AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

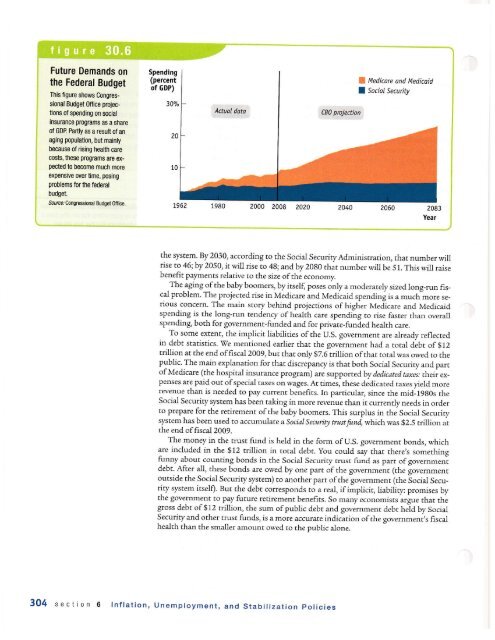

Future Demands on<br />

the Federal Budget<br />

Il s flgure shows Congressional<br />

Budget office projsc-<br />

tions of spending on soclal<br />

insurance Uoorams as a share<br />

of GDP hrtiy as a resuft of an<br />

aging populadon, but mainty<br />

because ot rislng hsalth care<br />

cos{s, tiese programs ars ex-<br />

pected to become much more<br />

expensiw over time, posing<br />

ffoblems lor the lederal<br />

budgst<br />

&urDa Congr€ssional Budget offico.<br />

f Medicorc and Medicoid<br />

J Social Secuity<br />

the system. By 20<strong>30</strong>, according to rhe Social Securiry Administration, that number will<br />

rise to 46; by 2050, it will rise to 48; and by 2080 that number will be 51. This will raise<br />

benefit payments relarive to rhe size ofrhe economy.<br />

of the baby boomers, by<br />

.The-aging itsef poses only a moderately sized long-run fis_<br />

cal problen. The projected rise in Medicare and Medicaid spending is a much more serious<br />

concern. The main story behind projections of higher Me&care and Medicaid<br />

spending is the long-run tendency of health care spending to rise fasrer than overall<br />

spending both for government-funded and for private-funded health care.<br />

. To some extent, the implicit liabilities ofthe U.S. government are already reflected<br />

in debt statistics. We mentioned eadier that the govirnment had a total debt of $12<br />

trillion at the end offiscal 2009, but that only $7.6 trillion ofthat toral was owed to the<br />

public The main explanation for thar discrepaacy is that both Social Security and part<br />

ofMedicare (the hospital insurance program) are suppo rred.by dedirated. taxis: theii expenses<br />

are paid out ofspecial taxes on wages, At times, these dedicated taxes yield more<br />

revenue than is needed to pay current benefits. In particular, since rhe mid-lggOs the<br />

Social Security system has been taking in more revenue tharr it currently needs in ord.er<br />

to prepare for the retirement ofthe baby boomers. This surplus in the Social Security<br />

system has been used to accurnulate a Social Secait! trustfaf which was g2.5 trillion at<br />

the end offiscal2009.<br />

The rnoney in the trust fund is held in the form of U.S. government bonds, which<br />

are included in the $12 trillion in rotal debt. you could say that rhere,s somerhing<br />

funny about counting bonds in the Social Security trust fund as p".t of gorr"rrrrn"rri<br />

debt. After all, these bonds are owed by one part of the govemment (the govemment<br />

outside the Social Securiry system) to another part ofrhe government (the Social Security<br />

system irsel$. But the debt corresponds to a real if implicit, liability: promises by<br />

the govemment to pay future retirement benefits. So many economists argue that the<br />

gross debt of$12 trillion, the sum ofpublic debt and government debt held by Socia.l<br />

Security and ocher trust funds, is a more accurate indication ofthe governmenCs fiscal<br />

health than the smaller amount owed co the public alone<br />

<strong>30</strong>4 section 6 lnflation, Unemployment, and Stabilization policies<br />

Year