AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

AP Econ Module 30 Deficits Debt - Sunny Hills High School

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

where Iis the yalue of ta-r revenues, G is government purchases ofgoods and services,<br />

and TR is the value ofgovernment transfers. A budgeisurplus is a p-ositive budget bal_<br />

ance, and a budget deficit is a negative budget balance.<br />

Other things equal, expa-nsionary fiscal policies-increased governmenr purchases of<br />

goods and services, higher government transfers, or lower ta-xei_reduce the budget bal_<br />

ance forth-at year. Thar is, expansionary fisca.l policies ma,ke a bud.get surplus smal'ier or a<br />

budget deficit bigger. Conversely, contracrionary fiscal policies-r"d,lced govemment pur_<br />

chases of goods and services, lower government tr.rr"f"rr, o, higher ta-res_increase the<br />

budget balance for that year, making a budget surplus bigger or a budget deficit smaller.<br />

You might think this means rhat changes in the budger balance can be used to<br />

measure fiscal policy. ln fact, economists often do just rhat: rhey use changes in rhe<br />

budget balance as a "quick-and-dirry'' way to assess whether currenr fiscal p;liry is expansionary<br />

or contracrionary. But they always keep in mind rwo reasons this quick_<br />

and-dirry approach is sometimes misleading:<br />

r Two differenr changes in fiscal policy that have equal-size effects on the budget bal_<br />

ance may have quite unequal effects on the economy. As we have already seen,<br />

changes in government purchases ofgoods and services have a larger effect on real<br />

GDP than equal-size changes in taxes and government rransfers.<br />

r Often, changes in the budget balance are rhemselves the result, not the cause, of<br />

flucruarions in the econom).<br />

To understand the second point, we need to examine the effects ofthe business cycle<br />

on the budger.<br />

The Business Cycle and the Cyclically Adjusted<br />

Budget Balance<br />

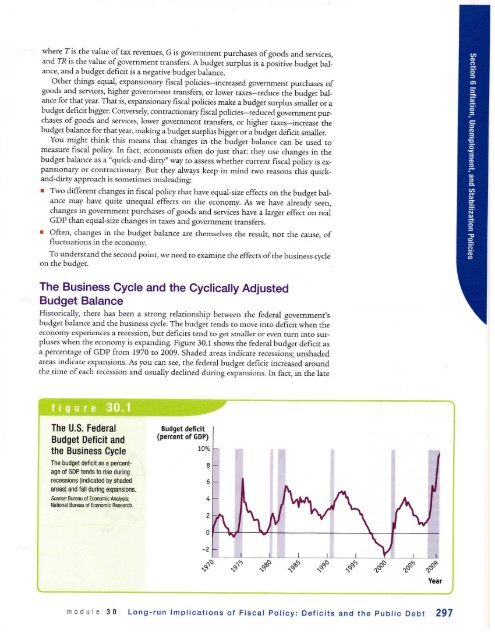

Historically, there has been a strong relationship between the federal government,s<br />

budget balance and the business cycle. The budget tends to move into deficit when rhe<br />

economy experiences a recession, but deficits tend to get smaller or even rurn inro sur_<br />

pluses when the economy is expanding. Figure <strong>30</strong>.1 shows the federal budget deficit as<br />

a percentage ofGDP from 1970 to 2009. Shaded areas indicate recessions; unshaded<br />

areas indicate expansions. As you can see, the federal budget deficir increased around<br />

the time ofeach recession and usually declined during expansions. In fact, in rhe late<br />

The U.S. Federal<br />

Budget Deficit and<br />

the Business Cycle<br />

The budget deficitas a percen!<br />

age of GDP tends to rise during<br />

recessions {indicated by shaded<br />

areas) and fall during expansions.<br />

Sourcer Blreau of <strong>Econ</strong>omic Analysis;<br />

Nalional Burcau of <strong>Econ</strong>omic Research.<br />

Budget deficit<br />

(percent of GDP)<br />

10%<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

^s<br />

sp<br />

gr"<br />

9tr<br />

g""<br />

gr"<br />

,"""<br />

t"s """"<br />

Year<br />

m0dule <strong>30</strong> Long-run lmplications of Fiscal Policy: Def ic its and the Public <strong>Debt</strong> 297