výročná správa annual report 2008

výročná správa annual report 2008

výročná správa annual report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

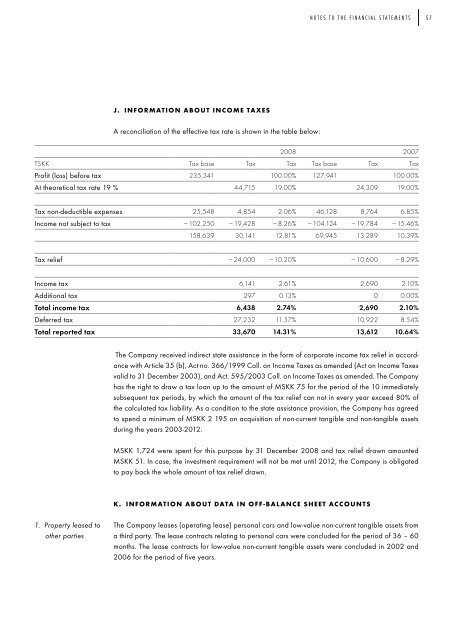

J. INFORMATION ABOUT INCOME TAXES<br />

A reconciliation of the effective tax rate is shown in the table below:<br />

n o t e s t o t h e f i n a n c i a l s t a t e M e n t s 5 7<br />

<strong>2008</strong> 2007<br />

TSKK Tax base Tax Tax Tax base Tax Tax<br />

Profit (loss) before tax 235,341 100.00% 127,941 100.00%<br />

At theoretical tax rate 19 % 44,715 19.00% 24,309 19.00%<br />

Tax non-deductible expenses 25,548 4,854 2.06% 46,128 8,764 6.85%<br />

Income not subject to tax − 102,250 − 19,428 − 8.26% − 104,124 − 19,784 − 15.46%<br />

158,639 30,141 12.81% 69,945 13,289 10.39%<br />

Tax relief − 24,000 − 10.20% − 10,600 − 8.29%<br />

Income tax 6,141 2.61% 2,690 2.10%<br />

Additional tax 297 0.13% 0 0.00%<br />

Total income tax 6,438 2.74% 2,690 2.10%<br />

Deferred tax 27,232 11.57% 10,922 8.54%<br />

Total <strong>report</strong>ed tax 33,670 14.31% 13,612 10.64%<br />

1. Property leased to<br />

other parties<br />

The Company received indirect state assistance in the form of corporate income tax relief in accordance<br />

with Article 35 (b), Act no. 366/1999 Coll. on Income Taxes as amended (Act on Income Taxes<br />

valid to 31 December 2003), and Act. 595/2003 Coll. on Income Taxes as amended. The Company<br />

has the right to draw a tax loan up to the amount of MSKK 75 for the period of the 10 immediately<br />

subsequent tax periods, by which the amount of the tax relief can not in every year exceed 80% of<br />

the calculated tax liability. As a condition to the state assistance provision, the Company has agreed<br />

to spend a minimum of MSKK 2 195 on acquisition of non-current tangible and non-tangible assets<br />

during the years 2003-2012.<br />

MSKK 1,724 were spent for this purpose by 31 December <strong>2008</strong> and tax relief drawn amounted<br />

MSKK 51. In case, the investment requirement will not be met until 2012, the Company is obligated<br />

to pay back the whole amount of tax relief drawn.<br />

K. INFORMATION ABOUT DATA IN OFF -BALANCE SHEET ACCOUNTS<br />

The Company leases (operating lease) personal cars and low-value non-current tangible assets from<br />

a third party. The lease contracts relating to personal cars were concluded for the period of 36 – 60<br />

months. The lease contracts for low-value non-current tangible assets were concluded in 2002 and<br />

2006 for the period of five years.