Commerzbank Aktiengesellschaft - CMVM

Commerzbank Aktiengesellschaft - CMVM

Commerzbank Aktiengesellschaft - CMVM

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 MANAGEMENT REPORT<br />

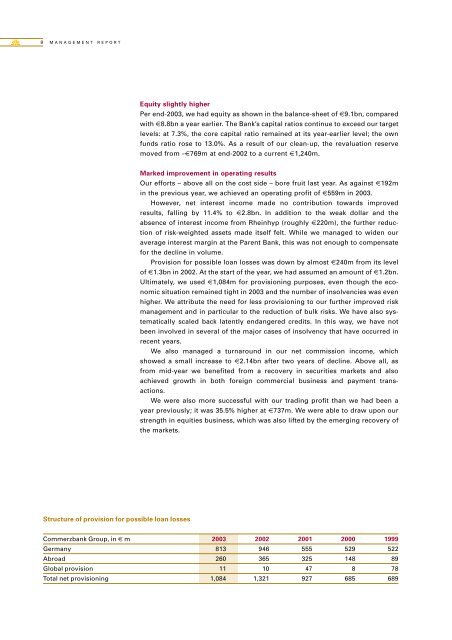

Structure of provision for possible loan losses<br />

Equity slightly higher<br />

Per end-2003, we had equity as shown in the balance-sheet of 79.1bn, compared<br />

with 78.8bn a year earlier. The Bank’s capital ratios continue to exceed our target<br />

levels: at 7.3%, the core capital ratio remained at its year-earlier level; the own<br />

funds ratio rose to 13.0%. As a result of our clean-up, the revaluation reserve<br />

moved from –7769m at end-2002 to a current 71,240m.<br />

Marked improvement in operating results<br />

Our efforts – above all on the cost side – bore fruit last year. As against 7192m<br />

in the previous year, we achieved an operating profit of 7559m in 2003.<br />

However, net interest income made no contribution towards improved<br />

results, falling by 11.4% to 72.8bn. In addition to the weak dollar and the<br />

absence of interest income from Rheinhyp (roughly 7220m), the further reduction<br />

of risk-weighted assets made itself felt. While we managed to widen our<br />

average interest margin at the Parent Bank, this was not enough to compensate<br />

for the decline in volume.<br />

Provision for possible loan losses was down by almost 7240m from its level<br />

of 71.3bn in 2002. At the start of the year, we had assumed an amount of 71.2bn.<br />

Ultimately, we used 71,084m for provisioning purposes, even though the economic<br />

situation remained tight in 2003 and the number of insolvencies was even<br />

higher. We attribute the need for less provisioning to our further improved risk<br />

management and in particular to the reduction of bulk risks. We have also systematically<br />

scaled back latently endangered credits. In this way, we have not<br />

been involved in several of the major cases of insolvency that have occurred in<br />

recent years.<br />

We also managed a turnaround in our net commission income, which<br />

showed a small increase to 72.14bn after two years of decline. Above all, as<br />

from mid-year we benefited from a recovery in securities markets and also<br />

achieved growth in both foreign commercial business and payment transactions.<br />

We were also more successful with our trading profit than we had been a<br />

year previously; it was 35.5% higher at 7737m. We were able to draw upon our<br />

strength in equities business, which was also lifted by the emerging recovery of<br />

the markets.<br />

<strong>Commerzbank</strong> Group, in 7 m 2003 2002 2001 2000 1999<br />

Germany 813 946 555 529 522<br />

Abroad 260 365 325 148 89<br />

Global provision 11 10 47 8 78<br />

Total net provisioning 1,084 1,321 927 685 689