <strong>and</strong> systems infrastructure <strong>and</strong> technologies.<br />

There is a risk that our infrastructure will lack the necessary scalability,<br />

fl exibility <strong>and</strong> resilience to support its successful execution.<br />

This is particularly relevant to our operating companies in developing<br />

markets which may not yet have the necessary logistics infrastructure<br />

<strong>and</strong> capabilities in place to accommodate our direct sourcing plans.<br />

We are now currently evaluating a new format <strong>and</strong> product ranges to<br />

ensure that the B&Q China proposition is aligned with our customers’<br />

needs in order to provide a sustainable <strong>and</strong> long-term return.<br />

We remain committed to the measures implemented throughout 2009<br />

to ensure the Group is appropriately managed in a tough economic<br />

environment.<br />

Strong cash generation throughout 2009 has enabled the Group to<br />

reduce fi nancial net debt from £1 billion at the end of 2008/09 to £250<br />

million at the end of 2009/10. Given the robust health of our balance sheet,<br />

the ongoing availability of undrawn bank facilities <strong>and</strong> the recovery of the<br />

bond markets, we are confi dent that we have suffi cient fi nancial fl exibility<br />

to manage the business through any worsening of the economic climate.<br />

We have introduced challenging targets across our major operating<br />

companies to ensure we have identifi ed those categories that will benefi t<br />

most, in terms of optimising cash margin gains, from a more collective<br />

approach to both international contract negotiations <strong>and</strong> own-br<strong>and</strong><br />

opportunities.<br />

Increased alignment of products, sourcing, <strong>and</strong> packaging strategies<br />

for our major own-br<strong>and</strong> products continue to drive cost price<br />

reduction opportunities.<br />

The Kingfi sher Sourcing Organisation has also been enhanced to ensure<br />

it has the appropriate structures to deliver improved direct sourcing<br />

opportunities across the Group.<br />

We have plans to make the necessary information technology investment<br />

to maintain or extend the useful lives of our existing technologies <strong>and</strong><br />

developing solutions that directly support our Delivering Value plans.<br />

Where possible, we are also seeking to eliminate complex or heavily<br />

bespoke technologies that may hold back new <strong>and</strong> innovative<br />

customer offers.<br />

We remain committed to ensuring that we invest in the right supply chain<br />

infrastructures to support our growth plans <strong>and</strong> allow us to maximise<br />

synergies <strong>and</strong> effi ciency opportunities.