AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3. Explain how each of the following events would affect che<br />

public debr or implicir liabilities ofthe U.S. govemmenr, orher<br />

rhings equal. Would the public debc or implicit liabilities be<br />

greater or smaller?<br />

a- The growth rate ofreal GDp increases.<br />

b. Retirees live longer.<br />

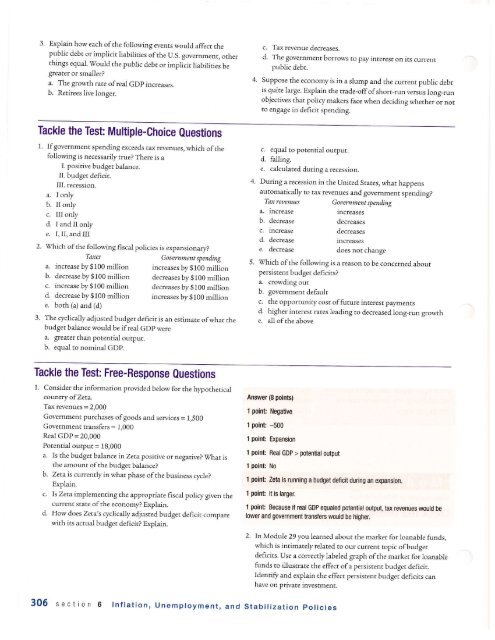

Tackle the Test Muttiple-Choice Questions<br />

1. Ifgovernment spending exceeds tax revenues, which ofthe<br />

following is necessarily rrue? There is a<br />

I. positive budget balance.<br />

II. budger deficit.<br />

IIL recession.<br />

a. I oriy<br />

b. II only<br />

c. III only<br />

d. I and II only<br />

e. I,II, and III<br />

2. Which ofthe following fiscal policies is expansionary?<br />

Goremfient spendihg<br />

a- increase by $100 million increases by $100 million<br />

b. decrease by $100 million decreases by $100 million<br />

c. increase by $100 million decreases by$100 miltion<br />

d. decrease by $100 million increases by$100 million<br />

e. both (a) and (d)<br />

3. The cyclically adjusted budget deficit is an estimare ofwhar che<br />

budger balance would be ifreal GDp were<br />

a. greater than potencial ourput.<br />

b. equal to nominal GDP.<br />

Tackle the Test Free-Response Questions<br />

1. Consider rhe information provided below for rhe hypothetical<br />

co]ufitry of Zeaa.<br />

Tax revenues = 2,000<br />

Government purchases ofgoods and services = 1,500<br />

Government transfers = 1,000<br />

Reat GDP = 20,000<br />

Po.enrialourpur= 18,000<br />

a- Is rhe budget balance in Zeta positive or negative? at is<br />

the amount ofthe budget balance?<br />

b. Zeta is currenaly in whar phase of the business cycle?<br />

Explain.<br />

c. Is Zeta implemenring the appropriate fiscal poliry given the<br />

current state ofthe economy? Explain.<br />

d. How does Zerts cyclically adjusted budget deEcir compare<br />

with irs actual budget deficit? Explain.<br />

c, Tax revenue decreases.<br />

d. The government bortows to pay interest on ias cuffent<br />

public debr.<br />

4. Suppose rhe economy is in a slump and the current public debt<br />

is quire large. Explain the trade-offofshorr-run versus long_run<br />

objectives that policy makers face when deciding whether or nor<br />

to engage in deficit spending.<br />

c. equal co potenrial output.<br />

d. falling.<br />

e. calculated during a recession.<br />

4. During a recession in rhe United States, whar happens<br />

automatically ro ta,r revenues and government spending?<br />

T.lt reltenues<br />

Goltethtuent spehding<br />

a. inctease<br />

increases<br />

b. decrease<br />

c. increase<br />

decreases<br />

decreases<br />

d. decrease<br />

e. decrease<br />

increases<br />

does not change<br />

5. Which ofthe following is a reason co be concerned about<br />

persistent budger defi cits?<br />

a. crowding out<br />

b. govemmenr defaulr<br />

c. the opportunity cost olfirture interest paymenrs<br />

d. higher interest rares leading to decreased long,run growch<br />

e. all oF the above<br />

Answer (8 points)<br />

1 point Negative<br />

1 point -500<br />

1 point Expansion<br />

1 point Real cDP > potentiat output<br />

l point No<br />

1 point Zeta is runninq a budget deflcit during an expansion.<br />

1 point lt is larger.<br />

1 point Because if real GDP equaled poten al output, tax revenues would be<br />

lowerand government transfurs would be higher.<br />

<strong>30</strong>6 section 6 lntlation, Unemptoyment, and<br />

Stabilization Policies<br />

2. In <strong>Module</strong> 29 you learned abour rhe market fi:r loanable funds,<br />

which is inrimarely relared ro our current topic ofbudget<br />

deficits. Use a correcrly labeled graph ofthe marker for loanable<br />

funds co illusrrate the effecr ofa persistent budger deficit.<br />

Idenrifyand explain rhe effecc persistent budget deficits can<br />

have on private invescment.